GBP/USD Rebounds Modestly From 1.20385 Level, FOMC Meeting Awaited

- GBP/USD pair gains positive traction on Tuesday to snub previous session losses

- Investors seem to have decided to wait on the sidelines against submitting aggressive bets ahead of the key FOMC meeting on Wednesday

- The latest UK Flash PMI readings offer support to the Cable

- Greenback continues to draw support from prospects of aggressive policy tightening by the fed in its Key Monteray Policy meeting on Wednesday

GBP/USD pair came under renewed buying pressure on Tuesday after attracting bullish bets in the first hour or so of the early Asian session to lift off spot prices from the vicinity of 1.20385 level. At the time of speaking the pair is up over 10 pips for the day and looks set to maintain its bid tone going forward to the European session.

Fears that the aggressive monetary policy tightening by the FED would lead to economic slowdown led to the US Dollar index(DXY) dismal performance and was last seen oscillating in a narrow range in the last hour. Concerns of a possible recession also weighed on investors' sentiment. This was evident from a generally weaker tone around the US equity markets, which extended some support to the Cable. As such Walmart on Monday cut its quarterly and full-year profit estimates because of rising food inflation. As a result, Walmart shares plunged nearly 9% in extended trading and dragged other retailers with it. To add to that investors seem to have decided to wait on the sidelines against submitting aggressive bets ahead of the key FOMC meeting report scheduled for release on Wednesday. The combination of factors was seen as a factor that undermined the safe-haven greenback.

That said, A fresh leg up in the ten-year benchmark yields boosted by rising odds of a hawkish monetary stance by the FOMC members in their next meeting slated for 25th-27 July was seen as a key factor that underpinned the safe-haven greenback. In fact, most investors seem convinced that the FED would stick to a 75bps interest rate in its upcoming monetary policy meeting as a way of tackling the burgeoning inflation which rose to a four-decade high in July. This in turn should cap the upside for the GBP/USD pair against any further uptick and warrants caution to investors against submitting aggressive bullish bets.

On the British docket, the latest UK PMI readings released last week showed the weakest rise in UK private sector business activity for 17 months. Input cost inflation also slowed down during July. The flash UK composite output index registered in July was 52.8 in July, down from 53.7 in June and the lowest reading since February 2021. The better-than-expected reading reaffirmed market bets for a 50bps interest rate by the Bank of England in its August meeting. This in turn was seen as a key factor that continued underpinning the cable and exerted upward pressure on the shared currency.

Going forward investors will take cues from the release of the New Home Sales report and the CB Consumer Confidence report scheduled for release during the Mid-North-American session. That said the focus now shifts toward the FED monetary policy statement report scheduled for release on Wednesday during the mid north American session. The report would influence the near-term USD price dynamics. This, in turn, should assist traders to determine the next leg of a directional move for the GBP/USD pair.

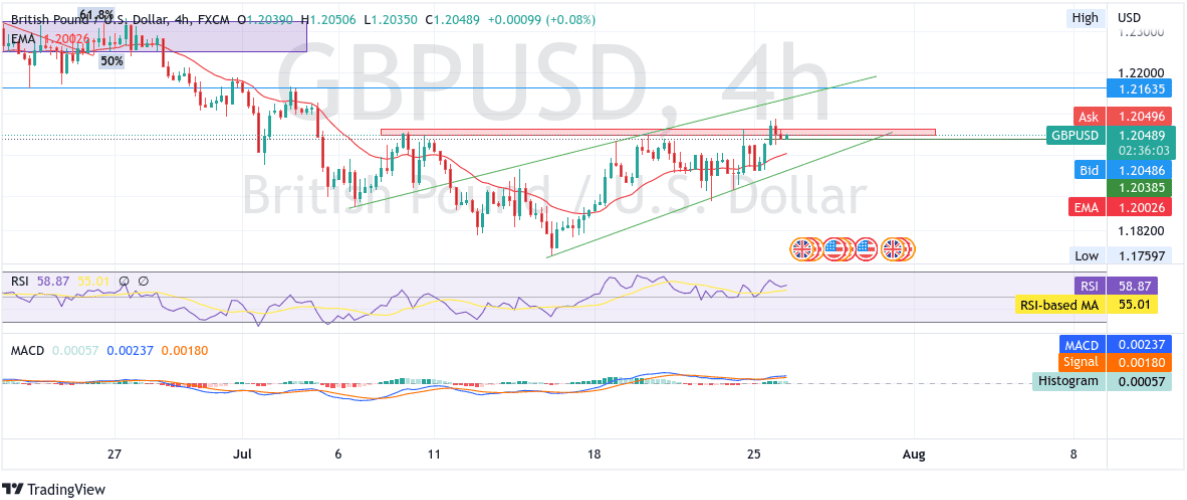

Technical Outlook: Four-Hours GBP/USD Price Chart

From a Technical Perspective, Tuesday’s positive move would encounter an immediate hurdle ranging from 1.20466 -1.20635. Sustained strength above the said barricade would validate the bullish outlook and would be seen as a fresh trigger for bulls to continue phishing up the price hence paving the way for more gains. The asset could then accelerate the bullish momentum towards testing the next barricade which is the upper horizontal trendline of the ascending channel plotted from 6th July. The said hurdle if Brocken decisively would pave the way for aggressive technical Buying.

The moving average convergence divergence (MACD) crossover at 0.00126 adds to the bullish filter. The RSI(14) level at 54.09 is far from the overbought territory but above the neutral level. . To add to that the 20 Exponential Moving Average(EMA) level at 1.20027 pointing upwards validates our bullish filter.

On the Flipside, a pullback toward testing the lower horizontal trendline of the ascending channel pattern turned support zone, if broken decisively would pave the way for aggressive technical selling.