AUD/USD Retreats From Fresh One-Month High And Moves Back Below 0.66600 Mark on Mixed Ausi Macro-Data

Key Takeaways:

- AUD/USD cross returns from a fresh one-month high and drops below the 0.66600 mark

- Mixed Ausi-Macro data, released earlier today, weighs on the antipodean

- Rebounding the U.S. dollar helps limit further gains around the AUD/USD pair

- Markets shift focus toward the RBA interest rate decision announcement on Tuesday for fresh AUD/USD directional impetus

The AUD/USD cross witnessed fresh supply on Monday during the mid-Asian session and dropped from a new one-month high/0.66906 level touched earlier in the session and moved back below the 0.66600 mark on mixed Ausi macro data released earlier today.

An Australian Bureau of Statistics (ABS) report released earlier today showed retail sales in Australia dropped by 0.2% month-over-month in October 2023, unrevised from flash data, coming after a 0.9% increase in the prior month. This was the first decline in retail trade since June, as consumers hit the pause button on some discretionary spending and awaited Black Friday sales events.

In that same line, corporate profits in Australia fell by 1.3% QoQ in Q3 of 2023, slowing sharply from a downwardly revised 12.1% plunge in Q2, compared with market forecasts of a 0.3% drop, an ABS report showed. This was the softest decline in corporate profits since Q1 of 2021, with profits falling much softer at miner (-7.7% vs -20.9% in Q2). Through the year to September, corporate profits dropped by 1.7%, much weaker than a 10.7% plunge in the prior period. To a greater extent, the downbeat Ausi Company's gross operating profit and retail sales (MoM) figures overshadowed the modest rise in the value of new home loans for owner-occupied homes in Australia. The value of new home loans for owner-occupied homes in Australia rose 5.6% month-on-month to A$17.23 billion in October 2023, reversing from a 0.1% decline in September and exceeding market forecasts for a 0.8% gain, an ABS report showed.

Further weighing on the Aussie dollar (AUD) is the firm market expectation that the Reserve Bank of Australia will leave its official cash rate unchanged at 4.35% during Tuesday's December monetary policy announcement. This comes after the inflation rate in Australia fell to 5.4% year-on-year in the third quarter of 2023, down from 6.0% in the previous period, despite the employment rate rising significantly last month.

Moreover, the Antipodean continues to be weighed by the modest bounce in U.S. dollar demand on Monday, supported by rebounding U.S. Treasury bond yields. The U.S. Dollar index, which measures the greenback against a basket of currencies, rose slightly on Monday above the 103.300 mark but looked very shaky amid the general downbeat mood surrounding the buck amid firm market expectations that the Fed is done with its rate-hiking cycle.

Bets were reaffirmed after Powell said on Friday that the U.S. central bank plans on "keeping policy restrictive" until policymakers are convinced that inflation is under control.

"It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance or to speculate on when policy might ease," Powell said in prepared remarks for an audience at Spelman College in Atlanta. "We are prepared to tighten policy further if it becomes appropriate to do so."

Powell's remarks come on the heels of dovish comments by Fed Governor Christopher Waller, who said on Tuesday that he is increasingly confident that monetary policy is currently well-positioned to slow the economy and get inflation back to 2%. These, combined with the minutes of the November Monetary Policy Meeting and the softer U.S. consumer and producer inflation reports, fully cement market expectations that the Fed will leave its rates unchanged during the December meeting.

Going forward, market participants now look forward to second-tier U.S. economic data, which, along with the broader market risk sentiment, will influence the USD. The main focus, however, remains on the release of the RBA interest rate decision on Tuesday.

