GBP/JPY Struggles Around 169.000s Level and Plunge 100 Pips To 167.800s Levels

- GBP/JPY witnessed fresh selling on Tuesday to extend the sharp pullback from the vicinity of the 169.009 level

- Japanese Services Sector Stagnates According to the latest Flash PMI Data by Markit Economics

- UK Flash PMIs Match Market Expectations and Offers Some Support to the Sterling Pound

- A bleak outlook for the UK economy continues to undermine the British Pound and Exerts Upward Pressure on the GBP/JPY Pair

GBP/JPY cross extended its recent sharp pullback from the vicinity of 169.009 level, or the weekly high and witnessed fresh selling on Thursday for now, which seems to have snapped an eight-day winning streak. As per press time, the GBP/JPY is trading in modest losses and is down over 40 pips for the day and looks as if it will maintain its offered tone heading into the European session.

The Japanese Yen's recent uptick could be attributed to the ongoing US dollar sell-off in the last three days despite a downbeat Japan services PMI data released early today.

Japanese Services Sector Stagnates

The au Jibun Bank Japan Services PMI declined to 50.0 in November of 2022 from a final 53.2 in the prior month, signalling no change in business activity, a preliminary figure showed. That said, recovery within the tourism industry, following October's launch of the National Travel Discount Programme, reportedly continued to support growth in order books which expanded for a third consecutive month, but at a softer rate. Finally, amid labour shortages and general economic uncertainty, sentiment weakened to an eight-month low.

Japan Inflation hits Four-Decade High, Weighing on BOJ Position

The Japan Services PMI data comes after a Japan inflation data reading released last week by the internal affairs ministry showed Consumer prices excluding fresh food had climbed by 3.6% in October from a year ago, with the acceleration driven by processed food and the fading impact of mobile phone fee cuts.

The reading outpaced a 3.5% forecast by analysts and marked the fastest price growth since 1982. Core inflation has now exceeded the Bank of Japan's 2% price target for seven months, with the yen's historic fall amplifying the trend. Following the release, Gov. Haruhiko Kuroda reiterated his view that the central bank's ultra-low interest rates remain appropriate. However, he acknowledged that the latest gains were significant and inflation could accelerate further. While economists largely agree with the BOJ that inflation will cool in Japan next year, partly due to government subsidies, some analysts see the central bank as underestimating the underlying strength of prices. "It's getting harder for the BOJ to keep saying that the current cost-push inflation is temporary," said Mari Iwashita, chief market economist at Daiwa Securities. "If the yen remains weak, more companies will try to pass on costs to consumers."

On the Sterling Pound front, the Pound drew support from reports that the UK government might look to pursue a Swiss-style relationship with the European Union. This comes on the back of expectations that the Bank of England will lift interest rates further to tame inflation.

UK Flash PMIs Match Market Expectations

Lifting the Pound also was the UK FLash PMIs which came in as per the market expectations. The S&P Global/CIPS UK Manufacturing PMI stood at 46.2 in November 2022, unchanged from the previous month, while analysts expected it to drop further to 45.8, a preliminary estimate showed. Manufacturing production declined further, although at a much softer pace, as easing supply bottlenecks helped to support output. Additionally, The S&P Global/CIPS UK Services PMI held at 48.8 in November 2022, unchanged from the previous month, while analysts expected it to drop further to 48, a preliminary reading showed. Service sector activity and volumes of new work continued to decline amid weak domestic demand due to rising costs and gloomy economic conditions. Still, service providers signalled only a slight decrease in new work from abroad due to a weaker pound and robust demand from US clients.

Further LIfting the Pound was the UK Retail sales data released late last week, which showed Retail sales in the UK had increased 0.6% month-over-month in October of 2022 after falling an upwardly revised 1.5% in September when many businesses, including retailers, observed an additional bank holiday for the Queen's funeral. Figures compare with market forecasts of a 0.3% rise. Increases were seen in all main sectors apart from food stores, where sales fell by 1%. The report came a day after the UK Chancellor of Exchequer had announced his Autumn Statement, with the Sterling trading slightly weaker in the immediate aftermath [of the autumn statement].

That said, A bleak outlook for the UK economy continues to undermine the British Pound and is one of the main factors exerting downward pressure on the GBP/JPY pair. As we advance, investors now look forward to the UK Docket featuring Key Bank of England(BOE) Monetary Policy Committee Members' Speeches for subtle clues regarding future monetary policy.

