UK Brent Crude Oil Recovers For The Second Consecutive Day Above $93.00 A Barrel On Supply Tightness

Key Takeaways:

- UK Brent crude oil edged higher Wednesday during the Asian session to mark a second day of solid gains

- Supply tightness helps the UK Brent crude oil price recover above 93.00 a barrel

- Further rate hikes by central banks worldwide might help limit further UK Brent crude oil price gains

- Oil traders now look forward to the release of the crude oil inventory data later today for fresh UK Brent crude oil directional impetus

The UK Brent Crude Oil ticked higher on Wednesday during the Asian session to extend the overnight bounce from the 92.40 - 92.33 region. Supply tightness helped markets overlook past rising interest rates and their economic implications.

An American Petroleum Institute report on Tuesday showed stocks of crude oil in the U.S. rose by 1.586 million barrels in the week that ended September 22nd, 2023, after a 5.25 million barrel draw in the previous week. This weekly gain marked the second in U.S. Crude Oil Inventories in the last seven weeks, while analysts expected a fall of 1.650 million barrels. The data comes on the heels of a fuel export ban in Russia, which is set to tighten fuel supplies across Europe and impact global oil prices. This, combined with the extension of supply cuts by Saudi Arabia and Russia until the end of the year as part of the OPEC+ group's plan, points to substantially tighter oil supplies in the coming months, which support crude oil prices.

Despite the supporting factors, UK Brent crude oil continues to face heavy headwinds from rising U.S. Treasury bond yields, bolstered by hawkish Fed expectations, which extends support to the greenback and might help cap the upside for crude oil prices. The greenback rose to a ten-month high on Wednesday as investors continued to bet that the Federal Reserve (Fed) will raise interest rates by at least 25 basis points (bps) before the end of this year.

The bets were reaffirmed after the Federal Reserve (Fed) mid-this month announced it had left its federal funds rate unchanged during its September FOMC meeting but signalled there could be another hike this year. Additionally, FOMC Member Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, said on Tuesday that a soft landing for the U.S. economy is more likely than not but still pegged the probability at about 60% that the Fed "potentially" raises rates one more quarter of a percentage point and then holds borrowing costs steady "long enough to bring inflation back to target in a reasonable period of time."

The Bank of England (BoE), on the other hand, ended its run of 14-straight interest rate hikes after it held its overnight lending rate at 5.25% during its September meeting amid cooler inflation in the U.K. Still, policymakers reiterated their commitment to tightening policy further if deemed necessary. However, markets fear that further rate hikes by central banks will dent economic activity and, in turn, reduce crude oil demand, ultimately leading to low crude oil prices.

As we advance, oil traders look forward to the official inventory data (crude oil inventories) set for release later today. The official data is expected to show increased demand for crude oil, which will further boost oil prices.

