AUD/USD Sticks To Fed Rate Hike Inspired Gains And Rallies To Fresh Weekly High Just Above 0.68000 Mark

Key Takeaways:

📌AUD/USD rallies to a fresh weekly high, supported by a combination of factors

📌Fed hikes interest rate by 25bps, but dovish comments of an imminent pause by Fed chair see DXY extend corrective slide

📌Better-than-expected Australian inflation report suggests the likelihood of a less hawkish Reserve Bank of Australia

📌Firm market expectations that China will work on more stimulus to spur the economy continue to support the Aussie dollar (AUD)

AUD/USD cross extended its recent modest pullback from the vicinity of 0.67355 level touched on Wednesday. It kicked off a new campaign on a positive note, trading just above the 0.68000 mark on Thursday during the mid-Asian session amid the prevalent U.S. dollar selling. The U.S. dollar index (DXY), which measures the greenback against a basket of currencies, extended the corrective slide from the vicinity of the 101.653 level and dropped below the 100.800 mark on Thursday as dovish comments from Fed Chairman Jerome Powell on Wednesday hinted at holding rates steady.

The Federal Reserve's (Fed) Chair on Wednesday, during an FOMC press conference, said that it's certainly possible that they will raise funds again at the September meeting if the data warrants, but mentioned that it's also possible that they would choose to hold steady. They are going to be making careful assessments. Powell's comments came after the FOMC announced that it had hiked its benchmark Fed funds rates by 25bps to 5.5%, the highest level in 22 years, as it continues to fight inflation in the U.S. economy. The accompanying FOMC statement showed Policymakers pledged to continue to monitor the implications of incoming information for the economic outlook and would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of inflation and employment goals. Wednesday's decision and the likelihood that the Fed will pivot were widely expected following better-than-expected headline and core inflation numbers released mid-month. At the same time, the job market is still resilient.

Powell's comments came after the FOMC announced that it had hiked its benchmark Fed funds rates by 25bps to 5.5%, the highest level in 22 years, as it continues to fight inflation in the U.S. economy. The accompanying FOMC statement showed Policymakers pledged to continue to monitor the implications of incoming information for the economic outlook and would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of inflation and employment goals. Wednesday's decision and the likelihood that the Fed will pivot were widely expected following better-than-expected headline and core inflation numbers released mid-month. At the same time, the job market is still resilient.

In other news, Building permits in the United States dropped by 3.7% to a seasonally adjusted annual rate of 1.441 million in June 2023, down from the seven-month high of 1.496 million recorded in May, revised data showed. Additionally, sales of new single-family houses in the United States dropped 2.5% to a seasonally adjusted annualized rate of 697 thousand in June 2023, compared to May's 15-month high of 715 thousand and below the market consensus of 725 thousand.

That said, the combination of weak U.S. macro data was seen as another factor that undermined the greenback and helped exert upward pressure on the AUD/USD pair. Shifting to the Australian docket, an Australia Bureau of Statistics report on Wednesday showed Australia's inflation rate dropped to 6.0% year-on-year in the second quarter of 2023, down from 7.0% in the previous period and below market forecasts of 6.2%. Quarter-on-quarter, Australia's annual inflation dropped to 0.8% in the second quarter of 2023, down from 1.4% in the previous period and below the market consensus of 1.0%. The better-than-expected Australian inflation data report suggests that the Reserve Bank of Australia could be less hawkish in its next monetary policy meeting, indicating the path of least resistance for the AUD/USD is to the downside. However, in the meantime, the Australian dollar (AUD) continues to be supported by firm market expectations that China will work on more stimulus to spur the economy amid growing evidence that the post-Covid economic recovery has run out of steam.

Going forward, investors look forward to the U.S. docket featuring the release of the GDP (QoQ) (Q2) preliminary data, the Core Durable Goods Order (MoM) (Jun) data, and the Initial Jobless Claims data for the previous week.

