USD/CHF Remains Resilient Above 0.92000 Mark Amid A Stronger U.S. Dollar, Jerome Powell's Speech Awaited

Key Takeaways:

- USD/CHF remains resilient above the 0.92000 mark despite an early pullback from an eleven-week high/ 0.92252 level

- The ongoing rise in U.S. Treasury bond yields, bolstered by hawkish Fed expectations, helps exert upward pressure on the USD/CHF cross

- The divergence in monetary policy adoption between the Federal Reserve (Fed) and the Swiss National Bank (SNB) continues to weigh on the Swiss Franc (CHF)

- The market's focus shifts toward the Fed chair's speech for fresh USD/CHF directional impetus

The USD/CHF pair prolonged its strong move-up witnessed over the past one and a half months or so and gained traction for the twentieth successive day on Thursday. The momentum lifted spot prices to a near eleven-week high/ 0.92252 level during the second half of the Asian session after rebounding in the last hour or so to reverse an intraday drop to the 0.91957 level/(daily low) and ultimately recoup a majority of its earlier losses and remain resilient above the 0.92000 mark.

Rising U.S. Treasury bond yields, supported by prospects of further monetary policy tightening by the Fed, assisted the U.S. dollar to increase to a ten-month high/106.838 on Wednesday, which in turn is seen as a key factor acting as a tailwind to the USD/CHF cross and helping cap the downside for the shared currency.

The markets seem convinced that the Federal Reserve (Fed) will raise interest rates by at least 25 basis points (bps) before the end of this year after the Fed signalled during its September FOMC Meeting announcement that there could be another hike this year despite leaving its Fed funds rate unchanged, ranging from 5.25% to 5.5%. The bets were reaffirmed after FOMC Member Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, said on Tuesday that a soft landing for the U.S. economy is more likely than not but still pegged the probability at about 60% that the Fed "potentially" raises rates one more quarter of a percentage point and then holds borrowing costs steady "long enough to bring inflation back to target in a reasonable period of time."

In contrast, market analysts expect the (SNB) to maintain a dovish stance for the remainder of this year as inflation pressures in Switzerland have gradually cooled down and likely resume hiking interest rates in early 2024. It is worth noting that the Swiss National Bank, during its September meeting, left its overnight lending rate unchanged at 1.75%, saying the significant tightening of monetary policy over recent quarters is countering remaining inflationary pressure.

That said, going forward, the divergence in monetary policy adoption between the Federal Reserve (Fed) and the Swiss National Bank (SNB) is set to weigh on the Swiss franc (CHF) and suggests the path of least resistance for the USD/CHF pair is to the upside.

Further contributing to the sentiment around the USD/CHF cross was the upbeat U.S. macro data released on Wednesday, which showed new orders for manufactured durable goods in the U.S. unexpectedly rose 0.2% month-over-month in August 2023, rebounding from an upwardly revised 5.6% slump in July and beating market forecasts of a 0.5% fall. Moreover, the generally weaker tone around the U.S. equity markets further supports the greenback and helps cap the downside for the USD/CHF cross.

As we advance, investors look forward to the U.S. docket featuring the release of the GDP (QoQ) (Q2) report, the Initial Jobless Claims (previous week) report, and the Pending Home Sales (MoM) (Aug) report. The main focus, however, remains on the Fed Chair's speech during the late North American session.

