EUR/USD Eases Below The 1.03000 Mark Amid Notable USD Demand, EU/US PMIs On Sight

- EUR/USD bears force a bearish turnaround, denying the EUR/USD cross the chance to extend its sharp rebound from the vicinity of the 1.02231 level.

- A fresh leg up in the US Treasury Bond Yields, along with a softer risk tone, offered some support to the safe haven-green back amid top Fed official's comments

- Eurozone Current Account Surplus Narrows Sharply

- OECD's downward economic outlook for the eurozone undermines the Euro

- Eurozone and US Manufacturing PMIs, Service PMI,s and Markit Composite PMIs are set to be released later today

EUR/USD pair attracted some buying in the vicinity of the 1.03025 level and extended Monday's sharp rebound from the vicinity of the 1.02231 level. The uptick, however, lacked follow-through and ran out of steam ahead of the 1.03000 levels amid renewed USD buying interest.

A fresh leg up in the US Treasury Bond Yields, along with a softer risk tone, offered some support to the safe haven-green back amid top Fed official's comments suggesting that they were not yet done with the increasing interest rates further. On Monday, Cleveland Fed President Loretta Mester told CNBC's "Closing Bell" that the rate hikes could be slowed, but inflation figures were not convincing enough to stop the hikes entirely. "We've had some good news on the inflation front, but we need to see more good news and sustained good news to make sure that we are returning to price stability as soon as we can," she said.

The US Dollar index(DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, rebounded on Wednesday from the vicinity of 107.074 level and was last up 0.07% at 107.146 as at 05:20 (UTC+3) after slipping the previous day by more than 0.5%. The US dollar's recent uptick could be attributed to investors tempering their risk appetites ahead of the release of minutes of the Federal Reserve's policy meeting that could offer clues on the outlook for inflation and interest rates. It should be noted that the minutes of the regularly scheduled meetings are released three weeks after the date of the policy decision(the fed released their interest rate decision on 3rd November).

Further lifting the US Dollar was the upbeat retail sales data released last week, which showed households had stepped up purchases of motor vehicles and a range of other goods, suggesting consumer spending picked up early in the fourth quarter, which could help to support the economy. Additionally, The number of Americans filing new claims for unemployment benefits fell by 4,000 to 222,000 on the week ending 12th November, below expectations of 225,000, pointing to a continuously tight job market and adding leeway for the Federal Reserve to tighten policy, despite the surge in layoffs from large tech companies. That said, the number of New Building permits issued by the government dropped by 2.4 percent from a month earlier to a seasonally adjusted annual rate of 1.526 million in October 2022, the lowest since August 2020 and compared with market expectations of 1.512 million. In turn, this was seen as a factor that undermined the greenback.

Shifting to the European docket, Christine Largade, the European Central Bank(ECB) President, in a speech at the European Banking Congress, said, "With the economy facing a new environment, we will adjust our monetary policy and continue to act decisively to bring inflation down to our medium-term target". We expect to raise rates further - and more than withdrawing accommodation may be needed. Ultimately, we will raise rates to levels that bring inflation back down to our medium-term target on time. As I explained recently, how far we need to go and how fast will be determined by the inflation outlook," she added.

In an interview with Financial Times, European Central Bank (ECB) policymaker Robert Holzmann supported calls for a third straight 75 basis points (bps) rate increase for the December monetary policy meeting.

Core consumer prices in the Euro Area, excluding energy, food, alcohol & tobacco, increased 5 percent year-on-year in October of 2022, in line with preliminary estimates. It is the highest core inflation rate on record, compared to 4.8 percent in September. Compared to the previous months, the core CPI went up 0.6 percent, according to a flash estimate by the European Statistical Office.

Eurozone Current Account Surplus Narrows Sharply

Further limiting the Euro was the news that the current account surplus in the Euro Area had decreased sharply to EUR 3.8 billion in September 2022 from EUR 33.1 billion in the same month a year earlier. The goods account shifted to a EUR 9.3 billion deficit from last year's EUR 22.3 billion surpluses, with imports reaching an all-time high of EUR 275.5 billion on higher energy prices.

Further limiting the Euro was the Organisation for Economic Co-operation and Development(OECD) was the downward economic outlook for the eurozone. The report stated that The global economy is facing significant challenges. Growth has lost momentum, high inflation has broadened across countries and products, and is proving persistent. Risks are skewed to the downside. Energy supply shortages could push prices higher. Interest rate increases are necessary to curb inflation and heighten financial vulnerabilities. Russia's war in Ukraine increases the risks of debt distress in low-income countries and food insecurity.

As we advance, investors will look for clues from dockets featuring November Manufacturing PMIs, Service PMI,s and Markit Composite PMIs. Investors will look for clues from the US docket featuring the release of the US Building Permits data, the US Core Durable Goods Order(MOM) data for October; the US Initial Jobless Claims data. The reports would influence near-term USD sentiment and provide trading opportunities around the EUR/USD Pair.