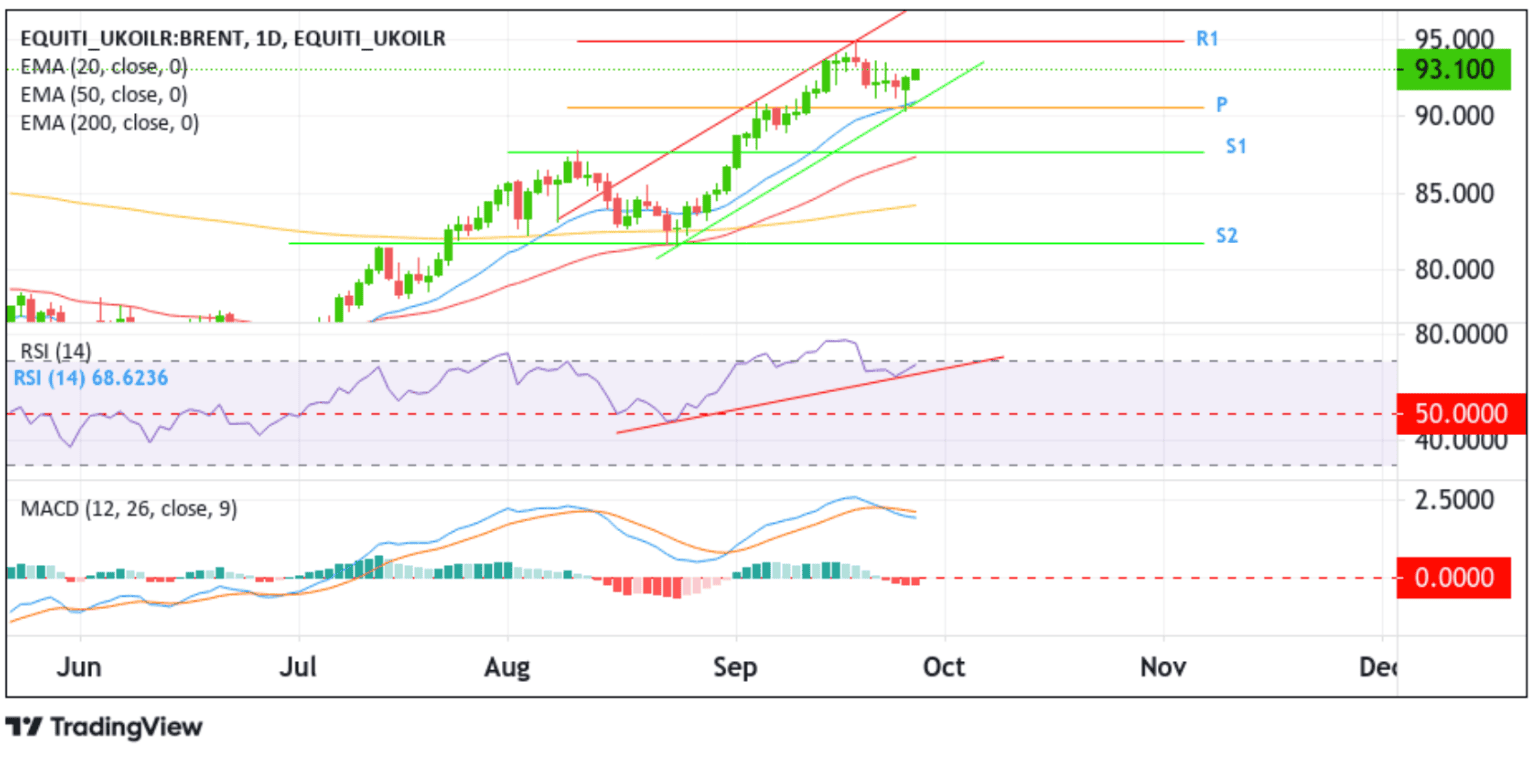

Technical Outlook: Four-Hour EUR/GBP Price Chart

From a technical standstill, the UK Brent crude oil price is up 0.76% for the day and is looking poised for further upside moves. If buyer momentum increases, the precious black liquid could ascend toward the resistance level (R1) at 94.873. If the price pierces this barrier, buying interest could gain further momentum, creating the proper condition for an advance toward the key resistance level plotted by an ascending trendline extending from the early August 2023 swing high. A decisive break above this resistance level would reaffirm the bullish bias and pave the way for further gains around UK Brent crude oil prices.

All the technical oscillators (RSI (14) and MACD) on the chart are in the dip-bullish territory, suggesting continuing the bullish price action this week. Further supporting the bullish outlook is the acceptance of the price above the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 81.723 level. Additionally, the 50 (red) and 200 (yellow) day EMA crossover (golden cross) at the 82.465 level adds credence to the bullish thesis.

If dip-sellers and tactical traders jump back in and trigger a bullish reversal, initial support appears at the key support level plotted by an ascending trendline extending from the late August 2023 swing low. A subsequent break below this support level would pave the way for a drop toward the pivot level (P) at 90.407. Acceptance below this level would be a fresh trigger for sellers to push the price further down. The UK Brent crude oil price could drop toward the support level (S1) at 87.709. If sellers manage to breach this floor, downside pressure could accelerate further, paving the way for a decline toward the 50 (red) and 200 (yellow) day EMA crossover (golden cross) at 82.465, followed by the 200-day (yellow) EMA level at 81.723, and in highly bearish cases, extend a leg down to the 81.491 support level (S2).