USD/CNH Extends Modest Rebound From 6.96142 Level On U.S. Dollar Pullback Ahead Of U.S. Retail Data

- USD/CNH Cross attracts fresh buying during the mid-Asian session extending Wednesday's modest rebound from the 6.96142 level

- A strong leg-up in the U.S. treasury bond yields gives an intraday lift to the greenback limiting more losses against the pair

- August's consumer price index report on Tuesday showed inflation rose 0.1% month on month but landed as per the market's expectations

- China expected to hold the medium-term rate steady when the PBOC releases its monetary policy report today

- The U.S. Census Bureau is set to release the U.S. retails Sales Report today which will be important to forecast next week's FOMC action

USD/CNH pair witnessed renewed buying pressure after attracting fresh bullish bets in the last hour. The early Asian session extended the modest rebound from the vicinity of 6.96142 levels touched earlier on Wednesday and, for now, seems to have snapped the previous day's losing streak. The pair now looks to build upon its offered tone heading into the European session.

A strong leg-up in the U.S. treasury bond yields and a softer risk tone offered some support to the greenback. They helped to exert upward pressure as investors digested the previous session's dramatic market rout triggered by a hot inflation reading. As such, the yield on the 2-year Treasury, the part of the curve most sensitive to Fed policy, rose 4 basis points to 3.799%. At the same time, the yield on the benchmark 10-year Treasury note was down 1 basis point to 3.412%.

The U.S. Dollar index(DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, was sluggish on Wednesday. Trading essentially unchanged at 109.510 after surging 1.5% overnight, its biggest one-day percentage gain since March 2020 in the wake of the latest batch of economic data. As per the press time, the U.S. Dollar index picked up bids to pare the previous day's losses around 109.70 during the early Asian session.

The producer price index, a gauge of prices received at the wholesale level, fell 0.1%, according to a Bureau of Labor Statistics report on Wednesday. Excluding food, energy, and trade services, PPI increased 0.2%. Economists surveyed by Dow Jones had expected headline PPI to decline by 0.1%. On a year-over-year basis, the headline PPI increased 8.7%, a substantial pullback from the 9.8% rise in July and the lowest annual gain since August 2021. Core PPI increased 5.6% a year ago, matching the lowest rate since June 2021.

Those numbers come a day after the BLS reported consumer price index data for August that was higher than expected. The two reports differ in that the PPI shows what producers receive for finished goods, while the CPI reflects what consumers pay in the marketplace. "The PPI report fleshes out the picture on inflation in the U.S. and makes it look not quite as bad as the August CPI report did," said Bill Adams, chief economist for Comerica Bank. "Inflation is slowing as gas prices fall. But the process is slow, and inflation looks set to stay well above the Fed's target for at least a few more quarters." Following the Tuesday report, stocks tanked, and expectations surged for Federal Reserve action at its meeting next week. Stock market futures were positive after the PPI report. The Dow Jones Industrial Average futures opened 33 points, or 0.11%, higher Wednesday night. S&P 500 futures added 0.15%, while Nasdaq 100 futures advanced 0.14%.

Following the two reports, Markets have now priced in a high possibility that the Fed will raise rates by 75 basis points next week, but the chance of a full 1% rate increase is also being considered.

On the Chinese docket, the one-year medium-term lending facility (MLF) is expected to stay unchanged at 2.75%, according to a Reuters poll of economists when the People's Bank of China releases its Monetary policy report later today. The official Securities Times reported that some of China's big state-owned commercial banks are expected to cut personal deposit rates from Thursday. It said that the interest rate for three-year time deposits and certificates of deposit (C.D.s) would be lowered by 15 basis points. This comes after China cut its benchmark lending rates last month, with the one-year loan prime rate (LPR) lowered by 5 basis points to 3.65% and the five-year LPR slashed by a more significant margin of 15 basis points to 4.30%. That said, this, in turn, was seen as a key factor that undermined the Chinese Yuan and continued lending support to the haven greenback.

As we advance, traders will look for cues from releasing the monetary policy report by the People's Bank of China. The report would influence CNH price dynamics and allow traders to grab some trading opportunities around the pair. The main focus now shifts toward releasing the U.S. retail sales data report (MOM) for august later today at 8:30 E.T. (12:30 GMT), and it is expected to remain unchanged at 0.0%.