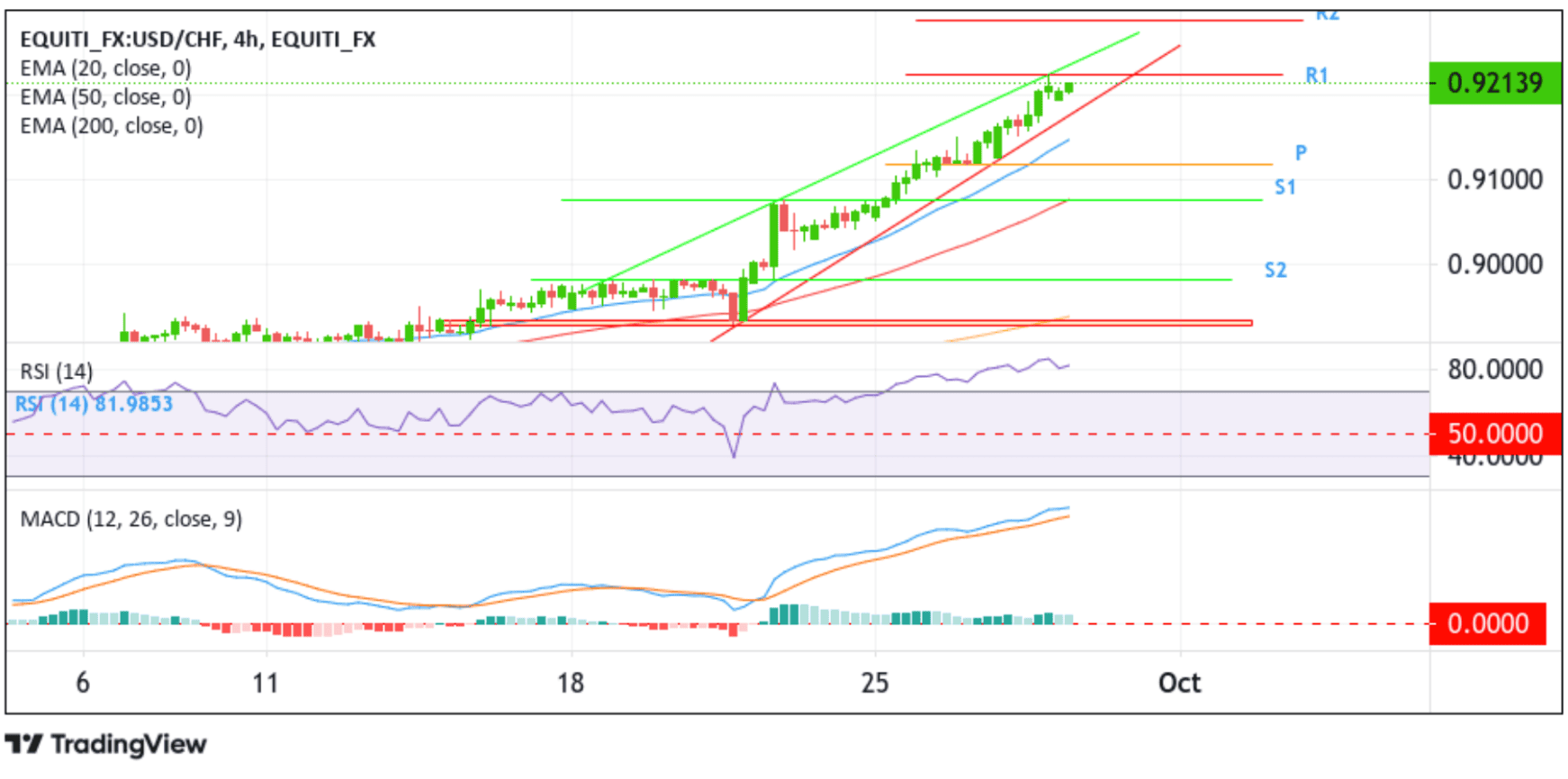

Technical Outlook: Four-Hour USD/CHF Price Chart

From a technical standpoint, the USD/CHF cross is under heavy bullish pressure, supported by the generally firmer tone around the greenback, and is currently trading 0.11% up for the day and 1.75% up for the week. An increase in buying momentum from the current price level would face stiff resistance at the 0.92252 level (R1). If the price clears this barrier decisively, the USD/CHF cross could accelerate its ascend towards the upper limit of the ascending channel pattern, extending from the August 21st swing higher-high. A subsequent break (bullish price level) above this resistance level would reaffirm the bullish thesis and act as a fresh trigger for bulls to push the price higher.

All the technical oscillators on the chart are in dip-positive territory, suggesting the continuation of the bullish price action this week. However, the Relative Strength Index (RSI) (14) momentum oscillator at 81.9853 level is in extreme overbought conditions, cautioning traders against submitting aggressive bullish bets around the USD/CHF cross. Nevertheless, the bullish outlook is firmly supported by the acceptance of the price below the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 0.87930 level. Additionally, the 50 (red) and 200 (yellow) day EMA crossover (golden cross) at the 0.87948 level further credence to the bullish thesis.

On the flip side, if dip-sellers and tactical traders resurface and spark a bearish reversal, initial support comes in at the lower limit of the ascending channel pattern extending from the August 20th swing lower-low. If sellers manage to breach this floor (support level), downside pressure could accelerate, paving the way for a drop toward the key pivot point (P) at 0.91192 level. A four-hour candlestick close below this level would pave the way for a further decline toward the 0.90763 support level (S1). On further weakness, the USD/CHF price could drop to the 0.89828 support level (S2) and, in highly bearish cases, fall to the demand zone ranging from 0.89001-0.88942 levels.