GBP/JPY Extends Recovery Momentum Towards Multi-Month Peak; Further Uptick Seems Elusive

Key Takeaways:

- GBP/JPY pair gained positive traction on Wednesday and extended the recovery momentum to trade near a multi-month peak (182.977) level

- A fresh batch of disappointing Japanese macro data weighs on the JPY and acts as a tailwind to the GBP/JPY cross

- GBP continues to draw support from subdued U.S. dollar demand

- Dovish BOE market expectations and JPY market intervention could help cap the upside for GBP/JPY

The GBP/JPY prolonged its recovery momentum from the monthly low (178.039) and traded near a multi-month peak (182.977) on Wednesday during the Asian session. It has managed to reverse its monthly losses fully. The Japanese Yen continues to weaken against the Great British Pound (GBP), with fresh macro data showing Japan's current account surplus fell to JPY 2.280 trillion in August 2023 from JPY 2.772 trillion in July, posting a positive reading for the seventh consecutive month but missing market expectations of JPY 3.091 trillion, a Japanese Ministry of Finance report showed on Tuesday.

The downbeat Japanese current account macro data report comes on the heels of a slew of disappointing macro data released last week, which showed Japanese nominal wage growth lagged behind the 3.1% core consumer inflation rate in August but increased by 1.1% from a year ago. Another government report revealed that Japan's household spending, a key indicator of private consumption, declined in real terms by 2.5% (YOY) in August 2023, compared with market consensus of a 4.3% fall after a 5.0% drop in the prior month. This warrants that the Bank of Japan (BoJ) will likely stick to a dovish stance in future monetary policy meetings, which weighs on the safe-haven JPY and acts as a tailwind to the GBP/JPY cross.

Shifting to the British docket, the Great British Pound (GBP) continues to draw support from subdued U.S. dollar demand. The U.S. dollar index (DXY), which measures the greenback against a basket of currencies, extended its modest decline from the monthly peak/107.351 level and fell below the 106.000 mark on Tuesday, influenced by rallying U.S. equity markets and Atlanta's Fed President Bostic's dovish comments. This comes against the ongoing Middle East War backdrop, which helped boost market demand for safe-haven assets.

Despite this, markets are still convinced the Fed will hike interest rates at least once before the end of the year, which remains supportive of rising U.S. Treasury yields, which would help cap further GBP gains. Market bets for a hawkish Fed were cemented after a U.S. Bureau of Labor Statistics report released on Friday showed the U.S. economy created 336K jobs in September 2023, well above an upwardly revised 227K in August and beating market forecasts of 170K. In contrast, the Bank of England (BoE) is expected to leave rates unchanged during its November meeting, which in turn undermines cable and would help limit further gains around the GBP/JPY cross.

Apart from these, speculations that Japanese authorities will intervene in the FX market to combat a sustained depreciation in the JPY might contribute to keeping a lid on further GBP/JPY gains. Japan Finance Minister Shunichi Suzuki, speaking at a regularly scheduled press conference last week, reiterated that it was important for currencies to move stably, reflecting economic fundamentals and that any decision on currency market intervention would be based on volatility.

