EUR/USD Pares Eurozone-CPI-Inflicted Losses And Moves Back Above 1.09000 Mark, Jerome Powell's Speech-Eyed

Key Takeaways:

- EUR/USD pair rises back above 1.09000 mark on post-Eurozone CPI announcement

- The modest bounce in U.S. dollar supply helps limit further losses around the EUR/USD pair

- Weaker-than-expected Eurozone inflation data cements market expectations that the ECB will not hike rates again this year

- Markets eagerly await Fed Chair Jerome Powell's speech for fresh EUR/USD pair directional impetus

EUR/USD cross witnessed fresh buying on Friday during the Asian session and extended the overnight modest pullback from the vicinity of the 1.08792 level. As of press time, the shared currency is trading with modest gains above the 1.09000 mark and looks well set for further gains in the coming session amid the prevalent tone surrounding the greenback.

The U.S. Dollar index, which measures the greenback against a basket of currencies, extended its retracement slide from the vicinity of the 103.591 level touched on Thursday and dropped below the 103.300 mark on Friday, weighed by the modest bounce in U.S. Treasury bond yields on Friday as markets continue to price in that the Fed will not hike rates again this year.

Markets seem convinced the Federal Reserve is done with its rate-hiking cycle after Fed Governor Christopher Waller said on Tuesday that he is increasingly confident that policy is currently well-positioned to slow the economy and get inflation back to 2%. Apart from this, minutes of the November Monetary Policy Meeting revealed that Federal Reserve officials at their most recent meeting expressed little appetite for cutting interest rates anytime soon, particularly as inflation remains well above their goal.

Additionally, two U.S. Bureau of Labor Statistics reports released early this month pointed to cooling inflation pressures at the consumer and producer level, which, together with slowing job and wage growth, fully reinforce market expectations that the Fed is done with its monetary policy tightening campaign. CME's Fed watch tool also shows that Fed fund futures traders have now priced in a 100% chance that the Fed will leave its Fed Funds rates unchanged at 5.25% – 5.5% during the December meeting.

Further weighing on the buck was the batch of mixed U.S. macro data released Thursday. A Thursday's U.S. Bureau of Economic Analysis report showed the U.S. core PCE price index, the Federal Reserve's preferred gauge to measure inflation, rose by 3.5% from the previous year in October 2023, the least since April 2021. The result aligned with market expectations and marked a slowdown from last month's 3.7%. Every month, core PCE prices advanced by 0.2%, easing from the 0.3% increase in September.

Elsewhere, a U.S. Department of Labor report on Thursday showed the number of Americans filing for unemployment benefits rose by 7,000 to 218,000 in the week ending November 25th, an increase from the revised number of 211,000 reported in the previous week but slightly below market expectations of 220,000. Meanwhile, continuing claims surged by 86,000 to 1.927 million in the prior week, marking the highest level since November 2021 and hinting at a softening labor market.

The current price movement comes hours after the EUR/USD cross dipped to hit a one-week low/1.08792 level, partly influenced by the weaker-than-expected Eurozone CPI data released earlier on Thursday. The inflation rate in the Euro Area declined to 2.4% year-on-year in November 2023, reaching its lowest level since July 2021 and falling below the market consensus of 2.7%, a preliminary estimate showed. Every month, consumer prices fell by 0.5% in November, the most significant monthly decline since January 2020. Excluding food and energy, the inflation rate in the Eurozone area also cooled to 3.6%, marking its lowest point since April 2022 and coming in below forecasts of 3.9%. In that same line, the euro area seasonally-adjusted unemployment rate stood at 6.5% in October 2023, unchanged from the prior month and matching market forecasts. The number of unemployed people rose by 48 thousand from a month earlier to an eight-month high of 11.134 million.

As we advance, investors look forward to the U.S. docket featuring the release of the ISM Manufacturing PMI data report. The main focus, however, remains on Fed Chair Jerome Powell's speech. Investors would look at Powell's tone and comments around inflation and future monetary policy actions, which would be crucial toward proving the next leg of a directional move for the EUR/USD pair.

