What is ISM Services PMI?

Key Takeaways:

- With a scale ranging from 0 to 100, a reading above 50 signifies expansion in the non-manufacturing sector, while a reading below 50 indicates contraction

- As a leading indicator, the ISM Services PMI can provide valuable foresight into the future state of the economy

- A stronger-than-expected(forecasted) ISM Services PMI reading strengthens the country's currency, while a weaker ISM Services PMI reading weakens the country's currency

The ISM Services PMI, also known as the Institute for Supply Management's Services Purchasing Managers' Index, is a widely recognized economic indicator that provides insight into the health of the services sector of the United States economy. It gauges the sentiment and business conditions among purchasing managers in various service-based industries such as healthcare, finance, retail, and transportation. The index is calculated from a survey comprising questions where respondents indicate whether certain aspects of their business, such as new orders, employment levels, and prices, have improved, remained unchanged, or deteriorated compared to the previous month. With its timely release, the ISM Services PMI offers valuable information for investors, policymakers, and businesses to gauge economic activity and make informed decisions.

What does it measure? How is it calculated?

The ISM Services PMI, also known as the Institute for Supply Management Services Purchasing Managers' Index, measures the performance of the non-manufacturing sector in the United States. It provides valuable insights into the health and growth of finance, healthcare, retail, and other service-based industries. This index is calculated through a monthly survey conducted by the Institute for Supply Management, assessing key elements like business activity, new orders, employment, and supplier deliveries. The data collected is then weighted and compiled into a single numerical value. A reading above 50 suggests expansion in the non-manufacturing sector, while a reading below 50 indicates contraction. As businesses in the service industry play a significant role in the overall economy, the ISM Services PMI is a crucial tool for economists, policymakers, and investors alike, enabling them to gauge economic trends and make informed decisions.

Is ISM Services PMI a leading indicator?

The ISM Services PMI is a key economic indicator that provides insightful information about the growth or contraction of the services sector. But the question remains: is the ISM Services PMI a leading indicator? The answer is a resounding yes. As a leading indicator, the ISM Services PMI can provide valuable foresight into the future state of the economy. Surveying purchasing managers in various industries within the services sector captures crucial insights about factors such as production, employment, new orders, and inventory levels, which can anticipate changes in economic activity. As a result, the movement of the ISM Services PMI often precedes changes in the overall financial performance, making it a reliable tool for economists, policymakers, and market participants alike.

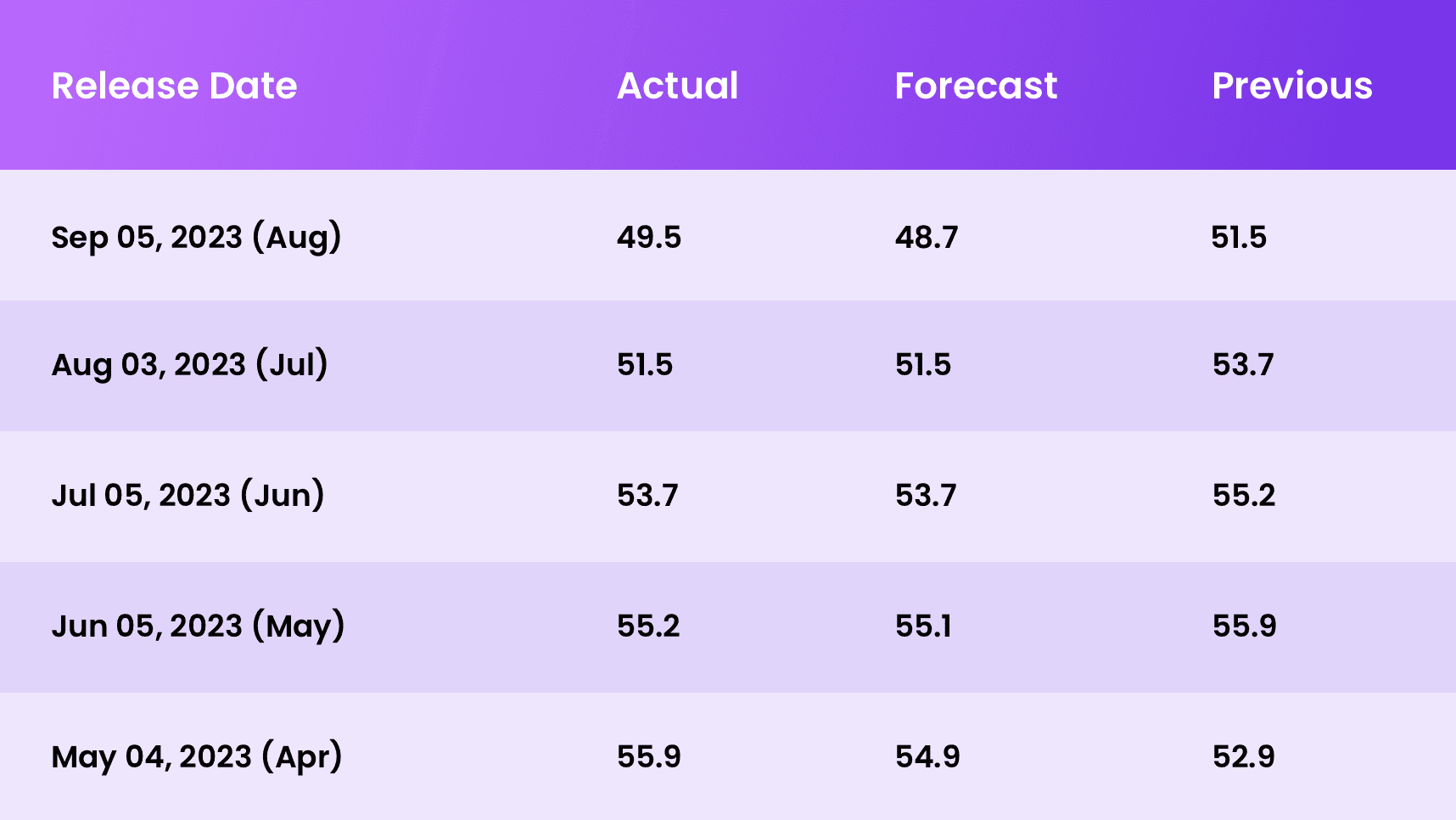

Below is a table showing the past five U.K. ISM manufacturing PMI figures released within the last five months, grouped according to the actual, forecasted, and previous data.

How does ISM Manufacturing PMI data affect Forex Markets?

When the ISM Services PMI exceeds expectations (actual data is higher/more robust than forecasted data), indicating growth and expansion in the services industry, it generally leads to increased investor confidence in the country's economy. This, in turn, can strengthen the value of the country's currency against other currencies as more investors flock to the currency as a safe-haven asset. Conversely, suppose the ISM Services PMI falls below expectations (actual data is lower/weaker than forecasted data), signalling a contraction or slowdown in the services sector. In that case, it can weaken the country's currency as investors seek more favorable investment opportunities elsewhere. Therefore, traders and investors closely monitor this data release, as it can provide valuable insights into potential forex market trends and assist in making informed trading decisions.

Looking to grow your wealth through social trading? Look no further than Pocket Trader! With Pocket Trader, you can connect with other traders, learn from experienced investors, and share your own insights with the community! Trade wiser now.