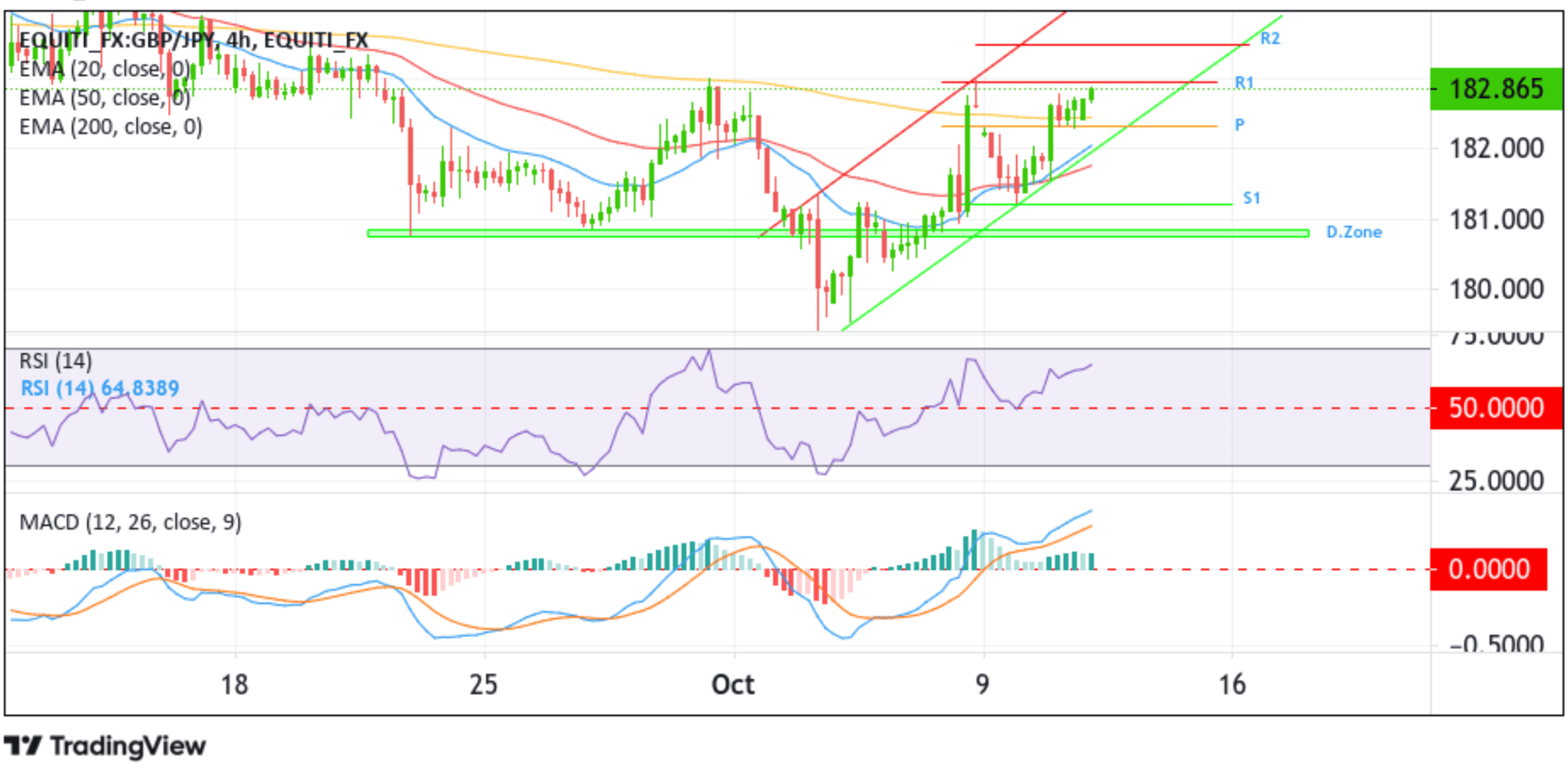

Technical Outlook: GBP/JPY Four-Hour Price Chart

From a technical standpoint, the price's ability to find acceptance above the technically strong 200-day Exponential Moving Average (EMA) at the 182.450 level supported the case for further buying around the GBP/JPY cross. Some follow-through buying would face immediate resistance at the 182.959 level (R1). If the price decisively clears this barrier, the price could extend a leg toward the 183.490 resistance level (R2). If this barricade fails to defend against the bullish momentum, the price could rally further toward the key resistance level plotted by an ascending trendline extending from the early October 2023 swing high. A subsequent break (bullish price breakout) above this resistance level would reaffirm the bullish bias and act as a fresh trigger for new buyers to jump in and push the price further upwards.

All the technical oscillators on the chart (RSI (14) and MACD) are in positive territory, suggesting continuing the bullish price action this week. Further supporting the bullish outlook is the acceptance of the price above the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 182.450 level.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support comes in at 182.450. A convincing move below this barricade would negate the bullish outlook and pave the way for an accelerated decline below the pivot level (P) at the 182.312 level toward the key support level plotted by an ascending trendline extending from the early-October 2023 swing low. If sellers manage to breach this floor, downside pressure could accelerate further, paving the way for a drop toward the 181.202 support level (S1), followed by the 180.844 – 180.759 demand zone.