AUD/USD Rebounds From A Two-Months Low On Upbeat Aussie Trade Balance Data And Softer U.S. Dollar

Key Takeaways:

- AUD/USD gained positive traction on Monday, rebounding off from a two-month low

- Better-than-expected Aussie trade balance data underpins the antipodean and helps limit further losses around the AUD/USD cross

- The fundamental backdrop seems tilted firmly in favor of USD bears, suggesting any further buying could still be seen as a selling opportunity

- Markets await the release of U.S. PMI data for fresh AUD/USD directional impetus

AUD/USD cross-caught fresh bids on Monday during the mid-Asian session and bounced from a two-month low/0.64862 level touched earlier in the session and retook the 0.65000 levels.

The catalyst for today's sharp bounce in the mid-Asian session could be attributed to the upbeat Australian Trade Balance data report released earlier today. Australia's trade surplus on goods declined to AUD 10.96 billion in December 2023 from an upwardly revised AUD 11.76 billion in the previous month, compared to market forecasts of AUD 11 billion, as exports grew less than imports, an Australian Bureau of Statistics report showed.

Shipments increased by 1.8% from the previous month to a seven-month high of 47.13 billion, mainly underpinned by non-monetary gold. On the original basis, outbound shipments to the country's largest trading partner, China, advanced 6.9% month-on-month to a nine-month high of AUD 18.51 billion. Meanwhile, imports rose 4.8% to AUD 36.17 billion, mainly driven by parts for transport equipment.

Further underpinning the antipodean and helping exert upward pressure on the AUD/USD pair is the modest rebound in the U.S. equity markets, which helps drive flows away from the buck toward the AUD/USD cross.

Despite the supportive factors, the fundamental backdrop seems tilted firmly in favor of USD bears. This comes amid reduced market bets on the Fed's aggressive early rate cuts.

Markets seem entirely convinced that the Fed will leave rates unchanged during the March meeting and start cutting rates during the third quarter of 2024 after a U.S. Bureau of Labor Statistics (BLS) report released on Friday showed that the U.S. economy added 353K jobs in January 2024, compared to an upwardly revised 333K in December and way above market forecasts of 180K. It is the most significant rise in employment in a year, signalling the tight labour market. Additionally, average hourly earnings for all employees on U.S. private nonfarm payrolls rose by 19 cents, or 0.6 percent, to $34.55 in January 2024, above market expectations of 0.3 percent. It was the most significant rise since March 2022. Over the past 12 months, average hourly earnings have increased by 4.5 percent.

The hot U.S. jobs report came days after the Federal Reserve (Fed) held its benchmark Fed fund rates unchanged during the January meeting and announced it does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%. Moreover, during the post-interest rate decision announcement, the Fed Chair ruled out a March rate cut, saying that based on the Wednesday meeting, he doesn't think it's likely that the committee will reach a level of confidence by the time of the March meeting to identify March is the time to do that.

The Fed chair scuttled a March rate cut after he vowed during an interview with "60 Minutes" on Sunday that the central bank would proceed carefully with interest rate cuts this year and likely move considerably slower than the market expected.

That said, CME's fed watch tool shows provided fund futures traders have priced in an 82.5% chance the Fed will keep rates unchanged at 5.25% - 5.5% during the March meeting.

In contrast, the Reserve Bank of Australia (RBA) could be forced to cut rates in the next monetary policy meeting after Australia's Q4 inflation rate dropped to a two-year low. An Australian Bureau of Statistics (ABS) report showed that Australia's inflation rate was at 4.1% yoy in Q4 of 2023, down from 5.4% in Q3 and below market expectations of 4.3%. This, combined with a string of weak economic data from China, continues to undermine the antipodean, suggesting the path of least resistance for the shared currency is to the downside.

As we advance, investors look forward to the U.S. docket featuring the release of the Services PMI (Jan) and the ISM Non-Manufacturing PMI (Jan) data reports.

