USD/CNH Lacks Clear Direction As Chinese Inflation Data Comes In Lighter Than Expected, Powell's Speech Eyed

Key Takeaways:

- USD/CNH rose slightly higher on Thursday during the mid-Asian session but lacked clear direction in the aftermath of lighter Chinese inflation data

- China's inflation rate fell more than expected, suggesting further rate cuts by PboC, which weighs on the Yuan (CNH)

- The prospects for further policy tightening by the Federal Reserve (Fed) remain supportive of elevated U.S. Treasury bond yields and act as a tailwind to the buck

- Markets eye Fed Chair Jerome Powell's speech during the late North American session for fresh USD/CNH directional impetus

The USD/CNH cross rose slightly higher on Thursday during the mid-Asian session, reversing some of its early losses, but it lacked clear direction in the aftermath of lighter Chinese inflation data. As per press time, the pair is trading above the 7.28700 mark and over 200 pips above its 2-month low/7.26636 level touched on Wednesday.

A National Bureau of Statistics of China report released early today showed China's consumer prices dropped by 0.2% YoY in October 2023, compared with a flat reading in the previous month and market estimates of a 0.1% fall, suggesting that multiple stimulus measures from Beijing did little to stimulate overall spending. Every month, the CPI unexpectedly fell by 0.2%, compared with the consensus of a flat figure after a 0.2% rise in August.

Excluding volatile food and energy prices, the so-called core CPI increased by 0.6% YoY in September, the least in four months, after a 0.8% rise in August.

Additionally, China's wholesale inflation (producer prices) declined by 2.6% year-on-year in October 2023, after a 2.5% fall in the previous month. The latest figure came slightly less than the market consensus of a 2.7% decrease, pointing to the 13th consecutive month of producer deflation. The immediate market reaction to the data report saw the Chinese Yuan (CNH) fall significantly against the buck before paring losses and retracing to trade with modest gains above the 7.28700 mark.

That said, the report and China's narrow economic recovery support widely held expectations of further rate cuts by the People's Bank of China (PBoC), which acts as a headwind to the CNH.

In contrast, markets are convinced that the Fed will hike interest rates by at least 25bps before the end of the year, which remains supportive of rising U.S. Treasury bond yields and acts as a tailwind to the buck and suggests the path of least resistance for the USD/CNH cross is to the upside. Reaffirming market bets that the Fed still needs to be done with hiking rates were the recent comments by Minneapolis Fed President Neel Kashkari, who warned that the central bank may not raise interest rates, given that inflation has remained sticky in recent months. While he acknowledged some resilience in the U.S. economy, he also noted that the Fed had more work to do regarding inflation.

Furthermore, Fed Chair Jerome Powell indicated last week that the option for higher rates remains on the table and that the central bank still needs to discuss rate cuts. That said, the Chinese Yuan continues to be weighed by the mixed Chinese macro data released earlier today, which showed China's exports in U.S. dollar terms fell by 6.4% in October from a year ago. That's worse than the 3.3% drop predicted by a Reuters poll. However, imports rose 3% in U.S. dollar terms in October from a year ago. That's in contrast to Reuters' forecast for a 4.8% drop from a year ago. Nevertheless, the continued extended decline in exports indicated further challenges for China's primary economic drivers, potentially hindering the country's growth.

As we advance, investors look forward to the U.S. docket featuring the release of the Initial Jobless Claims report for the previous week. The main focus, however, remains on Fed Chair Jerome Powell's speech later today.

