US WTI Crude Oil Rises For Second Consecutive Day On Middle East Conflict And Libya Outage

Key Takeaways:

- U.S. West Texas Intermediate (WTI) futures rose for the second consecutive day to trade at $72.53 a barrel

- The ongoing Middle East crisis and a Libyan supply outage weighed on oil demand, which underpinned crude oil prices

- A slightly larger-than-expected drop in U.S. crude oil stock supports crude oil prices

- Oil traders look forward to the release of U.S. crude oil inventory data for fresh directional impetus

The U.S. West Texas Intermediate (WTI) crude oil price rose modestly on Wednesday during the Asian session, extending the previous day's gains as the ongoing Middle East crisis and a Libyan supply outage weighed on oil demand, which helped exert upward pressure on crude oil prices, which in turn helped pare some of its early-week losses.

As of press time, U.S. West Texas Intermediate (WTI) futures rose 0.38 cents, or 0.52%, to trade at $72.53 a barrel, but are still 1.77%, or $1.30, down for the week.

The U.S. crude oil price drew support on Wednesday from the ongoing Middle East crisis after the Israeli military said early this week its fight against Hamas will continue through 2024, fueling concerns that the conflict could escalate into a regional crisis that would disrupt global oil supplies.

Moreover, U.S. WTI oil futures further drew support from the closure of Libya's 300,000 barrels per day (bpd) Sharara oilfield, one of its largest, which has been a frequent target for local and broader political protests and Middle East tensions.

Further extending support to U.S. WTI crude oil futures on Wednesday was the news that Saudi Arabia had emphasized its desire to support efforts to stabilize oil markets, following reports that Russia curbed its crude oil production level in December, according to Price Futures Group analyst Phil Flynn.

Additionally, an American Petroleum Institute (API) report released earlier today showed stocks of crude oil in the U.S. dropped by 5.215 million barrels in the week that ended January 5th, 2023, following a 7.418 million barrels fall in the previous week and way above market expectations of a 1.2 million decline, which in turn was seen as another factor that helped lift crude oil prices higher on Wednesday.

As we advance, oil traders look forward to releasing U.S. crude oil inventories later today, which will offer more cues on supply in the world's largest fuel consumer. The main focus, however, remains on Thursday's U.S. inflation data report.

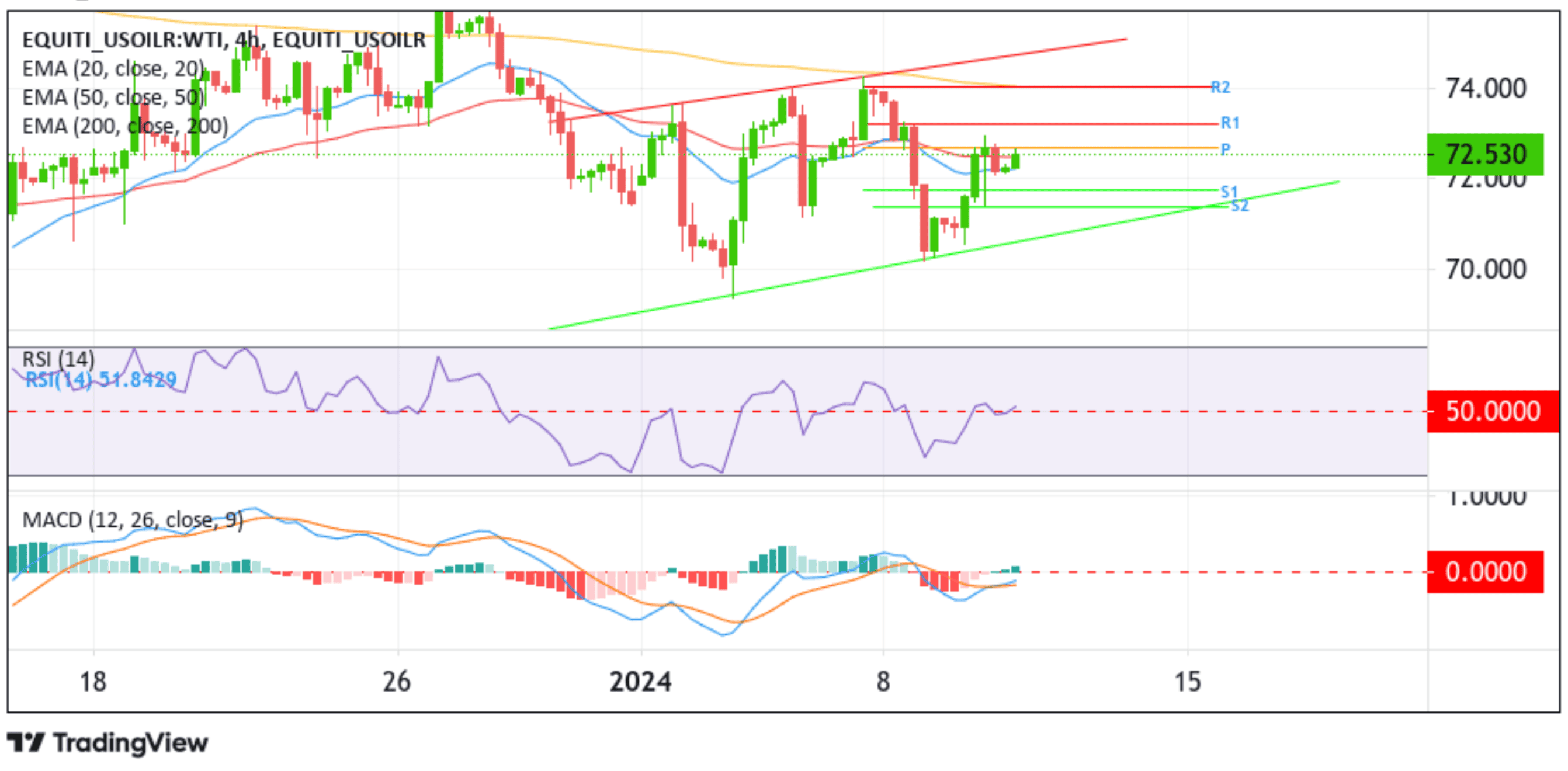

Technical Outlook: Four-Hours US WTI Crude Futures Price Chart

From a technical standpoint, the price of the precious black liquid is currently sitting directly below the pivot level (p) at $72.704, corresponding to the 61.8% Fibonacci retracement level (Golden Fib). Sustained strength above this level would act as a fresh trigger for new buyers to jump in, paving the way for a rise toward the $73.203 resistance level. A decisive move above this level would shift the focus toward the $74.044 ceiling, followed by the upper limit of the Bearish Flag chart pattern extending from the late-December 2023 swing to higher highs.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support comes in at the $71.738 level (S1). A decisive flip of this support level into a resistance level will pave the way for a fall toward intermediate support at $71.451 en route to the key support level plotted by an upward ascending trendline (lower limit of the Bearish Flag chart pattern extending from the early-January 2024 swing lower-lows). A subsequent break below the aforementioned key support level will reaffirm the negative bias and pave the way for additional losses. U.S. WTI crude oil futures could then accelerate the fall toward the $70.000 round mark, and, in extreme bearish cases, U.S. WTI crude oil futures could extend a leg down to the $68.165-$67.899 demand zone.