AUD/USD Rebounds Modestly From Key Zone, Retakes 0.6900s Amid Modest USD Pullback & Strong Oversold Conditions

- Modest USD Pullback from a monthly peak prompted some long-covering around the pair

- U.S. Jobs report showed an increase of 517,000 in January, crushing estimates, as the unemployment rate hit a 53-year low

- Upbeat Chinese Caixin Composite and services PMI data offer some support to the Aussie dollar despite a weaker than expected Aussie retail sales data

The AUD/USD cross staged a modest recovery from mid 0.68000's levels, or a one-week low touched earlier this Monday, and for now, seems to have snapped a two-day losing streak. At the peak, the shared currency is up over 15 pips for the day to trade above 0.69000s levels. The pair now looks set to build on its intraday ascent heading into the European session amid strongly oversold conditions.

A fresh leg down in the treasury bond yields and a weaker risk tone undermined the safe-haven greenback. Apart from this, signs of stability in the U.S. equity markets capped the safe-haven greenback and helped limit the downside for the major. The U.S. Dollar index (DXY), which measures the value of USD against a basket of currencies, was down 0.12%, rebounding from the vicinity of $103.105/one-month high after prices on Friday surged on a hotter-than-expected U.S. job report.

The U.S. economy unexpectedly created 517K jobs in January of 2023, the most since July, and way above an average monthly gain of 401K in 2022, beating market forecasts of 185K. Job growth was widespread in January, led by gains in leisure and hospitality (128K), professional and business services (82 K), and health care (58K).

Wages also posted solid gains for the month. Average hourly earnings increased 0.3%, in line with the estimate, and 4.4% from a year ago, 0.1 percentage point higher than expectations though a bit below the December gain of 4.6%. Commenting on the report, "Today's jobs report is almost too good to be true," wrote Julia Pollak, Chief Economist at ZipRecruiter. "Like $20 bills on the sidewalk and free lunches, falling inflation paired with falling unemployment is the stuff of economics fiction."

"Today's report is an echo of 2022′s surprisingly resilient job market, beating back recession fears," said Daniel Zhao, lead economist for job review site Glassdoor. "The Fed has a New Year's resolution to cool down the labor market, and so far, the labor market is pushing back." The hotter-than-expected job report came days despite the Federal Reserve's effort to slow down the economy and bring inflation from its highest level since 1980. If there is one thing the report has done, it reversed a move from Wednesday when traders raised bets that the U.S. central bank would stop hiking borrowing costs after a widely expected 25-basis-point increase in March. "After the Fed meeting it looked like markets had the advantage - it was still pricing in a rate cut, they took interest rates down, and they took the dollar down, and now I think 48 hours later the Fed looks like they might have the upper hand again," Chandler said. It is worth remembering that Fed officials in December said they expected to raise the central bank's benchmark overnight interest rate above 5% and have stressed they will need to hold it in restrictive territory for some time to sustain inflation. But traders had bet the rate would peak below 5% and that the Fed would cut rates in the second half of the year as the economy slows.

That said, Traders have now increased their bets that the Fed would approve a quarter percentage point interest rate hike at its March meeting, with the probability rising to 94.5%, according to CME Group data. They also expect another increase in May or June, bringing the central bank's benchmark funds rate to a target range of 5%-5.25%. Shifting to the Australian docket, a data report released on Monday by the Australian Bureau of Statistics showed retail sales in Australia dropped for the first time in a year in December 2022. Retail sales in Australia fell by 3.9% mom to AUD 34.47 billion in December 2022, unrevised from the flash data but reversing from a 1.7 percent rise in the prior month. This was the first decline in retail trade for 2022, following eleven straight monthly rises amid high cost-of-living pressures.

That said, the Aussie dollar continued to draw support from market economics data reports which showed the Caixin China General Composite PMI climbed to 51.1 in January 2023 from 48.3 in the previous month. It was the first growth in private sector activity since last August, buoyed by the removal of harsh pandemic measures. An expansion in services activity for the first time in five months mainly supported the upturn while the manufacturing sector became a drag. The Caixin China General Services PMI also increased to 52.9 in January 2023 from 48.0 in December. This was the first growth in the service sector since last August, buoyed by the recent rollback of pandemic curbs and faster-than-expected peaking of infections. New orders increased for the first time in five months. The modest upturn in new orders was supported by higher customer numbers, with new export business rising the most in 21 months.

As we advance, in the absence of any significant market-moving economic news data from both dockets, the U.S. bond yields, along with the broader market risk sentiment, will influence the U.S. dollar and allow traders to grab some trading opportunities around the pair.

