WTI vs Brent - What are the differences?

Key Takeaways:

- Crude oil has long been the backbone of the global energy industry, serving as the primary fuel source for various industries

- While there are numerous types of crude oil, two benchmarks stand out: West Texas Intermediate (WTI) and Brent crude oil

- In a world that heavily relies on fossil fuels, any significant event, whether political, environmental, or economic, can have a profound impact on crude oil prices

Crude oil has long been the backbone of the global energy industry, serving as the primary fuel source for various industries. As one of the most valuable commodities in the world, trading crude oil has gained significant attention from investors and traders alike due to the highly volatile nature of the oil market, which presents traders with opportunities to profit from price fluctuations. But what exactly is crude oil trading? Crude oil trading involves buying and selling contracts for the future delivery of barrels of oil. This highly liquid market operates on various platforms, including futures exchanges such as the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE). Crude oil pricing is influenced by several factors, including global supply and demand dynamics, geopolitical tensions, macroeconomic indicators, and even weather patterns. In this article, we will dive into the world of crude oil trading, differentiate the different types of crude oil, analyze why Brent is more expensive than WTI, and finally discuss how world events can affect crude oil prices.

WTI vs. Brent Crude

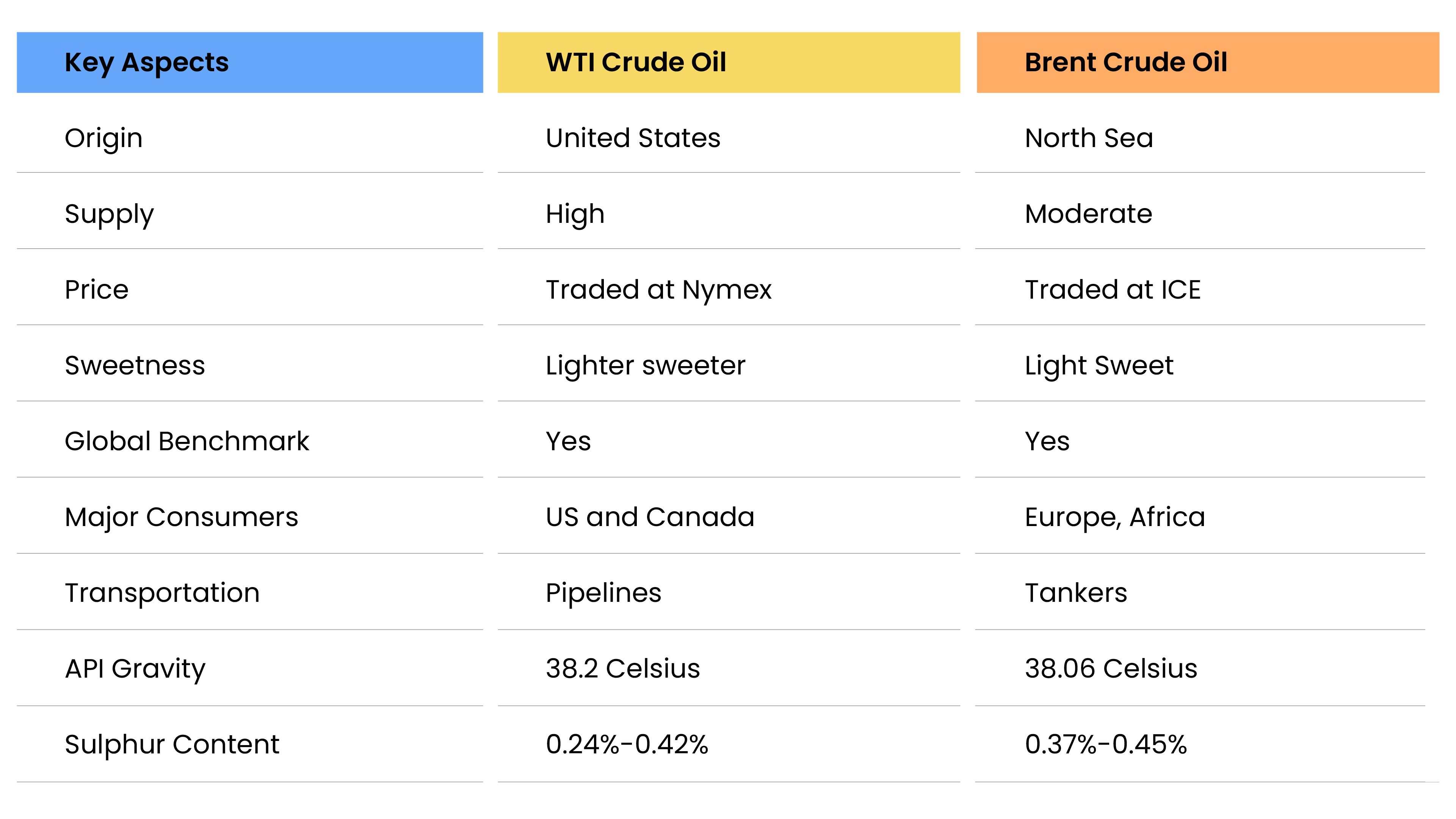

While there are numerous types of crude oil, two benchmarks stand out: West Texas Intermediate (WTI) and Brent crude oil. In this section, we will define these key types of crude oil and outline their differences in a simplified table format.