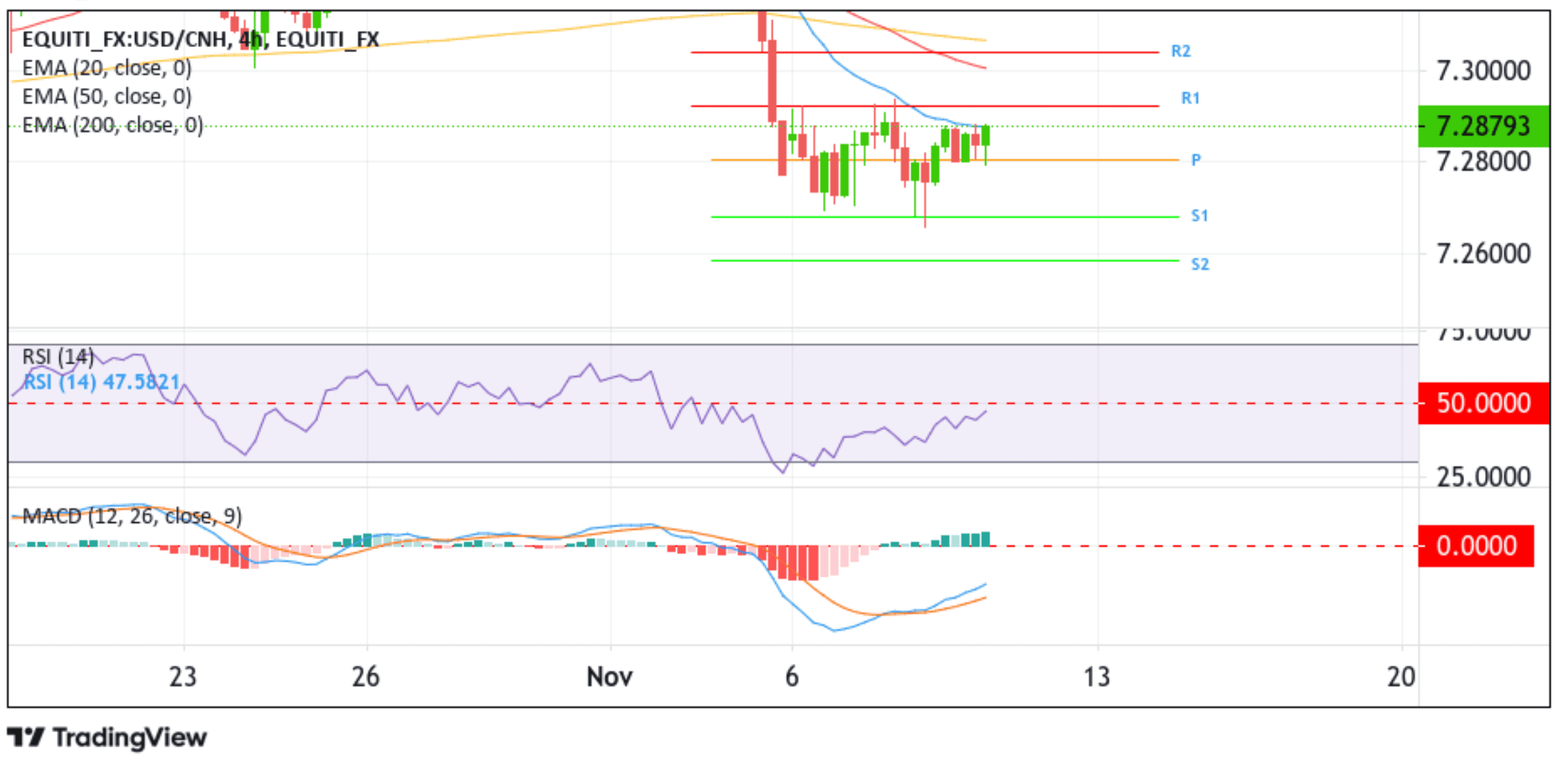

Technical Outlook: Four-Hour USD/CNH Price Chart

From a technical standpoint, the USD/CNH cross has been oscillating in a narrow range of 7.28794 - 7.27978 levels for the better part of Wednesday and early Thursday. The current price action shows the shared currency trading within striking distance of its upper limit, about which if, in the coming sessions, the price ascends and convincingly breaks above this barrier, USD/CNH could gain momentum, paving the way for a rise toward confronting the 7.29239 resistance level (R1). A clean break above this barrier could see the shared currency rise to tag the 50-day (red) Exponential Moving Average (EMA) at the 7.29985 level. Acceptance above this level will pave the way for a move above the 7.30000 mark toward the 7.30400 ceiling (R2), which sits directly below the technically strong 200-day (brown) EMA level at 7.30666. Sustained strength above these barricades could see new buy orders placed, causing the shared currency to rise toward the 7.34614 - 7.34349 supply zone.

On the flip side, if dip-sellers and tactical traders jump back in and catalyze a bearish reversal, initial support comes in at the 7.27978 level (p). On further weakness, the focus shifts lower to 7.26816 (S1), followed by 7.25788 (S2).