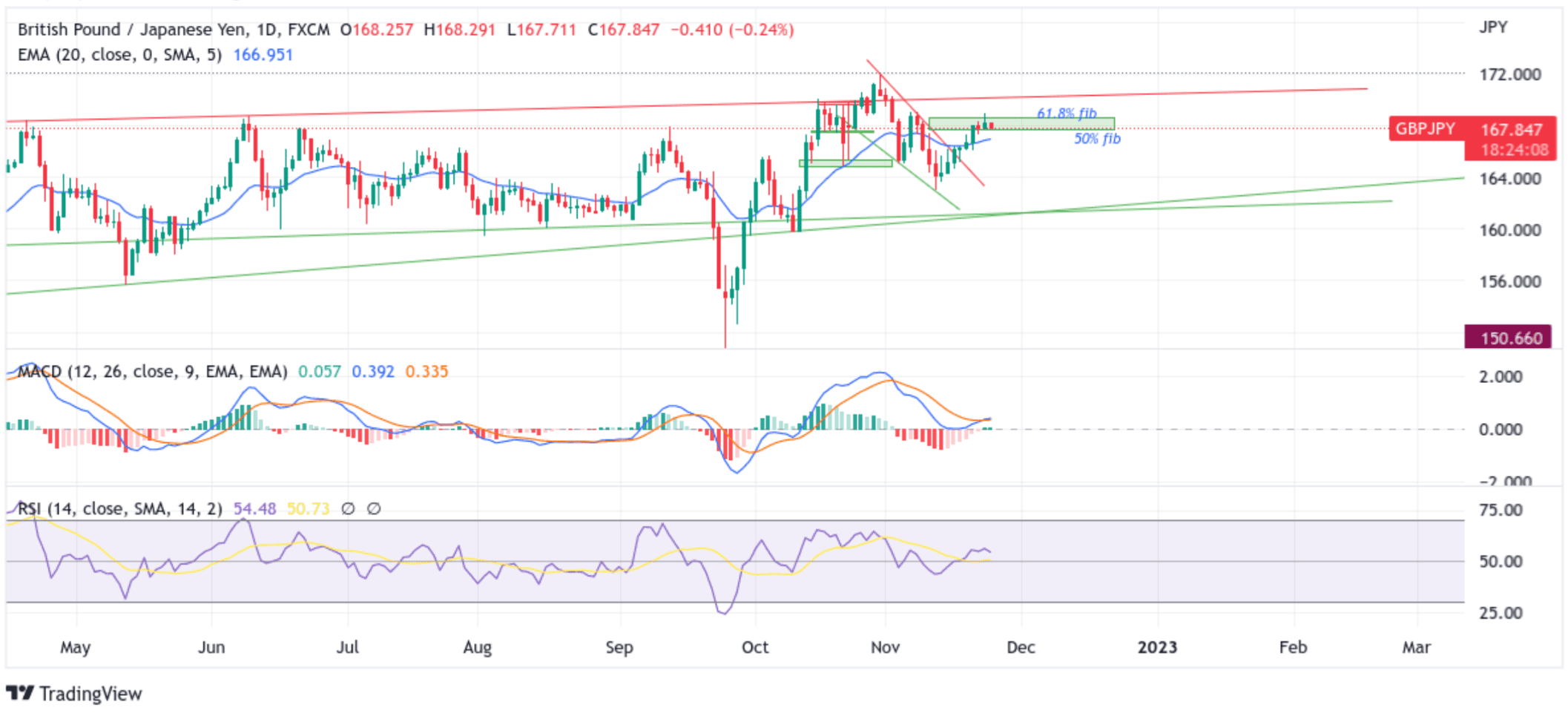

Technical Outlook: GBP/JPY One-Day Price Chart

From a technical standstill using a one-day price chart, the price extended the sharp rebound from the vicinity of 169.029 level (the second shoulder of the head and shoulder pattern formed between 17th October and 8th November), which is near the 168.696 (61.8% Fibonacci retracement level). Some follow-through selling below the 50% Fibonacci retracement level at 167.611 would drag spot prices to the upper trendline of the descending channel pattern plotted from October 2022 swing high(turned support level) but will, first of all, need acceptance below the 166.970 level (20 EMA level). If sellers manage to breach this floor, downside pressure could accelerate, paving the way for aggressive technical selling around the GBP/JPY pair and for a move toward the 163.885 Monthly support level.

All the technical oscillators are in positive territory, with the RSI (14) at 54.48 near the signal line, so it will be prudent to wait for a further downside move below the 50% Fibonacci retracement level before placing a bearish bet. The Moving Average Convergence Divergence (MACD) Crossover is above the signal line, pointing to a bullish sign for price action this week, but a move below the signal line would act as a sell signal.

On the flip side, if dip-buyers and tactical traders jump back in and trigger a bullish turnaround, initial resistance appears at 168.313 en route to the 169.009 (61.8% Fibonacci retracement level. If the price pierces both barriers, buying interest could gain momentum, creating the right conditions for an advance toward the 169.581- 169.870 Supply zone.