USD/ZAR Finds Support From Key Demand Zone Amid Red-Hot South African Inflation

- USD/ZAR Gains attracts fresh buying on Thursday during the early Asian session

- A softer risk tone surrounding treasury bond yields offers support to the greenback and exerts upward pressure on the Pair

- South Africa's Annual consumer inflation reaches another 13-year high, according to the latest inflation data

- Attention now shifts toward the Jackson Hole Symposium on Friday

USD/ZAR pair witnessed renewed buying pressure after attracting fresh bullish bets in the last hour. The early Asian session to stage a modest recovery from the 16.91 levels touched earlier on Tuesday and, for now, seems to have snapped a two-day losing streak. The Pair now looks to build upon its offered tone heading into the European session.

A strong leg-up in the U.S. treasury bond yields and a softer risk tone offered some support to the greenback and helped exert upward pressure on the Pair as investors digested a fresh batch of economic data. The yield on the benchmark 10-year Treasury note rose nearly 6 basis points to 3.111%, climbing above 3% for the first time in a month earlier in the week, while the yield on the short-term 2-year Treasury note was about 7 basis points higher, trading at approximately 3.401%.

The U.S. Dollar index(DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, rose on Wednesday, holding a 20-year high. Investors wait for a Friday speech by the Federal Reserve chairman for fresh clues on how aggressive the central bank will be in its battle against Inflation.

The U.S. dollar drew some support from Minneapolis Fed President Neel Kashkari's remarks on Tuesday. He reiterated the central bank's commitment to controlling Inflation through monetary policy tightening and said his biggest fear is that the persistence of price pressures is underestimated.

Following Kashkari's remarks, Traders are now currently pricing in a 47.5% chance the FED will raise interest rates by 50 basis points(bps) in September and a 52.5% chance it will raise them by 75bps. However, that could change when Powell speaks on Friday in Jackson Hole, Wyoming, where central bankers from around the globe will be gathered for the FED's annual economic symposium. That said, Market analysts believe Powell's message during the symposium will be more nuanced and possibly even reassuring. "if Powell comes off as hawkish as we expect on Friday, traders are likely to hop back on the bullish dollar bandwagon sooner rather than later," said Matt Weller, global head of research at forex.com and city index.

According to the National Association of Realtors, pending home sales declined 1% from June to July, as rising mortgage rates made housing less affordable. Sales were down 19.9% compared with a year ago. This came on the back heel of another disappointing Us macro data, which revealed that the U.S. private sector was weaker than expected in August. The S&P flash composite PMI(AUG) dropped to its lowest since May 2020, as demand for services and manufacturing contracted for the second-straight month in the face of high Inflation and tighter financial conditions. Despite the combination of negative factors, the downside seems limited.

On the South African docket, inflation data showed red-hot Inflation continued to surge in July. The South Africa statistics Head Office reported on Wednesday that the Annual consumer inflation had reached another 13-year high, increasing to 7,8% in July from 7.4% in June. Additionally, The consumer price index (CPI) jumped by 1,5% between June 2022 and July 2022 – only the fourth time since 2008 as prices for Transport, food and non-alcoholic beverages (NAB); and housing and utilities rose, continuing to place upward pressure on the annual rate. This, in turn, was seen as a key factor that undermined the South African rand and exerted upward pressure on the USD/ZAR pair.

As we advance, investors will look for directional impetus from the release of the Initial jobless claims report scheduled for release during the mid-north American session. Traders will further look for cues from the release of the US GDP QoQ report later today. The reports along with the broader risk sentiment will influence the USD price dynamics and allow traders to grab some trading opportunities around the Pair. The focus now shifts toward the Jackson Hole Symposium on Friday, in which Fed Chair Jerome Powell will update the market on his views on Inflation.

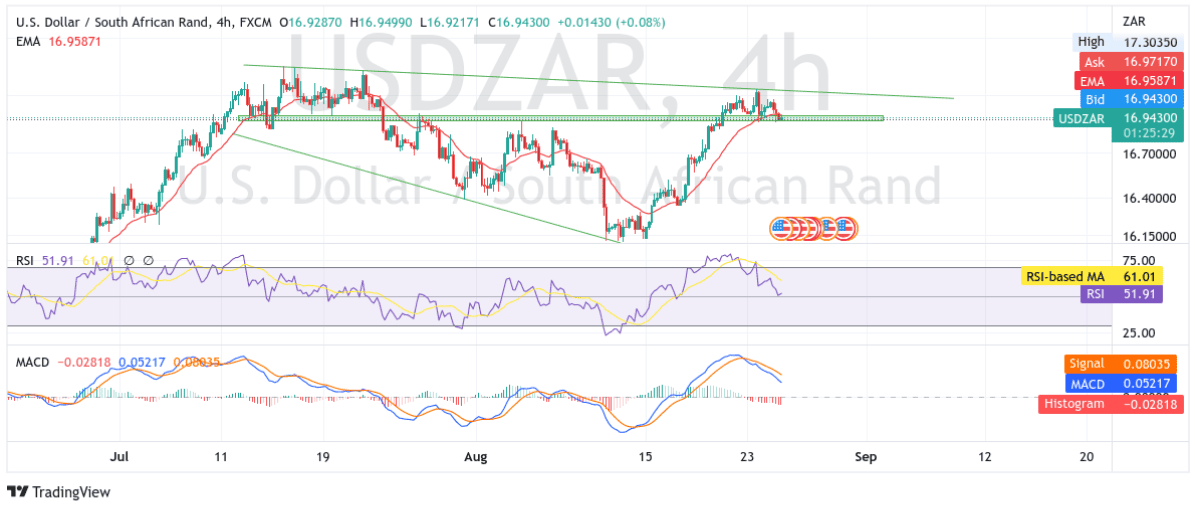

Technical Outlook: Four-Hour USD/ZAR Price Chart

From a technical perspective, spot prices are now looking to extend the momentum after finding support from the key Demand zone ranging from 16.91396 - 16.95559 levels. Some follow-through buying would lift spot prices towards testing the upper horizontal trendline of the bullish wedge chart pattern(turned resistance level) plotted from the July 2022 swing high and act as a barricade against the Pair. That said, a clean break above the aforementioned trendline would be a new trigger for bulls to continue pushing the price up and pave the way for additional gains.

The RSI(14) level at 51.91 is bullish but still far away from the oversold territory. However, the moving average convergence divergence (MACD) crossover at 0.14301 paints a bearish filter. Additionally, the 20 Exponential Moving Average(EMA) points downwards, further adding to the bearish credence indicating any further uptick seems elusive.

On the flip side, if the bears manage to regain back control of the market, pushing down the price towards the key Demand zone ranging from 16.91396 - 16.95559 levels. A convincing break below the said barricade would negate any term bullish outlook and pave the way for aggressive technical selling.