GBP/JPY Extends Recovery Momentum Above the 182.700 Mark, Fresh Japanese Maro data Helps Boost Sentiment

Key Takeaways:

- GBP/JPY edged higher on Tuesday, supported by various factors

- Fresh Japanese macro data helps boost sentiment around the GBP/JPY pair

- Disappointing U.K. Retail Sales Growth data weighs on the cable

- Markets' focus shifts toward the U.K. GDP and Trade Balance reports

On Tuesday, the GBP/JPY cross attracted some buying from the vicinity of the 182.041 level during the Asian session and extended the modest intraday recovery from a two-week low. As per press time, the shared currency is trading in modest gains above the 182.700 mark and looks set to maintain its bid tone heading into the European session.

The Great British Pounds (GBP) impressive performance against the Japanese Yen (JPY) over the last few days could be attributed to the possibility of the Bank of Japan (BoJ) retaining its monetary-policy easing for longer than initially thought. This comes after the BoJ's Summary of Opinions released on Monday revealed that policymakers generally backed the case for the need to patiently continue with the current monetary easing towards achieving price stability.

It is worth remembering that the BoJ, late last month, during its July Monetary Policy Meeting, took steps to make its yield curve control (YCC) policy more flexible, in turn fuelling speculation that the BoJ was almost done with its ultra-loose monetary policy setting that had dominated the Asian bank while other central banks around the world hiked interest rates aggressively to fight inflation.

However, in the following days, the positive mood was dampened after BoJ Governor Kazuo Ueda reiterated in his speech that the Central Bank wouldn't hesitate to ease policy further. Ueda added that more time was needed to achieve the 2% inflation target sustainably.

However, with positive macro data from the Japanese docket recently, market sentiment has been gradually changing in favor of the Yen, helping exert upward pressure on the GBP/JPY pair. A Ministry of Finance report early today showed Japan's current account surplus jumped to JPY 1,508.8 billion in June 2023 from JPY 497.9 billion in the same month a year earlier, exceeding market forecasts of a gain of JPY 1,395 billion and marking a fifth straight month of surplus in the current account. Additionally, Household Spending MoM in Japan increased to 0.90% in June from -1.10% in May 2023.

Moreover, a British Retail Consortium report early today showed. Retail sales in the United Kingdom rose 1.8% on a like-for-like basis in July 2023 from a year ago, slowing from a 4.2% gain in June and marking the lowest reading in nine months as heavy rain and high inflation hurt retail activity.

Apart from this, the Yen continues to be supported by the fact that the Bank of England's (BoE) Monetary Policy tightening cycle could be nearing its end, acting as a cable headwind. It is worth recalling that the Bank of England last week on Thursday raised its policy interest rate by 25 basis points to 5.25% during its August 2023 meeting, marking the 14th consecutive increase and bringing borrowing costs to fresh 2008 highs as the central bank continues to battle high inflation.

As we advance, in the absence of significant economic news data from both dockets, investors' attention shifts toward releasing the U.K. quarter two GDP report, the U.K. June industrial production data report, and the U.K. June trade balance report, all set for release on Friday.