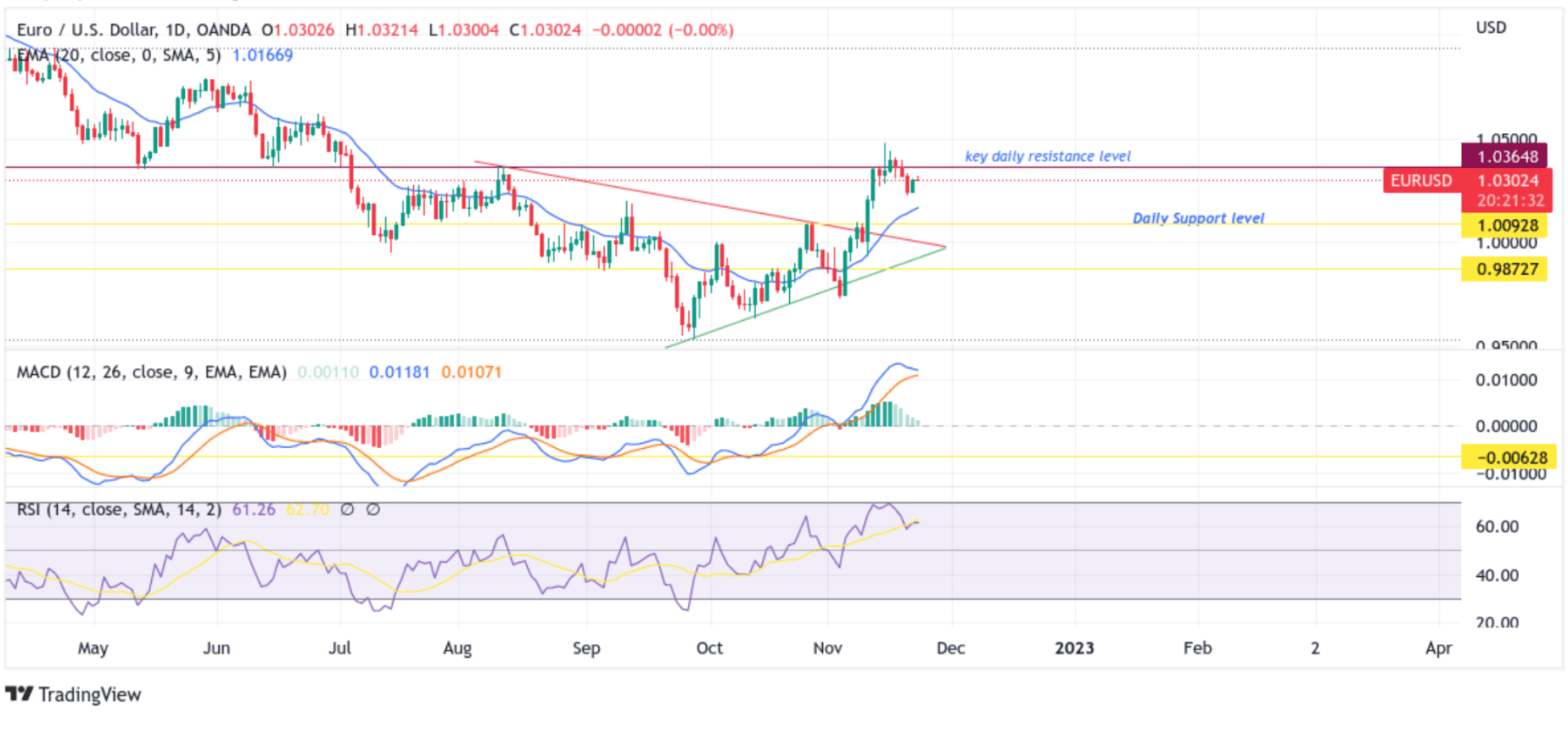

Technical Outlook: One-Day EUR/USD Price Chart

From a technical standstill, dip-sellers and tactical traders forced a bearish turnaround ahead of the 1.03648 key daily resistance level. Some following selling would drag spot prices toward the 1.00928 daily support level but will need acceptance below the 20 Exponential Moving Average level at the 1.01691 level. Further weakness below the aforementioned key support level would pave the way for a drop toward the upper trendline (turned support level)of the bullish pennant chart pattern plotted from the August 2022 swing high.

All the technical oscillators are in positive territory. That said, the RSI(14) at 61.26 shows a shift change from flashing overbought conditions, while the Moving Average Convergence Divergence (MACD) crossover above the signal line, pointing to a bullish sign for price action this week.

On the Flipside, if dip-buyers and tactical traders jump back in and trigger a bullish turnaround, initial resistance appears at the 1.03300 mark en route to the 1.03648 key daily resistance level. If Price pierces this barrier, buying interest could gain momentum, creating the right conditions for an advance toward the 1.04000 Ceiling.