GBP/USD Defies Odds And Moves Back Above Late 1.25000s On Softer U.S. Dollar, U.K. Markets Mark Bank Holiday

Key Takeaways:

- GBP/USD pair extends last week’s goodish bounce from the vicinity of the 1.25459 level and trades firmly above the late 1.250000s

- Retreating Treasury bond yields undermines the greenback, which in turn helps cap the downside for the GBP/USD cross

- Market expectations of a 25bps rate hike by the BoE plus growing concerns about worsening economic conditions in China extend support to the Cable

- U.K. markets remain closed today as the U.K. celebrates a Bank holiday; hence, there wouldn’t be any significant market movements from the U.K. docket

The GBP/USD cross extended the corrective pullback from the vicinity of the 1.25459 level touched last Friday and uplifted spot prices above the late 1.25000s on Monday during the Mid-Asian session. The cross looks set to maintain its offered tone heading into the European session amid fresh U.S. dollar weakness.

A fresh leg down in U.S. Treasury Bond Yields helped the U.S. dollar index, which measures the greenback against a basket of currencies, attract new selling below

104.200 on Monday, which in turn was seen as a key factor that acted as a headwind to the GBP/USD pair. Additionally, a goodish bounce in the U.S. equity markets further undermines the greenback and helps cap the downside for the GBP/USD pair.

Further weighing on the buck are the disappointing U.S. PMI readings released last Thursday, which showed both the U.S. Service and Manufacturing sectors all contracted last month, exacerbating risks of a mild recession in the U.S. Apart from this, a U.S. National Association of Realtors report released last Tuesday showed a massive drop in the number of existing homes sold last month.

Despite the combination of negative factors, further uptick seems elusive in the wake of firming market expectations that the Federal Reserve (Fed) will hike interest rates one more time by 25 basis points (bp) either during the September or November meeting. This comes after Fed Chair Jerome Powell warned last Friday during an annual retreat in Jackson Hole, Wyoming, that there could still be further rate hikes. While Powell said the central bank could be flexible, he said it still has a long way to go to fight inflation.

Further cementing the odds of a hawkish Fed was August’s FOMC Meeting Minutes report released this month. Federal Reserve officials expressed concern at their most recent meeting about the pace of inflation and said more rate hikes could be necessary unless conditions change. Noteworthy discussions during a two-day July meeting resulted in a quarter percentage point rate hike in August that markets generally expected to be the last of this cycle.

However, recent data pointing to a modest rise in inflation both at the consumer and producer levels, cooling job growth but a resilient job market, and stronger-than-expected U.S. GDP growth have, to a greater extent, reversed hopes that the Fed may refrain from tightening monetary policy further this year.

Shifting to the U.K. docket, an Office for National Statistics (ONS) report released last week showed Average weekly earnings, including bonuses in the U.K., rose by 8.2% year-on-year to GBP 663/week in the three months to June of 2023, the highest increase since the three months to July 2021, and above market forecasts of 7.3%. Additionally, The unemployment rate in the U.K. increased to 4.2% in the three months to June 2023, the highest since late 2021 and above market forecasts of 4% and 4% in the previous period.

That said, the upbeat U.K. wage report has undoubtedly increased the chances of a 25 basis point (bps) rate hike by the Bank of England (BoE) during the September meeting, despite headline inflation in the U.K. dropping sharply to 0.4% in July 2023 while core inflation remained at record highs. This, in turn, extends support for the Cable and helps limit further losses for the GBP/USD cross. Additionally, market sentiment remains fragile due to growing concerns about worsening economic conditions in China, which supports the Great British Pound (GBP) and helps exert upward pressure on the GBP/USD cross.

As we advance, the U.K. markets remain closed today as the U.K. celebrates a bank holiday; hence, there won’t be any significant market movements from the U.K. docket. In the meantime, the general market risk sentiment and treasury bond yields will continue to influence the U.S. dollar sentiment and provide short-term trading opportunities around the GBP/USD pair.