1. WTI Crude Oil:

West Texas Intermediate, or WTI, is a primary crude oil benchmark primarily sourced from the United States. It is renowned for its high quality, characterized by its lightness and low sulfur content. Traded at the New York Mercantile Exchange (NYMEX), WTI is a primary pricing reference for oil within the United States. Notably, it has a comparatively higher supply level, primarily due to America's booming shale oil production.

2. Brent Crude Oil:

On the other hand, Brent crude oil derives its name from its production area in the North Sea, specifically from fields in the United Kingdom, Norway, and other European nations. It is slightly heavier and contains a somewhat higher sulfur content than WTI. Brent oil is predominantly traded at the Intercontinental Exchange (ICE) and serves as a global benchmark. Brent's moderate supply is backed by its popularity in Europe, Africa, and the Middle East.

Below is a table showing the different aspects of WTI and Brent crude oil:

Why is Brent more expensive than WTI?

One common question among oil investors and market enthusiasts is why Brent is more expensive than WTI. To comprehend this phenomenon, we need to delve into the factors that influence the pricing of these two crude oil benchmarks.

Firstly, geographical location plays a significant role in determining the prices. Brent crude oil is primarily extracted from oil fields in the North Sea, whereas WTI originates from areas in the United States, specifically Texas. Due to differences in production, transportation, and infrastructure costs, Brent often faces higher associated expenses, leading to its relatively higher price.

Secondly, the quality of the crude oil affects pricing. Brent crude is known for its high quality, characterized by lower sulfur content and a higher API gravity, making it easier and cheaper to refine into various petroleum-based products. On the other hand, WTI crude exhibits slightly lower quality characteristics. As a result, Brent's superior quality fetches a premium, contributing to its higher pricing compared to WTI.

Additionally, supply-demand dynamics and geopolitical factors heavily influence these crude oil benchmarks. As an international benchmark, Brent is more susceptible to fluctuations caused by geopolitical tensions, conflicts, and global supply disruptions. WTI, however, is more immune to global disruptions and is predominantly tied to the US market dynamics. As a result, Brent often experiences higher price volatility than WTI, making it more expensive during heightened geopolitical instability.

Furthermore, the trading and investment sentiment surrounding these benchmarks also impact their pricing. Brent is traded on the Intercontinental Exchange (ICE) in London, making it easier for global investors, including oil companies and speculators, to access and trade contracts. The vast majority of contracts are settled in cash rather than physical delivery. In contrast, WTI futures are traded on the New York Mercantile Exchange (NYMEX), predominantly attracting US-based investors. The accessibility and broader participation in Brent contracts increase liquidity and create more demand, further influencing its pricing.

How World Events Can Affect Crude Oil Prices

The ever-fluctuating prices of crude oil are intricately connected to global events within and outside the oil-producing countries. In a world that heavily relies on fossil fuels, any significant event, whether political, environmental, or economic, can profoundly impact crude oil prices. Political instability in major oil-producing nations can disrupt production, resulting in supply shortages and a subsequent increase in oil prices. Similarly, natural disasters, such as hurricanes or earthquakes, can damage oil infrastructure, causing a decrease in production capacity. Additionally, economic factors like changes in global demand, currency fluctuations, and trade tensions between nations can greatly influence crude oil prices. Investors, policymakers, and consumers alike must closely monitor these world events as they play a pivotal role in shaping the volatile landscape of the crude oil market.

In conclusion, understanding the basics of oil trading, specifically WTI and Brent crude oil plays a crucial role in navigating the intricate world of financial markets. WTI, or West Texas Intermediate, is renowned as the benchmark for oil prices in the United States, while Brent crude oil is predominantly used as the global benchmark. By recognizing the fundamental differences between the two, investors can make more informed decisions when trading these commodities. Additionally, engaging in oil trading requires a comprehensive understanding of market dynamics, supply and demand factors, geopolitical events, and technical analysis. By keeping a close eye on these factors, novice and seasoned traders alike can effectively navigate the oil market's volatility and capitalize on profitable opportunities.

Looking to grow your wealth through social trading? Look no further than Pocket Trader! With Pocket Trader, you can connect with other traders, learn from experienced investors, and share your own insights with the community! Trade wiser now.