What is ISM Manufacturing PMI?

Key Takeaways:

- The ISM Manufacturing PMI is a widely recognized economic indicator that provides insight into the state of the manufacturing sector

- With a scale ranging from 0 to 100, a reading above 50 signifies expansion in the manufacturing sector, while a reading below 50 indicates contraction

- A stronger-than-expected (forecasted) PMI reading strengthens the country's currency, while a weaker PMI reading weakens the country's currency

The ISM Manufacturing PMI, or the Institute for Supply Management Manufacturing Purchasing Managers' Index, is a widely recognized economic indicator that provides insight into the state of the manufacturing sector. It is a monthly survey conducted by the Institute for Supply Management (ISM) that gathers data from purchasing managers across different industries. Aggregating responses to various questions regarding key aspects of manufacturing, such as new orders, production levels, employment, supplier deliveries, and inventories, calculate the PMI. This index is a critical tool for analysts, economists, and policymakers to gauge economic trends, forecast growth or contraction, and make informed decisions. The ISM Manufacturing PMI is highly regarded as an influential barometer of financial health and plays a pivotal role in understanding the overall economic performance of a nation.

What does it measure? How is it calculated?

The ISM Manufacturing Purchasing Managers' Index (PMI) measures the overall health of the manufacturing sector in a country. It provides valuable insights into the current business conditions, including production levels, new orders, employment, supplier deliveries, and inventory levels. The Institute for Supply Management (ISM) calculates the PMI from a monthly survey sent to purchasing and supply executives across different industries. These executives are asked to evaluate factors impacting their business, such as order backlogs, prices, and export/import levels. The responses are then compiled, weighted, and transformed into a single index that ranges from 0 to 100. A reading above 50 indicates expansion in the manufacturing sector, while a reading below 50 suggests contraction. This data is closely monitored by economists, investors, and policymakers as it offers crucial insights into the economy's direction.

How To Read ISM Manufacturing PMI Data

Understanding the intricacies of reading ISM Manufacturing PMI data is crucial for businesses and individuals looking to grasp the overall health and performance of the manufacturing sector. With a scale ranging from 0 to 100, a reading above 50 signifies expansion in the manufacturing sector, while below 50 indicates contraction. Additionally, paying attention to specific sub-indices, such as New Orders, Production, Employment, and Supplier Deliveries, allows for a more nuanced interpretation of the overall PMI. By monitoring these sub-indices and the overarching PMI figure, analysts can gain valuable insights into the strength and direction of the manufacturing industry, helping inform business decisions and economic forecasts.

Example Of ISM Manufacturing PMI Data

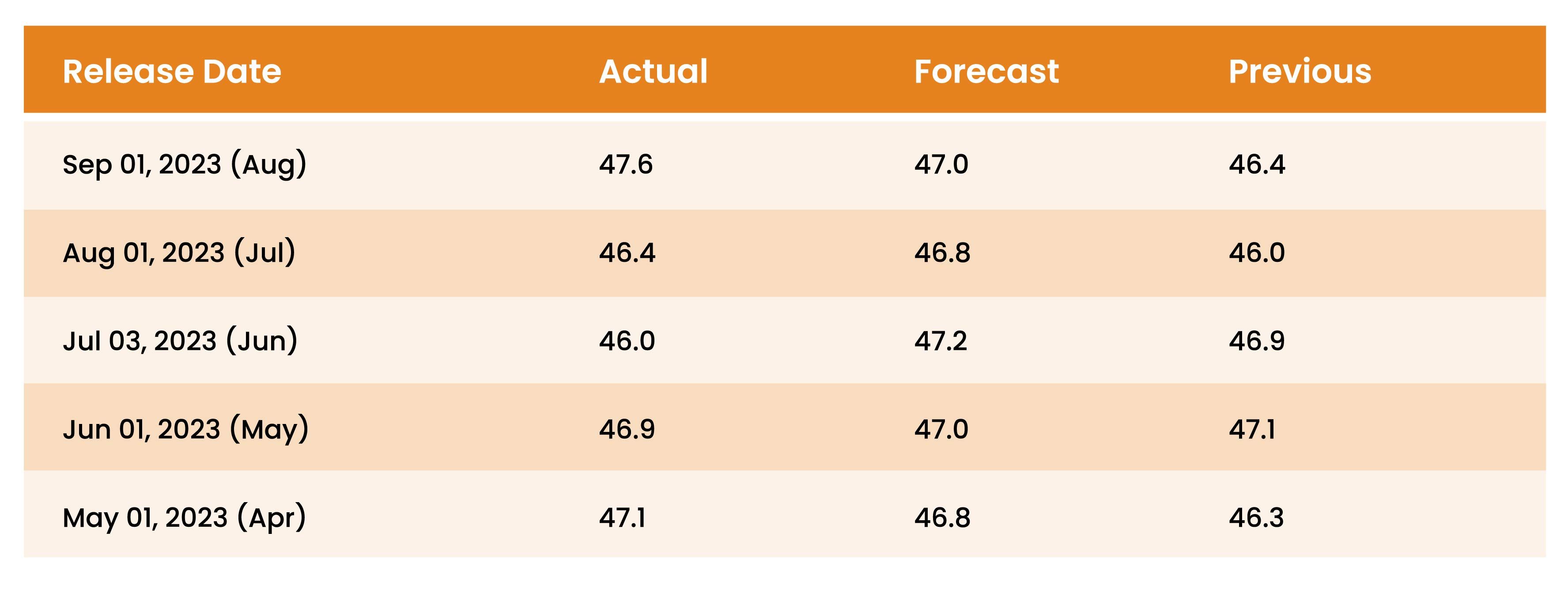

Below is a table showing the past five U.S. ISM manufacturing PMI figures released within the last five months, grouped according to the actual, forecasted, and previous data.

How does ISM Manufacturing PMI data affect Forex Markets?

When the ISM Manufacturing PMI data indicates a robust manufacturing sector (Actual data is higher/stronger than forecasted data), it often translates into increased consumer spending, job creation, and overall economic growth. Consequently, forex traders interpret this positive data as a sign of a strong economy, leading to higher demand for the country's currency. As a result, the country's currency tends to appreciate against other major currencies, causing forex markets to experience volatility and shifts in currency exchange rates. On the contrary, if the ISM Manufacturing PMI data suggests a contraction in manufacturing activity (Actual data is lower/weaker than forecasted data), forex traders perceive it as a sign of an economic slowdown. This may prompt a decrease in demand for the country's currency and a subsequent depreciation against other currencies. Therefore, closely monitoring and analyzing ISM Manufacturing PMI data is pivotal for forex traders to make informed decisions.

Looking to grow your wealth through social trading? Look no further than Pocket Trader! With Pocket Trader, you can connect with other traders, learn from experienced investors, and share your own insights with the community! Trade wiser now.