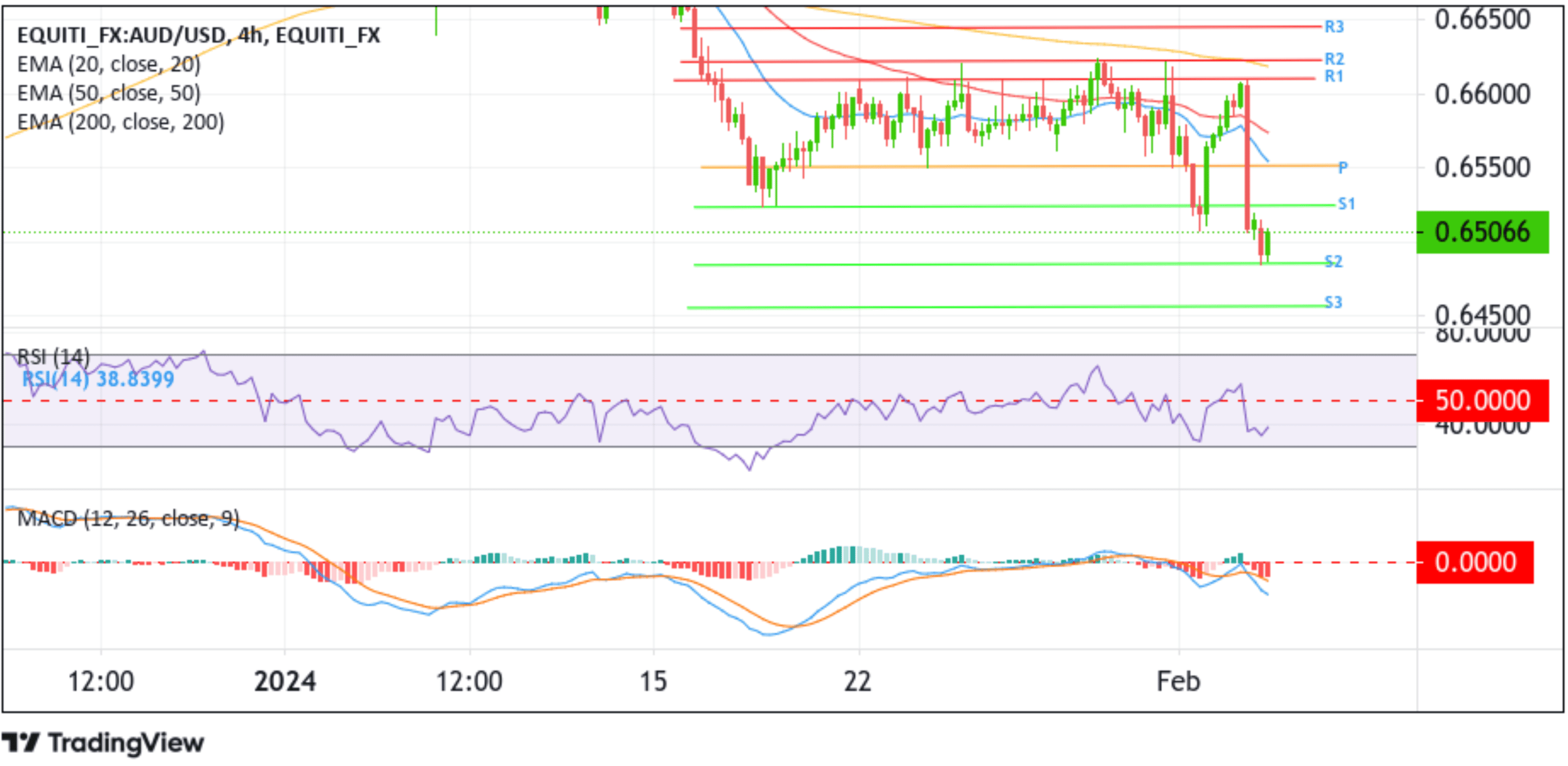

Technical Outlook: Four-Hour AUD/USD Price Chart

From a technical standpoint, the current four-hour candlestick is displaying some slight strength around the shared currency; however, further upticks seem elusive as the AUD/USD pair remains under heavy bearish pressure, and the fundamental backdrop is firmly tilted in favor of bears. The technical oscillators on the chart (RSI (14) and MACD) are in dip-negative territory, suggesting continuing the bullish price action this week. Additionally, the acceptance of the price above the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 0.66759 level supports the case for further upside moves. It suggests the current bullish pullback runs the chance of fizzling out sooner or later, and that further uptick could still be seen as a selling opportunity.

If bears return and catalyze a bearish reversal, initial support comes at the 0.64849 level. On further weakness, the focus shifts lower to the 0.64560 level (S2), about which downside pressure could accelerate if this level fails to hold, paving the way for more losses around the AUD/USD pair.