EUR/USD Collapses To A Fresh 22 Year-Low Amid Risk Aversion

- EUR/USD pair attracts fresh selling on Tuesday to drag spot prices below the 1.0000 psychological level

- Mounting Recession fears creep Euro back below parity

- U.S. Dollar rises to a five-week high as investors shied away from riskier assets

- A combination of negative factors undermines the Euro and drives flows away toward the safe-haven greenback

EUR/USD pair attracted fresh selling on Tuesday to extend the modest pullback from the 50% fib retracement level and dragged spot price to over a three-week low/fresh 22-year lows, just below the 1.0000 psychological level during the early Asian session. This marked the fourth day of a successive negative move in the previous five days to extend heavy losses around the pair witnessed since last week Friday amid sustained U.S. Dollar buying.

Elevated U.S. Treasury bond yields, bolstered by recent hawkish remarks by several FED officials reiterating an aggressive monetary tightening stance ahead of the Fed's Jackson Hole, Wyoming, symposium this week. It was a key factor that weighed on the EUR/USD pair and offered some support to the safe-haven greenback. On Friday, the latest of these officials, Richmond Fed President Thomas Barkin, said the "urge" among central bankers was toward faster, front-loaded rate increases.

That said, market analysts think Powell's message on Friday during the central bank's annual Jackson Hole economic symposium will be more nuanced and possibly even reassuring ." With investors now clearly expecting a relatively hawkish message from Fed Chair (Jerome) Powell at Jackson Hole on Friday. It's a perfect cocktail of risk-aversion and a hawkish Fed for the greenback to bound higher, especially when growth worries, especially in Europe, continue to mount," said Michael Brown, head of market intelligence at Caxton in London.

Mounting Recession fears drag Euro back below parity

The U.S. dollar rose across the board on Monday, driving the Euro back below parity, as investors shied away from riskier assets amid growing fears that interest-rate hikes in the United States and Europe, aimed at curbing Inflation, would weaken the global economy. As a result, European stocks ended the day in losses as almost all sectors and major bourses traded in negative territory.

The German Bundesbank recently released its monthly report, which portrayed a bleak economic outlook. The report further noted that recession in Germany is increasingly likely and that Inflation will continue to accelerate and peak at more than 10%. Risk sentiment was further dampened by hawkish signals from ECB policymakers, with Bundesbank President Joachim Nagel recently telling a German newspaper that the ECB must continue hiking interest rates even as recession risks in Germany grow.

Additionally, The Euro fell following Russia's announcement late on Friday of a three-day halt to European gas supplies via the Nord Stream 1 pipeline at the end of this month. Investors remained worried that the halt could exacerbate an energy crisis that has weighed on the common currency in recent months. That said, negative factors undermined the Euro and drove flows away to the safe-haven greenback.

The weakness briefly drove the Euro below $1 for the first time since July 14. The Euro was last down 1.1% at $0.99345. As we advance, Market Participants now look forward to second-tier U.S. and Europe economic data, which will influence the USD and Euro price dynamics and the broader market risk sentiment. Investors will further look for clues from the speech of the ECB's executive board member, Fabio Panetta. Later today, while they wait for the Minutes from the ECB's most recent policy meeting to be published on Thursday, The focus now shifts toward the Jackson Hole Symposium, in which Fed Chair Jerome Powell will update the market on his views on Inflation.

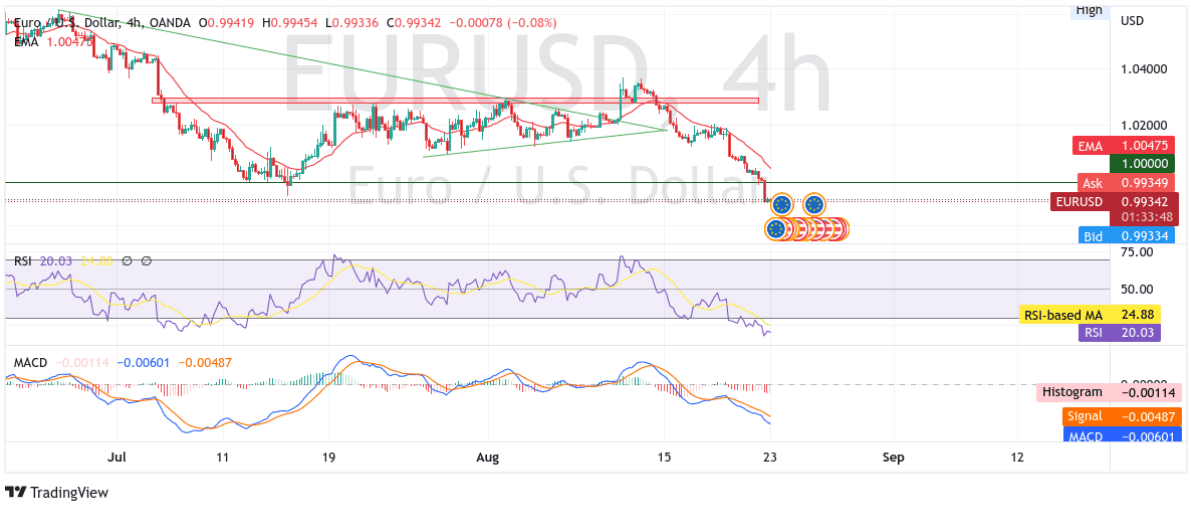

Technical Outlook: Four-Hour EUR/USD Price Chart

From a technical standstill using a four-hour price chart, the price has extended the modest pullback from the 50% fib retracement level at 1.01976 amid a clear rejection from the lower horizontal trendline of the bearish triangle chart pattern(turned resistance level). The trendline is plotted from July 27 and acted as a barricade against the pair. Some follow-through selling would drag spot prices towards the immediate hurdle(demand zone), ranging from 0.96679 - 0.97377 levels (levels last seen between July and October 2002). That said, a clean break below the aforementioned zone would be a new trigger for bears to continue pushing the price down and pave the way for more losses.

The moving average convergence divergence (MACD) crossover at -0.00198 paints a bearish filter. The RSI(14) level at 20.05 flashes extreme oversold conditions warranting caution to investors against submitting aggressive bearish bets ahead of today's Fabio Panetta's speech. Additionally, the 20 and 50 Exponential Moving Average(EMA) crossover(Golden cross) at the 1.02775 level further adds to the downside bias.

On the flip side, if the bulls manage to regain market control, pushing the price back to the 1.00000 psychological level would shift the bearish bias towards the euro bulls. However, any meaningful uptick still seems elusive at the moment.