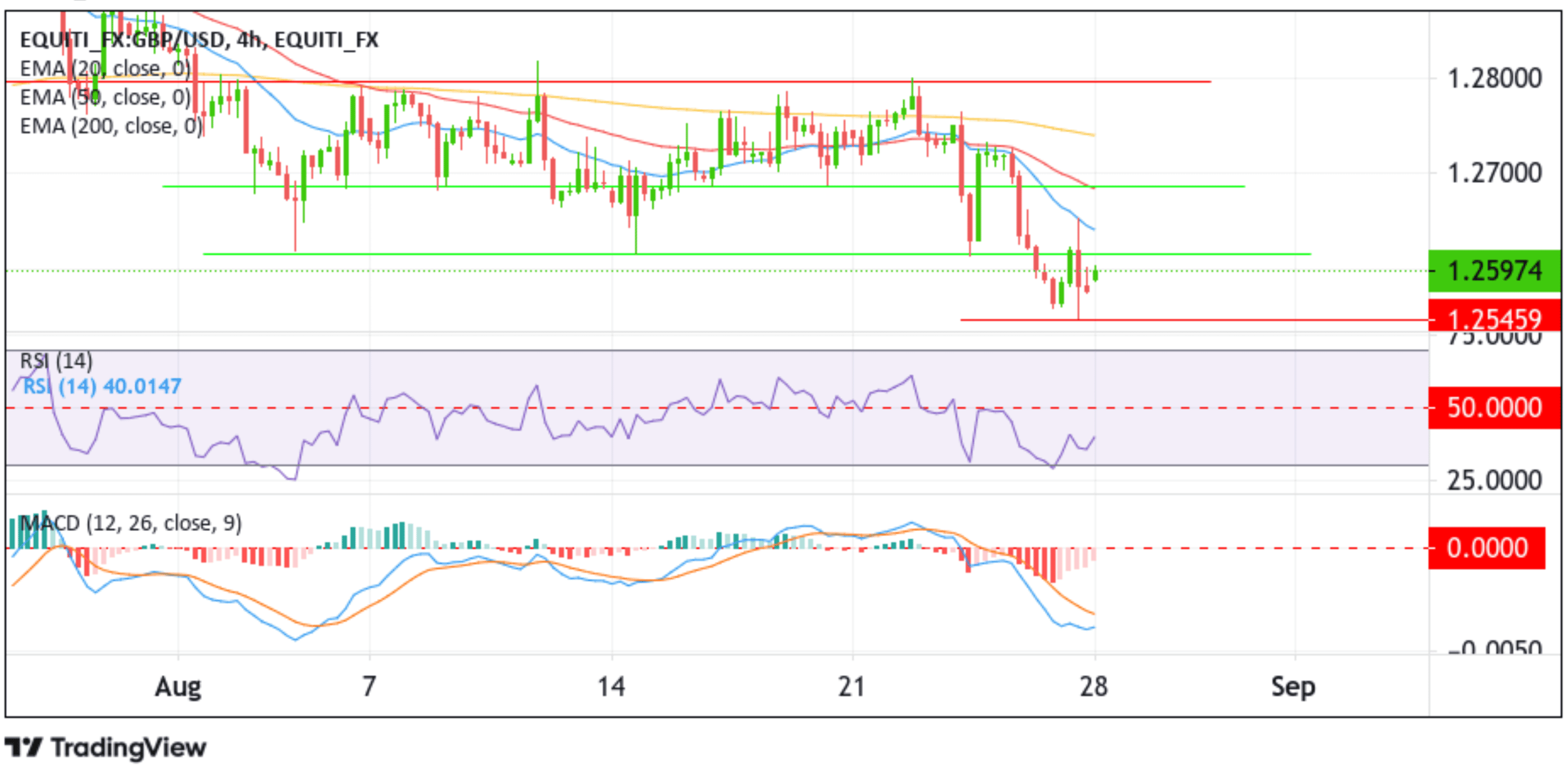

Technical Outlook: Four-Hours GBP/USD Price Chart

From a technical standpoint, a further increase in buying pressure from the current price level would cause the GBP/USD price to tag the 20-day (blue) Exponential Moving Average (EMA) level at 1.26420. Acceptance above this EMA level will pave the way for an ascent toward the 1.26868 resistance level, which coincides with the 50-day (red) EMA level. On further strength, the GBP/USD price could rally toward the technically 200-day solid (yellow) EMA level at 1.27363, about which, if the price pierces this barrier, buying interest could gain further momentum, paving the way for an extended rally toward the 1.27971 key resistance level. A decisive flip of this resistance level into a support level will reaffirm the bullish bias and pave the way for further gains around the GBP/USD cross.

On the flip side, the 1.25459 level now acts as immediate support, below which a bout of short-covering can drag the pair back toward the 1.2500 mark. Any further drop will likely attract selling at lower levels.