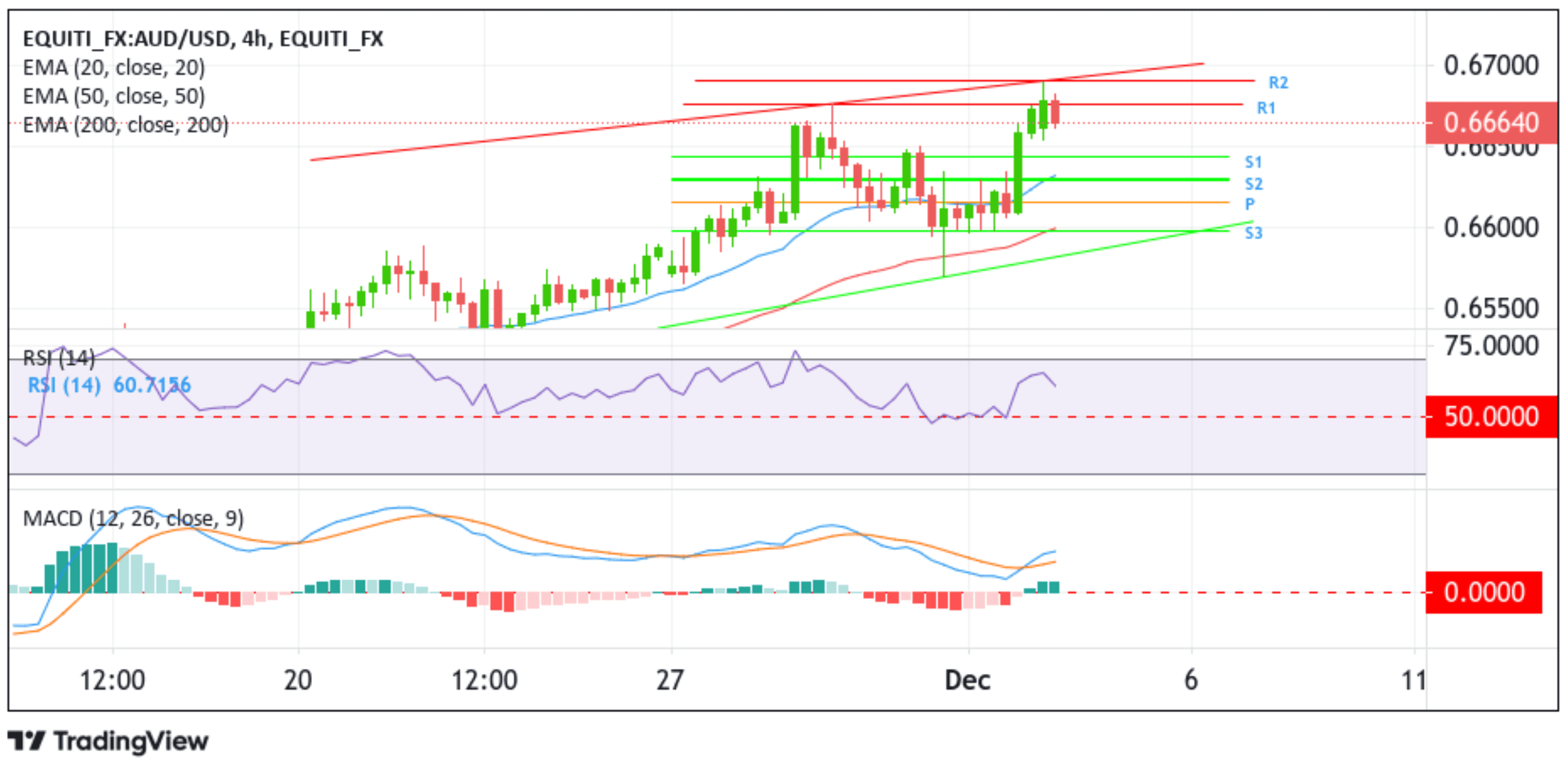

Technical Outlook: Four-Hours AUD/USD Price Chart

From a technical standpoint, AUD/USD cross-rebounded from the vicinity of the 0.66906 level and dropped below the 0.66600 mark. A further downtick could still be seen as a buying opportunity as the shared currency remains well above the technically strong 200-day (brown) EMA level at 0.63868. The chart's technical oscillators (RSI (14) and MACD) are all in positive territory, suggesting continuing the bullish price action this week. Moreover, some follow-through selling would face stiff resistance from the 38.2% fib level at 0.66438 (S1), the 50% fib level at 0.66296 (S2), and the 61.8% fib level (golden fib)/pivot (P) at 0.66156, thus suggesting the current price action runs the risk of fizzling out sooner or later.

If buyers jump back in and trigger a bullish reversal, initial resistance comes at the 0.66754 level (R1). On further strength, the focus shifts toward the 0.66906 level (R2). A convincing move above this level will pave the way for AUD/USD to retest the key resistance level plotted by an upward ascending trendline extending from the late-November 2023 swing to higher highs. A subsequent break above this resistance level will reaffirm the bullish bias and pave the way for additional gains around the AUD/USD cross.