AUD/USD Gains Positive Traction Amid Retreating Bond Yields

- AUD/USD looks to build upon Tuesday's rebound from the 50% Fibonacci retracement level

- Disappointing US Macro data drag ten-year treasury bond yields lower on Wednesday

- Hawkish FED expectation in the monetary policy decision today to cap the upside for the AUD/USD pair against any further uptick

- Current Price action suggests the market has priced in positive Australia CPI reading

AUD/USD cross gained positive traction on Wednesday after attracting bullish bets from the vicinity of 0.69371 level during the early Asian session to lift off spot prices from the previous day's low. This marks the fourth day of a positive move during the last seven, and for now, the pair looks to build upon Tuesday's retracement from the 50% Fibonacci retracement level, which coincides with a key support zone. At the time of speaking, the pair is up over 10 pips for the day and has recovered part of its early lost ground.

The ten-year U.S. benchmark yields retreated on Wednesday and fell 0.3% as investors became increasingly pessimistic about the FED's ability to reign in inflation this late in the game, as well as the choking effect aggressive interest rate tightening will have on an already fragile economy.

Additionally, disappointing U.S. macro data also turned out to be another factor that dragged the ten-year treasury bond yields lower on Wednesday. The Consumer confidence report came in yesterday lower than expected. It confirmed that most consumers had low confidence in the economy amid high prices for consumer goods as inflation bites. The U.S. New Home sales report also came in yesterday, showing that the number of new single-family homes sold during the month of July had fallen more than expected to a two-year low.

That said, fears of a possible recession weighed on investors' sentiment. This was evident from a generally weaker tone around the U.S. equity markets, which extended some support to the safe-haven greenback. Investors also remain worried that a more aggressive move by the FED to constrain inflation and the ongoing Russia-Ukraine war could pose challenges to the global economy. This, in turn, acted as a tailwind for the greenback and undermined the riskier-perceived Aussie.

That said, The fundamental backdrop still favours the bears as the greenback continues to draw support from prospects of aggressive policy tightening by the FED in its Key Monetary Policy meeting on Wednesday. Most investors seem convinced that the FED would stick to a 75bps interest rate in its upcoming monetary policy meeting to tackle the surging inflation, which rose to a four-decade high in July. This, in turn, should cap the upside for the AUD/USD pair against any further uptick and warrants caution to investors against submitting aggressive bullish bets.

The current price action suggests the market has priced in positive macro data news from the Australian docket. The Australian Bureau of Statistics will announce the Consumer Price Index(CPI), which is expected to land at 5.1% against a preliminary reading of 4.6%. In the meantime, the US Bond yields and the broader market risk sentiment will influence the USD price dynamics around the AUD/USD pair.

Going forward, the focus now shifts to the release of the FED interest rate decision report scheduled for release later today during the mid-North American session. The report would influence the near-term USD price dynamics. This, in turn, should assist traders in determining the next leg of a directional move for the AUD/USD pair.

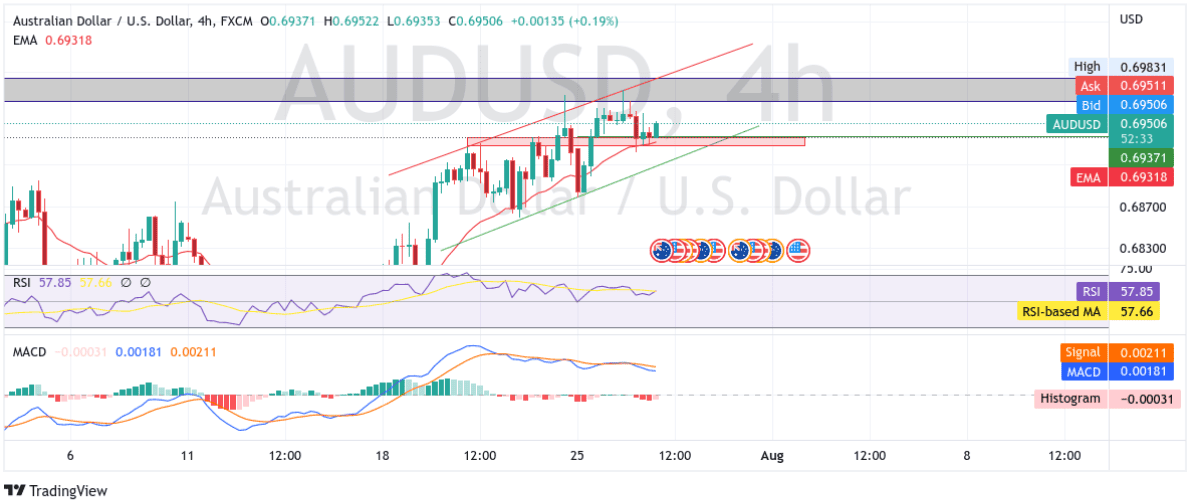

Technical Outlook: Four-Hours AUD/USD price Chart

From a technical perspective, using a four-hour price chart, the price looks to build upon Tuesday's retracement from the 50% Fibonacci retracement level, which coincides with a key support zone ranging from 0.69279-0.69371 levels. Some follow-through buying can lift the AUD/USD pair towards the immediate hurdle ranging from 0.69707- 0.69944 levels, coinciding with the upper horizontal trendline of the ascending channel pattern plotted from 20th July. Sustained strength above the said barricade would validate the bullish outlook and be seen as a new trigger for bulls to continue pushing up the price, paving the way for more gains.

The RSI(14) level at 57.85 is far from the overbought territory but above the neutral level. The moving average convergence divergence (MACD) crossover would add to the bullish filter later today. Additionally, the 20 Exponential Moving Average(EMA) level at 0.69321 pointing upwards validates our bullish filter.

On the flip side, a pullback toward testing the support zone ranging from 0.69279-0.69371 levels and a subsequent break below the aforementioned zone would negate any near-term bullish bias and pave the way for technical selling.