EUR/USD Price Looks To Build Upon Last Week Sharp Rebound

- EUR/USD seeks to recover from last week's losses

- A combination of factors undermined the US Dollar

- FEDS monetary policy meeting scheduled for mid-this week to provide the next leg of a directional move for EUR/USD pair

EUR/USD cross attracted some deep buying in the vicinity of 1.02086 level on the first day of the week and staged a modest intraday recovery from the weekly low to lift spot prices to a fresh daily high during the early Asian session. The pair looks to build upon late last week’s sharp rebound from the 1.01300 level and was last seen trading with modest gains, just above mid 1.02100 level.

The ongoing steep decline in the benchmark ten years US benchmark yields saw the US Dollar index(DXY) continue its corrective pullback from a two-decade high amid receding bets for a more aggressive fed rate hikes by the federal reserve in its July policy meeting. This in turn was seen as a key factor that undermined the safe-haven greenback and offered support to the major. It is worth recalling several FOMC members said earlier this month they were not in favor of a bigger interest rate increase the market had priced in and that they will likely stick to a 75bps rate increase, following the release of the hotter-than-expected US consumer inflation report. Apart from this, signs of stability in US equity markets undermined the safe-haven greenback. Furthermore, mounting recession fears turned out to be another factor that exerted upward pressure on spot prices.

Hawkish ECB Monetary Policy Decision Shrugged off by Disappointing Flash PMI Readings and Italy Political Instability

On the European front, the European central bank last week on Thursday announced a 50bps hike to its interest rates in an attempt to cool rampant inflation in the eurozone and bring the inflation to its target of 2%. That said, the ECB monetary decision came on the backdrop of disappointing Flash PMI(Purchasers Managers Index) readings which showed eurozone business activity declined in July, as a downturn in manufacturing gathered pace and service sector growth slowed, with rising costs forcing consumers to reduce expenditure. To add to this the ongoing political uncertainty surrounding Italy, a member of the Eurozone following Italy’s prime minister (Mario Dragi ) resignation last week on Thursday in the wake of a collapse of his coalition government leaving the way for fresh elections contributed to the weak sentiment surrounding European equity markets. That said, Investors also remain concerned that global supply chain disruptions caused by the Russia-Ukraine war would continue pushing consumer prices even higher.

That said, investors still seem convinced that the FED would deliver a large rate hike in the year to tame inflation which reached a four-decade high in the latest US consumer inflation report. This in turn should be supportive of the greenback and support prospects of some dip-buying around the USD. This in turn would ultimately cap the downside for the EUR/USD pair.

Going forward the focus now shifts toward the FED monetary policy statement report scheduled for release on Wednesday during the mid north American session. The report would influence the near-term USD price dynamics. This, in turn, should assist traders to determine the next leg of a directional move for the EUR/USD pair.

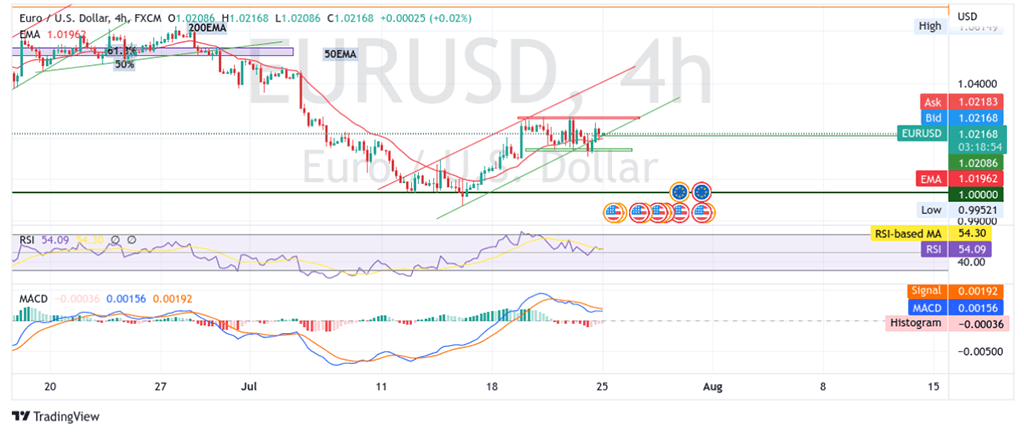

Technical Outlook: Four-Hours EUR/USD price Chart

From a Technical Perspective, the Price looks set to build upon last week's sharp rebound from the 1.01300 level. Strong follow-through buying would lift spot price to the immediate hurdle ranging from 1.02681-1.02776 levels. The said barrier if cleared decisively would pave the way for more gains and push the asset to the next barrier which is the upper horizontal trendline of the ascending channel pattern formation. The trendline turned resistance zone is plotted from 13th July and would act as a barricade against the pair.

The RSI(14) level at 54.09 is far from the overbought territory but above the neutral level. The moving average convergence divergence (MACD) crossover later today will add to the bullish filter. To add to that acceptance above the 20 Exponential Moving Average(EMA) level at 1.01951 adds to the bullish filter.

On the flip side, a pullback towards the lower horizontal trendline of the ascending channel pattern formation and a subsequent break below the said trendline would negate any near-term bullish bias and pave the way for aggressive technical selling.