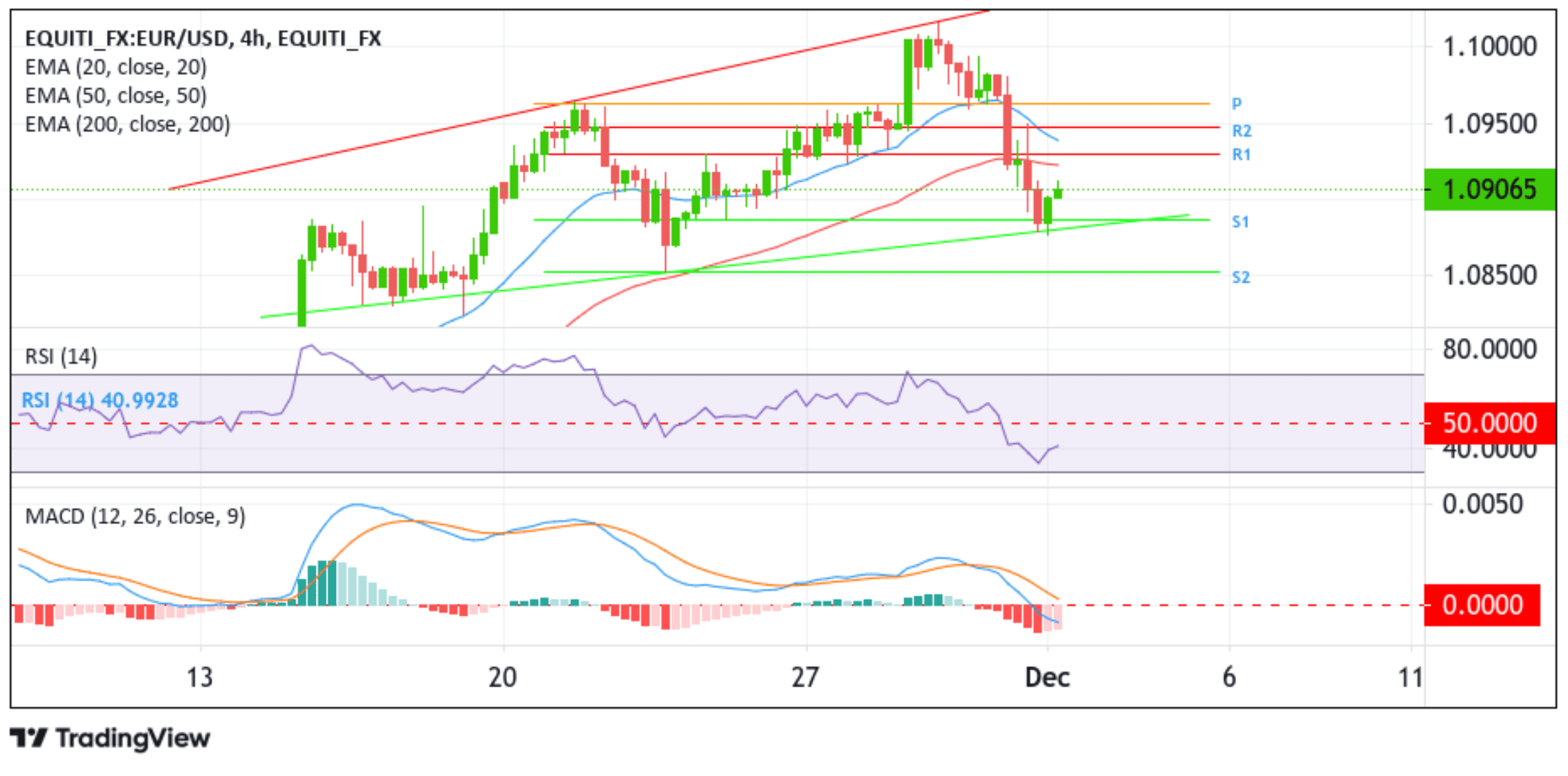

Technical Outlook: Four-Hour EUR/USD Price Chart

From a technical standstill, the price has extended the modest bounce from the vicinity of the 1.08792 level touched on the post-Euro CPI dip on Thursday. A further increase in buying pressure above the current price level would pave the way for an ascent toward tagging the 50-day (red) EMA level at the 1.09226 level, which sits directly below the 1.09301 resistance level (R1), which corresponds to the 38.2% Fibonacci retracement level. Acceptance above these barricades would pave the way for a further upward movement toward tagging the 20-day (blue) EMA level at 1.09356 before moving further toward the 1.09468 resistance level (R2), corresponding to the 50% Fib level. A convincing move above this level will pave the way toward the pivot level (p), corresponding to the 61.8% fib level (golden fib). A decisive break above this level would act as a fresh trigger for new buyers to jump in, leading to a rally above the 1.10000 mark toward the 1.10163 ceilings.

On the flip side, if sellers jump back in and catalyze a bearish turnaround, initial support comes in at the 1.08865 level. On further weakness, EUR/USD could drop toward retesting the key support level plotted by an ascending trendline extending from the mid-November 2023 swing to lower lows. A decisive break (bearish price breakout) below this level would open the door for a decline toward the 1.08515 support level (S2), and if this level fails to defend itself, EUR/USD could drop further toward the 1.08238 floor.