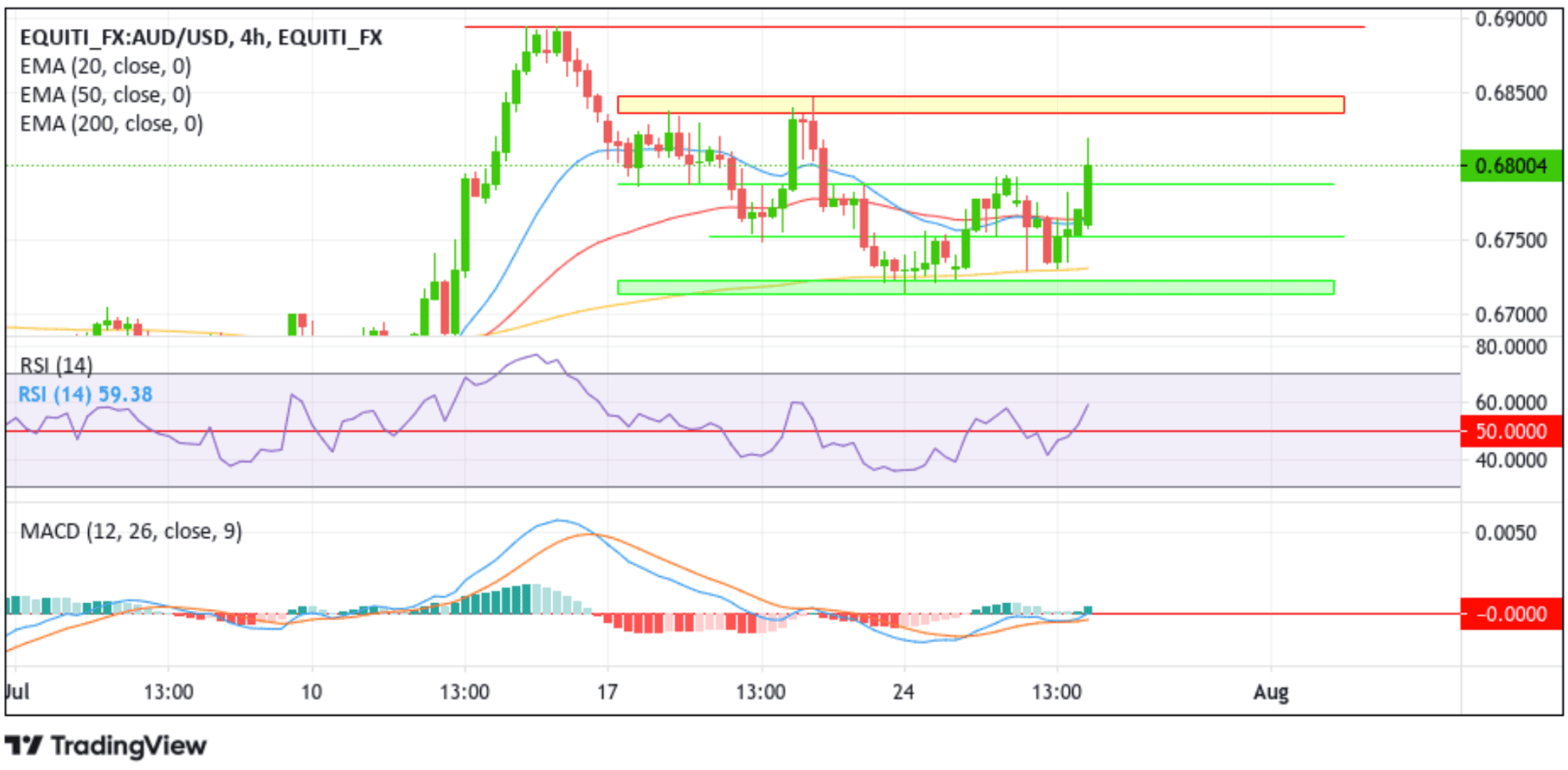

Technical Outlook: Four-Hours AUD/USD Price Chart

AUDUSD Sticks To Fed Rate Hike-Inspired Gains And Rallies Chart

From a technical standpoint, a further increase in buying momentum from the current price level will uplift the AUD/USD pair towards the supply zone ranging from 0.68472 - 0.68303 levels, about which sustained strength beyond as the potential to lift spot prices towards the July 2023 swing high resistance level at 0.68936. A convincing move above this resistance level, followed by acceptance above the 0.69000 round mark, will pave the way for further gains around the AUD/USD pair.

On the flip side, if bulls close in on their profits, bears could force a bearish reversal toward the 0.67870 support level. A decisive flip of this support level into a resistance level could pave the way for a drop toward the buyer congestion zone due to the 20 (blue) and 50 (red) days Exponential Moving Average (EMA) at 0.67695 and 0.67672 levels, respectively. If sidelined sellers join in from this zone, it will rejuvenate the bearish momentum, provoking an extended decline below the 0.67529 support level toward the technically strong 200-day (yellow) EMA level at 0.67303. Acceptance below this level will reaffirm the bearish bias and pave the way for aggressive technical selling around the AUD/USD pair. The AUD/USD could then accelerate its downfall toward the demand zone ranging from 0.67238 - 0.67148 levels en route to the 0.67000 round mark.