US WTI Crude Oil Price Steadies Above 10-Month High As Focus Shifts Toward Fed's Decision

Key Takeaways:

- US WTI crude oil was flat-lined during the mid-Asian session but remained firm above a ten-month high

- Supply concerns and recovering demand in China continue to stir markets and help push crude oil prices higher

- Markets focus now shifts toward the release of the Fed Interest Decision and the accompanying statement for fresh US WTI crude oil directional impetus

The U.S. West Texas Intermediate (WTI) crude oil price was flat-lined on Monday during the Asian session. Still, it remained within a ten-month high as supply concerns and recovery demand in China continued to stir markets. As of press time, the precious black liquid is up 0.02%/ (1 cent) for the day and looks poised to extend gains for a fourth consecutive week amid a weaker U.S. dollar and the ongoing output cuts and recovery demand in China.

The U.S. WTI crude oil price looks set to extend its bullish momentum further for a fourth consecutive week after climbing the past three weeks and to touch its highest level in more than nine months after Saudi Arabia and Russia extended supply cuts until the end of the year as part of the OPEC+ group's plan. Further supporting the bullish momentum in crude oil was the news last week that China's central bank had decided to cut the amount of cash that banks must hold as reserves for the second time this year to help keep liquidity ample and support a nascent economic recovery. The People's Bank of China (PBOC) said it would cut all banks' reserve requirement ratio (RRR), except those implementing a 5% reserve ratio, by 25 basis points starting Sept. 15.

Additionally, the Federal Reserve (Fed) is set to start its two-day meeting on Tuesday. It is widely expected to leave its Fed Funds rate unchanged during the September meeting, which acts as a headwind to the greenback and helps exert upward pressure on crude oil prices. This comes after a U.S. inflation data report released last week by the U.S. Bureau of Labor Statistics (BLS) showed the annual core consumer price inflation rate in the United States, which excludes volatile items such as food and energy, fell to its lowest level in two years. Another U.S. BLS report released early this month indicated a gradual easing of labor market conditions.

Despite the combination of negative factors, the upside remains cushioned for the time being amid firm market expectations that the Federal Reserve (Fed) will lift interest rates by 25 basis points (bps) before the end of this year. Cementing the odds for a final 25 bps Fed rate hike before 2024 was the U.S. Department of Labor report released early this month that showed that new unemployment claims in the U.S. fell to their lowest in over six months in the final week of August, surprising market expectations of a moderate increase and challenging recent data that suggested some softening in the labor market. Additionally, the ISM Services PMI in the U.S. unexpectedly rose to a six-month high in August, reflecting resilience to high borrowing costs.

As we advance, in the absence of any significant market-moving economic news data, the focus now shifts toward the Fed's Interest Rate Decision announcement, the accompanying FOMC Statement, and the post-interest rate announcement press conference on Wednesday during the mid-north American session. The report would influence the near-term USD price dynamics. This, in turn, should assist traders in determining the next leg of a directional move for the US WTI crude oil price.

