EURO STOXX 50 Index Extends ECB-Inspired Gains Above The 4300.00 Mark

Key Takeaways:

- EURO STOXX 50 futures index extends ECB-Inspired gains to mark a second successive day of gains

- ECB Raises Rates Again by 25bps as MPS Hints at End of Tightening

- Vonovia SE, Plc. (Xetra: VNAn) and BMW ST, Inc. (MUN: BMWG) led the list of top gainers and losers on Friday

The Eurozone blue-chip futures index of shares (EU STOXX 50) edged higher on Friday during the Asian session, buoyed by the latest decision by the European Central Bank (ECB) to hike interest rates once again, beating market expectations of an ECB pause.

As of press time, the E.U. 50 Futures index rose 0.28% (12.1 points) to trade above the 4311.0 level and extend the after-hours trading gains on Thursday. Additionally, the move follows a winning day in the European markets, as stocks edged higher in the European and North American trading sessions on Thursday to close in heavy gains as markets reacted to the latest interest rate decision by the European Central Bank.

The European Central Bank (ECB) on Thursday hiked interest rates for the 10th consecutive time and signalled that it was likely done tightening policy, as inflation has started to decline but is still expected to remain too high for too long. Consequently, the primary refinancing operations rate reached a 22-year high of 4.5%, and the deposit facility rate set a new record at 4%. A key reason for the hike on Thursday appeared to be upward revisions in newly published staff macroeconomic projections for the euro area, which see inflation averaging at 5.6% in 2023 and 3.2% in 2024, both higher than previous estimates, primarily due to an elevated path for energy prices.

The accompanying monetary policy statement (MPS) revealed that, based on the Governing Council's current assessment, the key ECB interest rates have reached levels that, if maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target, suggesting the ECB had decided to pause its rate hiking cycle finally.

Speaking at a post-interest rate decision press conference, ECB Chair Christine Lagarde admitted that the ECB council was split between some governors who would have preferred to pause and reserve future decisions and those who preferred a rate hike, but in the end, as the ECB chair revealed, a solid majority of the governors agreed with the decision the ECB made to raise rates by 25bps. Thursday's decision was not widely expected, as economists and analysts were still divided over whether the doves or hawks in Frankfurt would win out at this September's meeting despite inflation in the Eurozone still holding above 5% and significantly surpassing the central bank's 2% target, even after nine consecutive increases in borrowing costs.

That said, following the ECB announcement, the euro fell sharply by as much as 0.5% against the U.S. dollar, dropping to a three-month low, while the primary index rose by as much as 0.56% to close at 4298.6 on Thursday and register one of the biggest daily gains in more than five months.

E.U. 50 Stoxx Index Movers

Here are the top E.U. 50 Stoxx index movers today before the bell, a week in which the primary index is set to close with heavy gains.

Top Gainers⚡

- Vonovia SE, Plc. (Xetra: VNAn) rose 5.12%/1.17 points to trade at €24.00 per share.

- Flutter Entertainment, Plc. (London: FLTRF) added 4.36%/610.0 points to trade at €14605.0 per share.

- CRH, Plc. (Ireland: CRH) gained 3.71%/1.84 points to trade at €51.40 per share.

Top Losers💥

- BMW ST, Inc. (MUN: BMWG) lost 1.46%/1.420 points to trade at €95.920 per share.

- Stellantis NV, Inc. (Millan: STLAM) declined 1.09%/0.194 points to trade at €17.574 per share.

- Mercedes Benz Group, Inc. (MUN: MBGn) shed 0.58%/0.390 points to trade at €66.460 per share.

Going forward, Market Participants now look forward to second-tier eurozone economic data, which, along with the broader market risk sentiment, will influence the euro and provide EU.50 Stoxx Index directional impetus.

