GBP/AUD Extends RBA-Inflicted Losses Below 1.91000 Mark; Andrew Bailey Speech Eyed

Key Takeaways:

- GBP/AUD pair extended RBA-inspired losses below the 1.91000 mark on Wednesday

- The Reserve Bank of Australia raised its cash rate by 25bps to 4.35% during its November meeting, which underpins the antipodean and helps cap the upside for the GBP/AUD cross

- The current price action seems to show markets have overlooked a slew of positive U.K. macro data released recently

- Markets eye Governor Andrew Bailey's speech during the late European session for fresh GBP/AUD directional impetus

GBP/AUD cross-extended the mid-day retracement slide from the vicinity of the 1.91872 level and dropped back below the 1.91000 mark during the second half of the Asian session on Wednesday. The pair is trading at 1.90723, down 0.16% for the day, and has confirmed a fresh breakdown below a key support level.

A combination of factors assisted the Australian dollar in extending its stellar performance against the Great British Pound (GBP) on Wednesday, which has until now reversed part of its previous gains achieved in the last three days. Boosting the antipodean was the decision by the Reserve Bank of Australia (RBA) on Tuesday to raise its cash rate by 25bps to 4.35% during its November meeting, matching market expectations. Still, it contrasted heavily with that of the Bank of England (BoE) and was seen as a crucial factor that drove flows away from the cable towards the antipodean.

That said, Tuesday's move brought borrowing costs to their highest level since January 2011, marking the 13th rate rise since May 2022, as inflation proved more persistent than expected a few months ago due to a further increase in service prices. Apart from this, an Australian Bureau of Statistics report released earlier today showed Building Permits YoY in Australia increased to -20.60% in September from -22.30% in August of 2023.

Moreover, a Chinese Trade Balance data report on Tuesday showed that China's imports rose by 3% in U.S. dollar terms in October from a year ago. That's in contrast to Reuters' forecast for a 4.8% drop from a year ago.

Furthermore, the current price action shows markets have overlooked a slew of positive U.K. macro data released recently. A British Retail Consortium report on Tuesday showed retail sales in the United Kingdom rose 2.6% on a like-for-like basis in October 2023 from a year ago, slowing from a 2.8% gain in September as higher costs continued to weigh on consumer confidence, while British households cut back spending to save for Christmas and higher fuel bills. Still, October's figure exceeded forecasts for a 2.4% rise. Additionally, a Halifax and Bank of Scotland report on Tuesday revealed that the House Price Index MoM in the United Kingdom increased to 1.10% in October from -0.30% in September of 2023.

Investors look forward to the U.K. docket featuring Bank of England Governor Andrew Bailey's speech during the late European session for fresh GBP/AUD directional impetus.

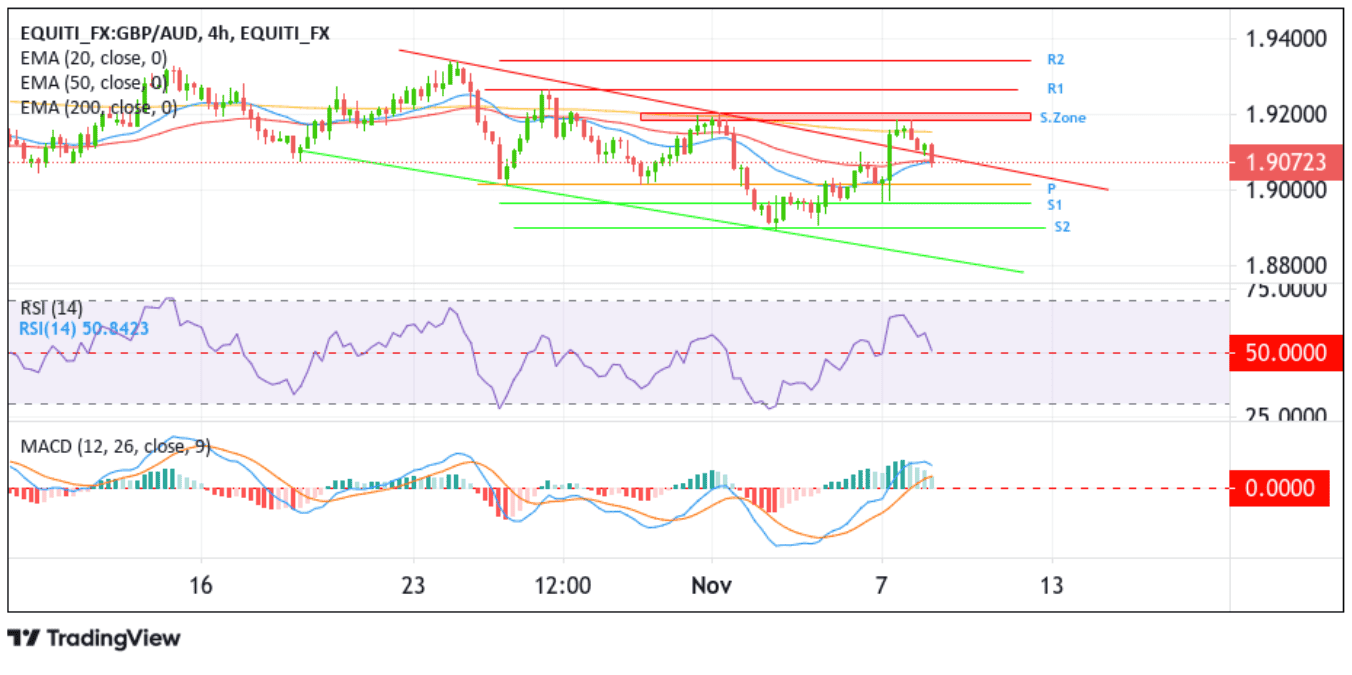

Technical Outlook: Four-Hours GBP/AUD Price Chart

From a technical perspective, the price's retracement move from the 1.91872 level and Wednesday's subsequent move below the upper limit of the descending channel pattern (bearish price breakout) portray a bearish bias. However, sellers should wait for near-term depreciating movements below the upper limit of the channel before placing aggressive bearish bets. Nevertheless, if selling momentum increases from the current price level in the coming session, the GBP/AUD pair could drop toward the key pivot (P) at the 1.90168 level. A clean move below this level will pave the way for a drop toward the 1.90000 round mark. A convincing move below this level will pave the way for a further extension of the retracement slide toward the 1.89665 support level (S1). On further weakness, the price could decline toward the next relevant support level at 1.88977, about which, if this level fails to be defended, GBPAUD could accelerate its decline toward retesting the lower limit of the descending channel pattern. A Clean break below this support level will reaffirm the bearish outlook and pave the way for dip losses around the GBP/AUD cross.

On the flip side, any meaningful pullback beyond the current price level is more likely to confront stiff resistance and run out of steam ahead of the technically strong 200-day Exponential Moving Average (EMA) at 1.91537. A convincing move above this level might trigger new buy orders and could see the shared currency make a fresh attempt to conquer the 1.92043 - 1.91852 supply zone. This is followed by the 1.92650 resistance level (R1) and the 1.93390 resistance level (R2), about which, if the latter is cleared decisively, the price could extend its bullish trajectory further toward the 1.94000 psychological mark.