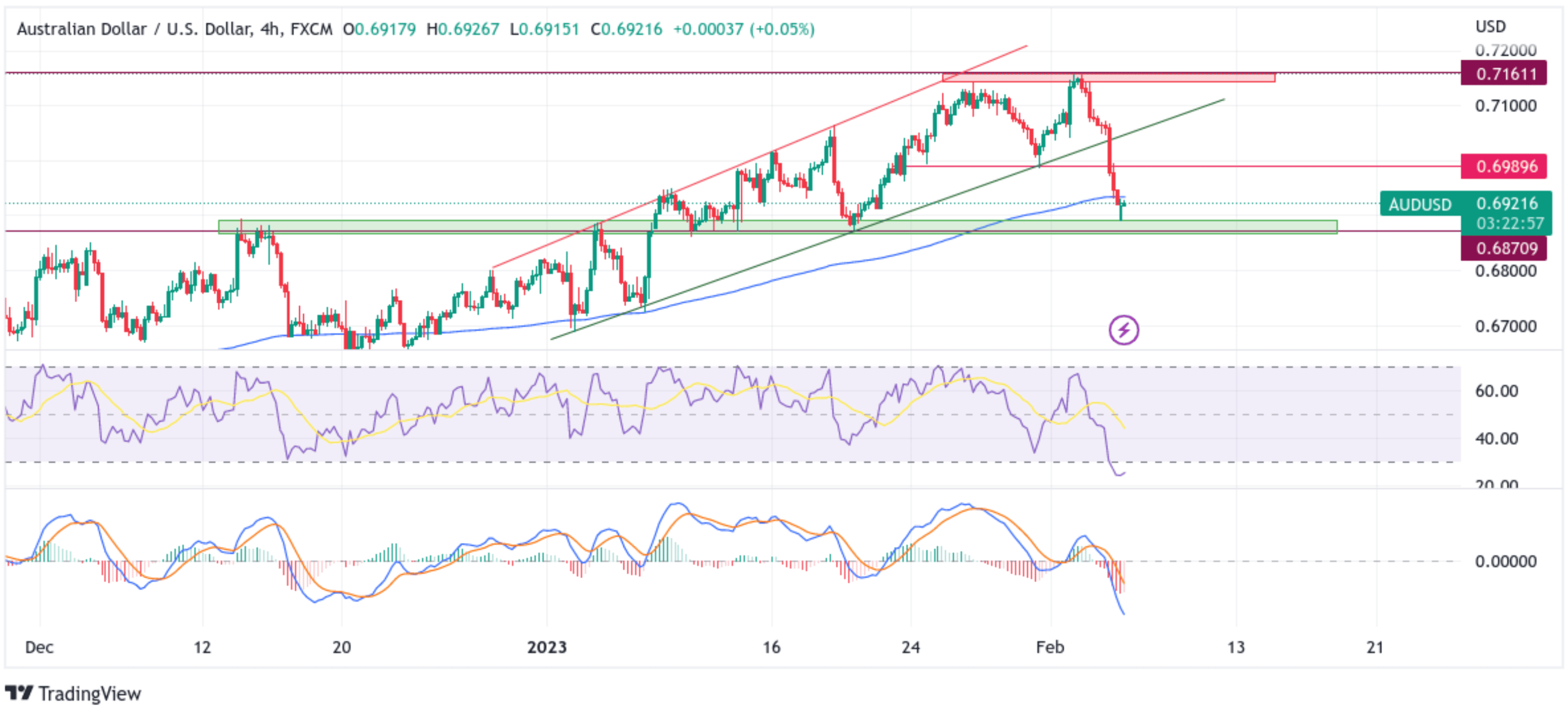

Technical Outlook: Four-Hour EUR/USD Price Chart

From a technical perspective, using a four-hour price chart, the price has extended the modest rebound from the vicinity of 0.68920 level (upper limit of the key demand zone ranging from 0.68695 - 0.68920 levels). Some follow-through buying can uplift the AUD/USD pair toward the key resistance level (the technically strong 200 Exponential moving average (EMA). Sustained strength above this level would negate any near-term bearish outlook and pave the way for aggressive technical buying. The bullish momentum could then accelerate toward the next relevant resistance level at 0.69896. If bulls pierce this barrier, the bullish trajectory could then accelerate toward testing the lower boundary channel (turned resistance level)of the multi-week-old descending channel pattern. Sustained strength above this barrier would pave the way for additional gains around the AUD/USD pair.

All the technical indicators are in negative territory, with the RSI (14) level at 28.90 in bearish territory and flashing oversold conditions warranting caution to tactical traders who might jump in the coming sessions from submitting aggressive bearish bets. On the other hand, the Moving average convergence divergence (MACD) crossover is also below the signal line, pointing to a bearish sign for price action this week. Still, a move above the RSI (14) signal line followed by a MACD sending a BUY signal would credence to the bullish uptick.

On the flip side, if sellers resurface and spark a bearish turnaround, the price will first find support at the demand zone ranging from 0.68695 - 0.68920 levels. On further weakness, the focus shifts lower toward the 0.68489 support level. If sellers breach this floor, the downside trajectory could accelerate toward testing the 0.68000 psychological mark.