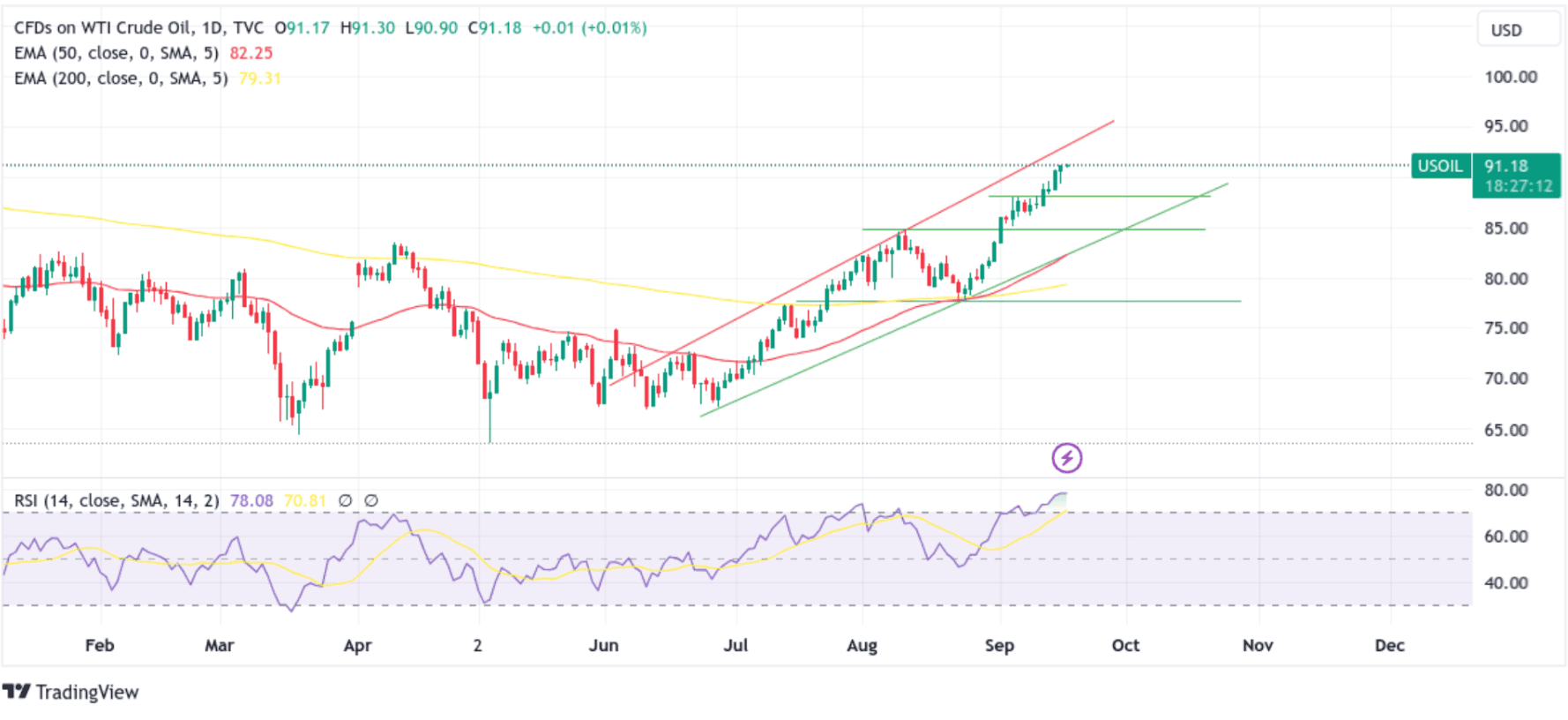

Technical Outlook: One-Day US WTI Crude Oil Price Chart

From a technical standstill, the price's ability to find acceptance above the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 77.28 level favored bullish oil traders and supported the subsequent bullish trajectory. A further increase in buying pressure from the current price level will uplift spot prices toward the upper limit of the bullish ascending channel pattern extending from the mid-June 2023 swing high. Buying interest could gain momentum if the price pierces this barrier, creating the right conditions to advance toward the 93.60 level. A subsequent breach above this resistance level will pave the way for a further rally toward the 98.19 - 97.66 supply zone, about which, if the price convincingly breaks above this zone, the focus will now shift toward the 100.00 ceilings.

The Relative Strength Index (RSI) technical oscillator on the chart is in dip-positive territory and flashing extreme over-bought conditions, warranting caution to traders against submitting aggressive bullish bets. Nevertheless, the bullish outlook is supported by the acceptance of the price above the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 77.28 level. Additionally, the 50 (red) and 200 (yellow) day EMA crossover at the 78.08 level adds credence to the bullish thesis.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support appears at the 88.06 level. On further weakness, the focus shifts lower to the 84.79 level, about which, if sellers manage to breach this floor, downside pressure could accelerate, paving the way for a drop toward the lower limit of the bullish ascending channel pattern extending from the late-June 2023 swing low. A one-day candlestick close below this support level would see the US WTI crude oil price accelerate its decline toward the 77.68 key support level.