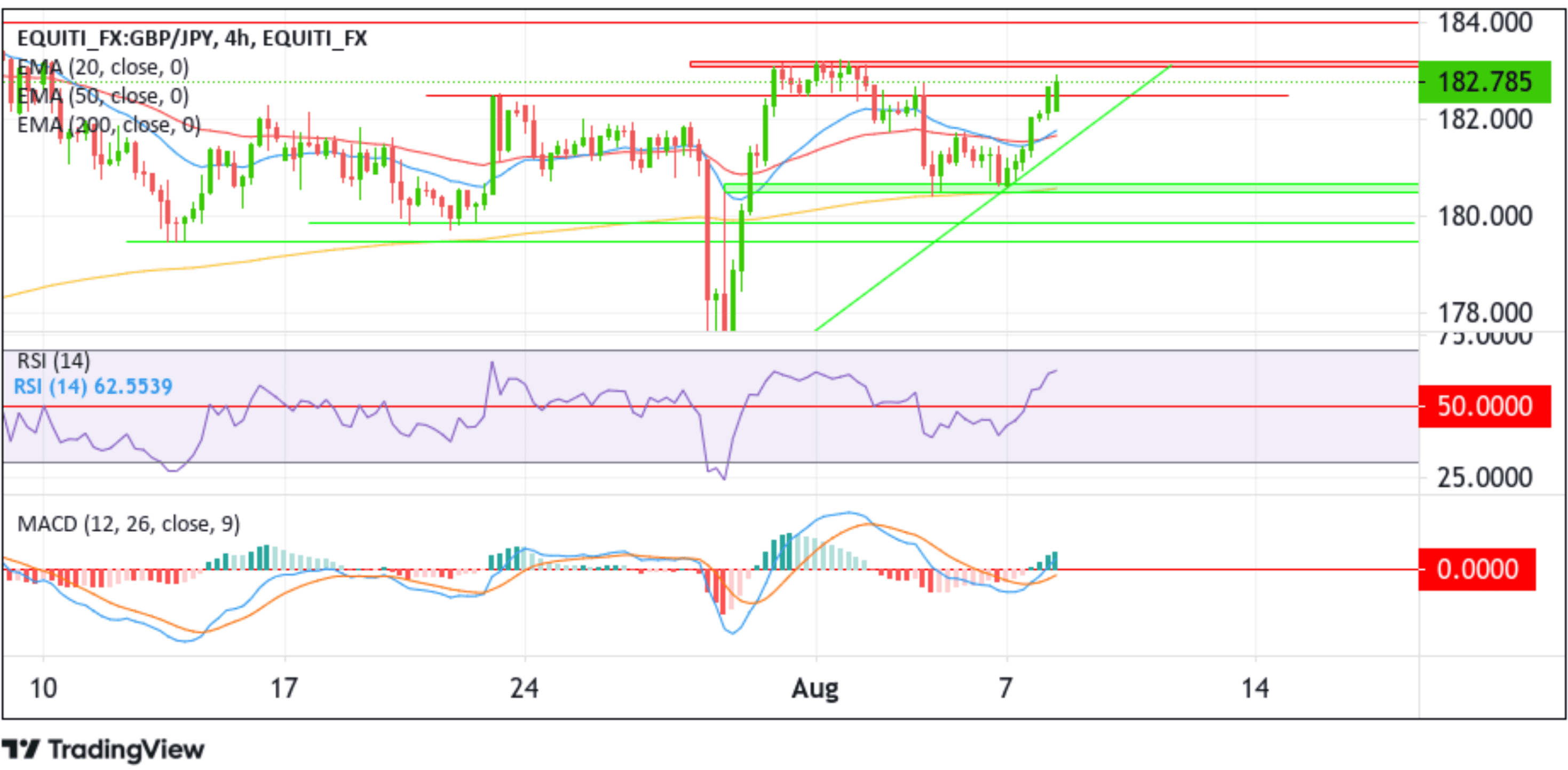

Technical Outlook: Four-Hours GBP/JPY Price Chart

From a technical perspective, a further increase in buying pressure from the current price level would face initial resistance at the 183.175 - 183.101 supply zone. Sustained strength above this zone would reaffirm the bullish bias and pave the way for a rally toward the 184.000 July 2023 swing high, about which, if the price pierces this barrier, it will pave the way for further gains around the GBP/JPY cross.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support comes in at the 182.506 horizontal level, below which the price could accelerate its decline toward tagging the 20 (blue) and 50 (red) day EMA levels at 181.885 and 181.686 levels, respectively. Acceptance below these levels would pave the way for a neat-term move towards retesting the upward ascending trendline extending from the late-July 2023 swing low (support level), about which a subsequent bearish price breakout below this support level would pave the way for a decline toward the demand zone ranging from 180.671 - 180.503 levels. The latter coincides with the technically strong 200-day (yellow) moving average, about which a convincing move below this barrier would negate the bullish bias and pave the way for aggressive technical selling around the GBP/JPY pair. The bearish trajectory could then be extended toward the 179.839 support level, and in dire cases, the price could drop to the 179.456 support level.