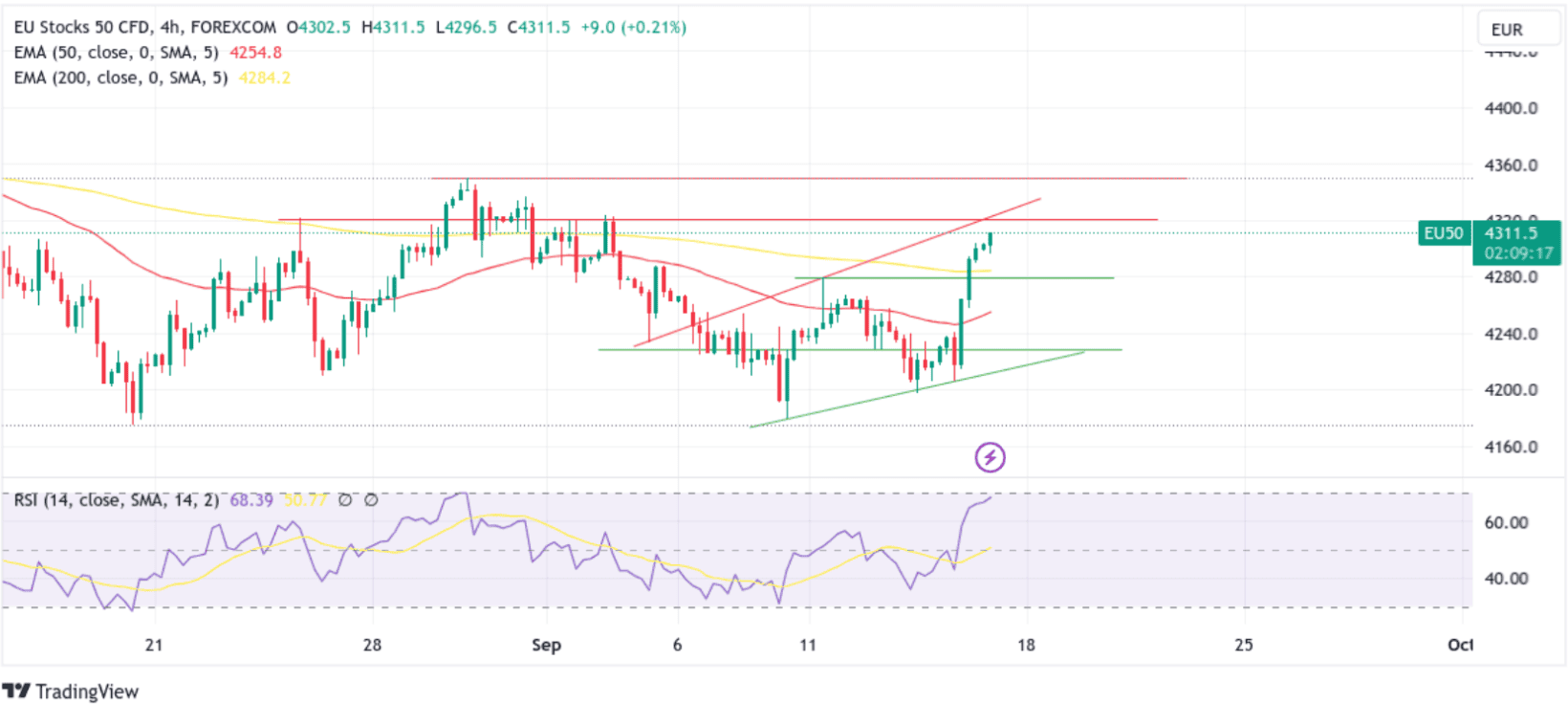

Technical Outlook: Four-Hour EU50 Stoxx Index Price Chart

From a technical perspective, the price's ability to find acceptance above the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 4283.8 level favored bullish buyers. It supported the case for further upside moves. A further increase in selling pressure from the current price level will uplift spot prices toward the 4321.2 resistance level. A four-hour candlestick close above this resistance level, followed by a subsequent break above the upper limit of the bearish flag chart pattern, would reaffirm the bullish thesis and pave the way for further gains around the main index. The upward trajectory could then accelerate toward the 4350.1 key resistance level, about which, if the price pierces this barrier, buying interest could gain further momentum, paving the way for a further rally toward the 4400.00 round mark and the 4404.2 key resistance level in dire cases.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes in at the 200-day (yellow) EMA level. Acceptance below this barrier would negate any near-term bullish outlook and pave the way for aggressive technical selling around the main index. The main index price could then accelerate its downfall below the 4279.8 support level toward tagging the 50-day (red) EMA level at 4257.8. On further weakness, the E.U. 50 Stoxx index could decline further toward the 4228.5 support level, below which the price could drop to retest the lower limit of the bearish flag chart pattern. A clean break below this support level would reaffirm the bearish bias and cause the main index to be more vulnerable to further southward moves.