USD/JPY Rises Modestly Above Mid-142.000 Despite Light Trading Volume

Key Takeaways:

- USD/JPY traded above Mid-142.000 levels on Wednesday, despite the light trading volume.

- Better-than-expected Japanese macro data suggest that BoJ might continue to stick to its ultra-loose monetary policy stance, which weighs on the yen.

- Downbeat U.S. Treasury yields might help limit further U.S. dollar uptick moves and, in turn, help cap the upside for the USD/JPY cross.

The USD/JPY cross-edged slightly higher on Wednesday in the Asian trading session and held above mid-142.000’s. Further USD/JPY price movement hinges on market sentiment, though much action is not expected amid light trading volume. A modest resurgence in U.S. dollar demand witnessed earlier today helped the USD/JPY pair extend its corrective pullback for the third consecutive day on Wednesday.

Apart from this, further signs of cooling inflation in Japan suggest that the Bank of Japan (BoJ) might continue to stick to its ultra-loose monetary policy stance in 2024 which weighs on the yen and helps exert upward pressure on the USD/JPY cross.

A Bank of Japan (BoJ) report on Tuesday showed the annual inflation rate excluding food and energy fell to 2.7% in December of 2023, the lowest since April of 2023 from 3.0% in the previous month and below market expectations of 3.0%.

The upbeat BoJ inflation report comes on the heels of a Japanese Ministry of Internal Affairs and Communications report released on Monday, which showed Japan’s unemployment rate stood at 2.5% in November 2023, unchanged from the previous month and matching market forecasts. It was also the lowest jobless rate since January, as the number of employed persons increased by 560,000 to 67.8 million, outpacing a rise in the number of unemployed people by 40,000 to 1.69 million.

Despite the combination of supporting factors, the greenback continues to be weighed down by firm, dovish market bets that the U.S. Federal Reserve will soon begin cutting interest rates. This was evident from the generally weaker tone around the U.S. Treasury bond yields, which could limit further upside moves for the USD/JPY pair.

In fact, the bets were reaffirmed after the Federal Reserve’s preferred measure of inflation, Core PCE prices in the US, which exclude food and energy, increased by 0.1% from the previous month in November of 2023, below market estimates of 0.2% and holding unchanged from the downwardly revised increase in the previous month. Core PCE prices rose by 3.2% from the previous year, below market expectations of 3.3% and slowing from the downwardly revised 3.5% in October

That said, the generally positive tone around the U.S. equity markets further undermines the greenback and could limit further gains around the shared currency. This, in turn, warrants caution for traders against submitting aggressive bullish bets.

Going forward, in spite of light trading volume, incoming second-tier Japanese economic data, along with broader market risk sentiment, will influence the Yen and provide some trading opportunities around the shared currency.

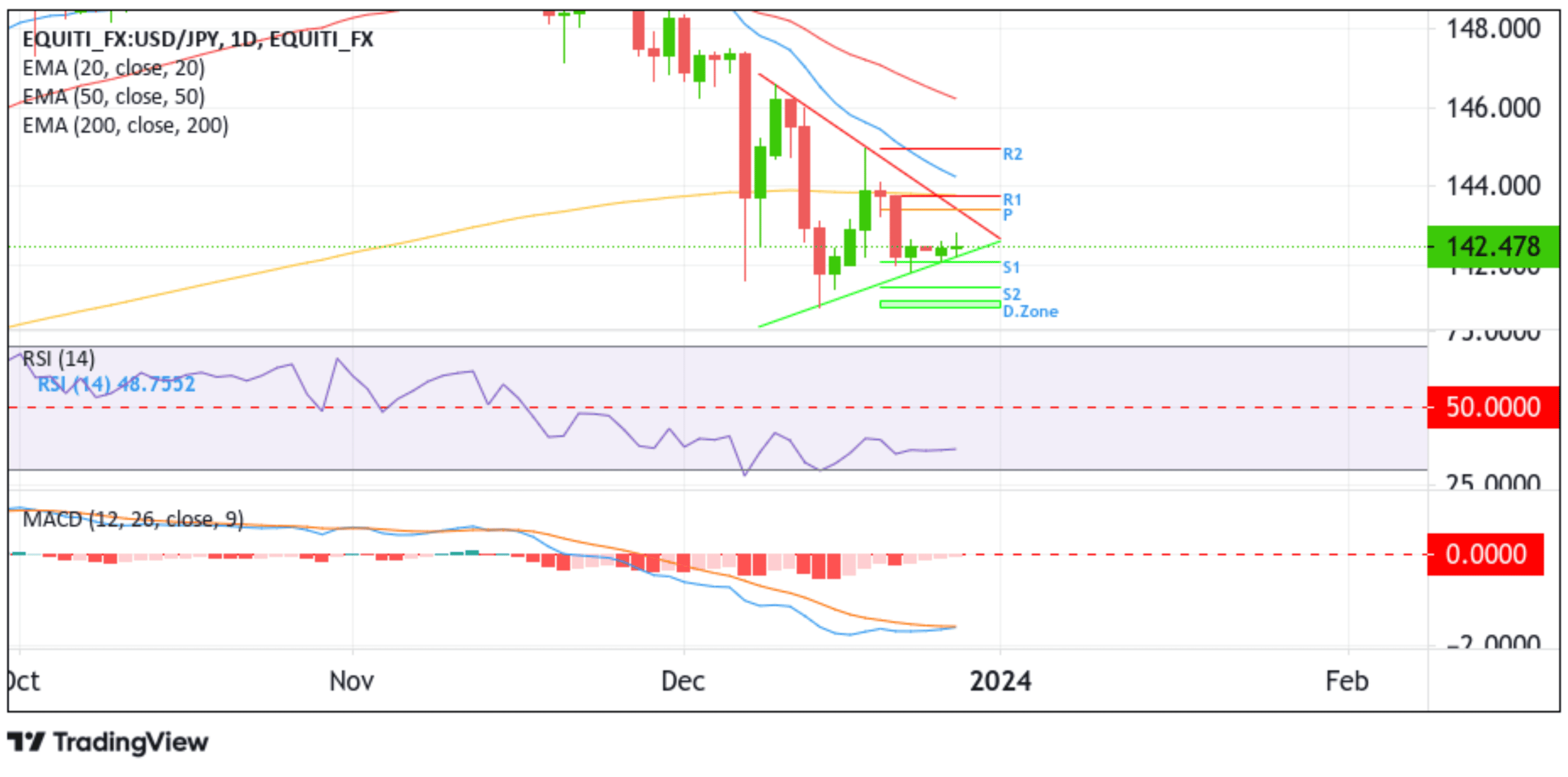

Technical Outlook One-Day USD/JPY Price Chart

From a technical perspective, the USD/JPY cross is trading with a bearish. Bias and a further increase in buying pressure would uplift spot prices toward the pivot level (p) at 143.406, about which, if buyers convincingly 141break above this barrier, the bullish momentum would be extended toward the main barricade (upper limit of the bearish symmetrical triangle). A subsequent rejection from the aforementioned resistance level will pave the way for an accelerated decline toward the lower limit of the bearish symmetrical triangle. A decisive move (bearish price breakout) below this level will act as a fresh trigger for new sellers to jump in, paving the way for a further decline toward the 142.115 level (S1), followed by the 141.447 level (S2) and in dire cases, the USD/JPY cross could extend the bearish trajectory toward the 141.142-140.938 demand zone.