USD/JPY Sticks To BoJ Ultra-Loose Monetary Policy Stance, Remains Capped Above 143.800 Mark

Key Takeaways:

- USD/JPY cross witnessed some buying on Wednesday during the Asian session and moved above the 143.900 mark

- BoJ's decision to maintain its ultra-loose monetary policy stance continues to weigh on the Yen

- Better-than-expected Japanese Trade Balance data gets overshadowed by the general downbeat mood surrounding the Yen

- Sustained U.S. dollar selling fails to offer any support to the USD/JPY cross

The USD/JPY cross attracted some buying near the 143.826 level and extended the modest intraday recovery from last Thursday's five-week low. The recovery momentum has lifted spot prices back above the 143.900 mark during the mid-Asian session and has managed to recover part of its previous losses in the last three trading sessions.

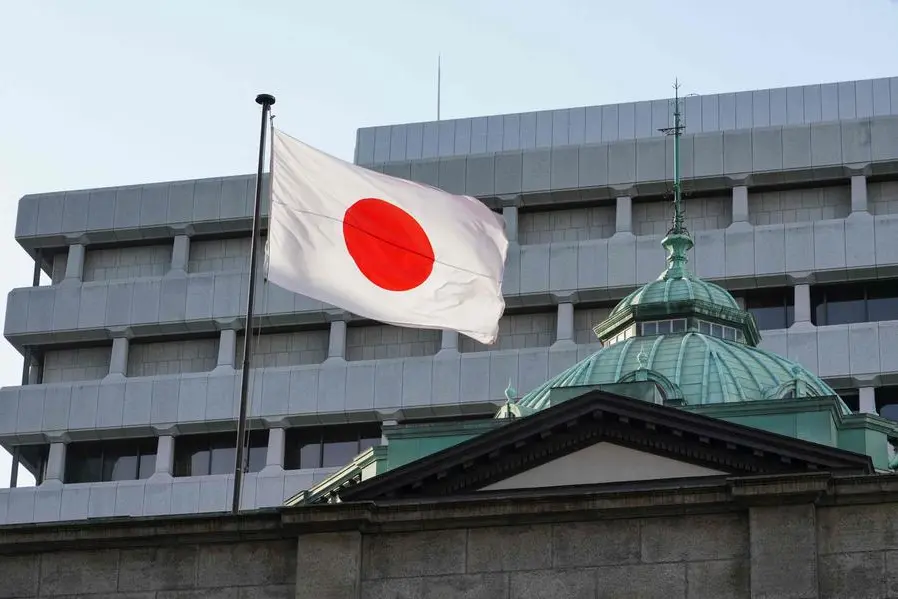

The Japanese Yen's (JPY) current lacklustre performance against the buck could be attributed to the latest Bank of Japan decision, in which the Central Bank decided to leave its ultra-loose monetary policy unchanged at its final meeting this year.

The BOJ decided unanimously to keep interest rates at -0.1% while sticking to its yield curve control policy that supports the upper limit for 10-year Japanese government bond yield at 1% as a reference, according to a policy statement released Tuesday.

The board further said that it will continue with monetary easing amid extremely high uncertainties at home and abroad. It also mentioned that policymakers will respond to economic activity prices and the development of financial conditions. By doing so, the BoJ aims to achieve a price stability target of 2% sustainably, accompanied by wage increases. The committee reiterated that it will not hesitate to take extra easing measures if needed.

Following the BoJ's decision, the immediate market implication saw yields for the 10-year Japanese government bond fall to 0.622%. At the same time, the Yen fell sharply by as much as 1.40% against the greenback to trade around 144.500 levels in the early European trading session. The Japanese stocks, on the other hand, rose significantly, posting one of their best gains so far this year. That said, the downbeat mood surrounding the Yen saw markets, to a greater extent, overlook a softer Japanese Trade balance report released earlier today, which showed Japan's trade deficit had decreased sharply to JPY 776.94 billion in November 2023 from JPY 2,057,64 billion in the same month of the prior year, compared with market estimates of a shortfall of JPY 962.4 billion, a Japanese Ministry of Finance report showed.

Shifting to the U.S. docket, the U.S. dollar index, which measures the greenback against a basket of currencies, fell on Wednesday below the 102.180 level, weighed by the generally weaker tone surrounding Treasury bond yields as investors continued to bet that the U.S. Federal Reserve will soon begin cutting interest rates despite Federal Reserve officials' recent attempt to push back against how investors and traders heard last week's Fed chair's comments.

This comes on the heels of comments by Atlanta Fed President Bostic, who said on Friday, "I'm not really feeling that this is an imminent thing', and that they wouldn't need to cut rates until Q3".

Bostic's comments came on the same day as those of New York's Federal Reserve President John Williams, who said rate cuts are not a topic of discussion for the central bank. "We aren't really talking about rate cuts right now," he said on CNBC's "Squawk Box." "We're very focused on the question in front of us, which, as Chair Powell said, is, have we gotten monetary policy to a sufficiently restrictive stance in order to ensure inflation comes back down to 2%? That's the question in front of us."

That said, to a greater extent, the generally weaker tone around the back fails to offer any support to the USD/JPY cross.

As we advance, investors look forward to the U.S. docket featuring the release of the Existing Home Sales (MoM) (Nov) and the CB Consumer Confidence (Dec) data reports set for release during the early North American session. In the meantime, the U.S. bond yields and the broader market risk sentiment will influence the USD price dynamics and provide short-term trading opportunities around the USD/JPY pair.

Technical Outlook: One-Day USD/JPY Price Chart

From a technical standpoint, the price's ability to find acceptance above the technically strong 200-day (yellow) Exponential Moving Average (EMA) at 143.562, followed by the subsequent move above the pivot level (P) at 143.725, which corresponds to the 50% Fibonacci Retracement Level, supported the case for further upside moves. Some follow-through buying would uplift spot prices toward the 144.724 resistance level (R1), which coincides with the key resistance level plotted by a downward-sloping trendline extending from the mid-November 2023 swing to higher-highs. A convincing move above these barricades will act as a fresh trigger for new buyers to jump in, paving the way for additional gains around the USD/JPY cross. The bullish recovery momentum could then be extended to tag the 20-day (blue) EMA level at 145.415 before heading toward the 146.193 resistance level (R2) later.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support comes in at 143.725. A decisive move below this level will pave the way for a drop toward the 200 (yellow) day EMA level at 143.562. Acceptance below this level would negate the current bullish bias and pave the way for dip losses around the USD/JPY pair. The downside momentum could then be extended toward retesting the 143.080 support level (S1), followed by the 142.485 support level (S2).