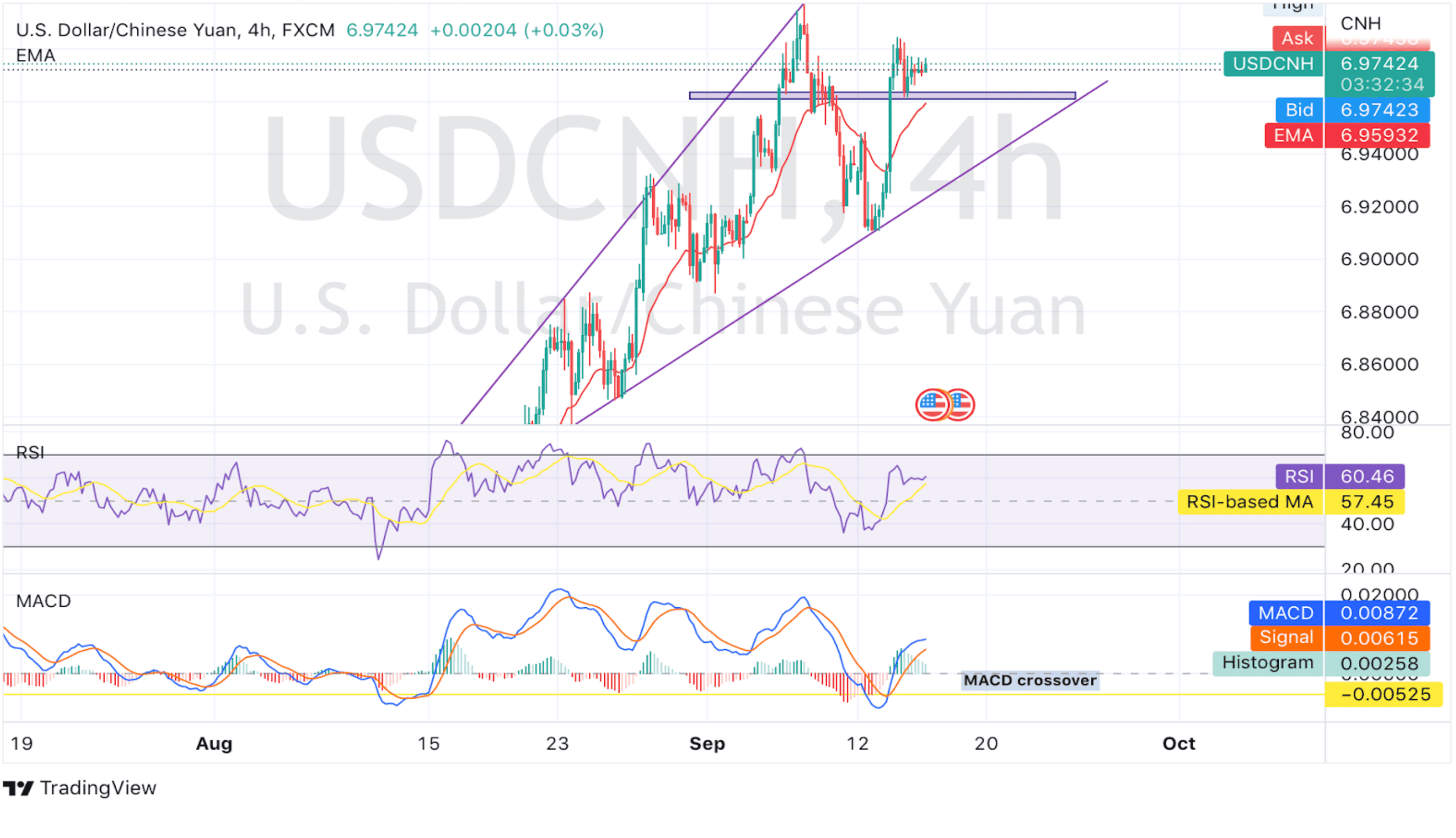

Technical Outlook: Four-Hours USD/CNH Price Chart

From a technical standstill using a four-hour price chart, the price has extended the modest pullback from the 6.96142 - 6.96632 region. Some follow-through buying would lift spot prices toward the downward-sloping trendline from the 14th September swing high(plotted in the one-hour chart). The aforementioned trendline would be a barrier against the asset(resistance level). That said, a clean break above the hurdle would be a fresh trigger for bulls to continue pushing the price up and pave the way for additional gains.

The RSI(14) level at 60.46 level is not far away from flashing overbought conditions. The Moving average convergence divergence(MACD) crossover at -0.00525 adds to the bullish sentiment. Additionally, The 20 Exponential Moving Average(EMA) pointing upwards adds credence to the upside bias.

On the Flipside, a pullback toward retesting the key demand zone ranging from 6.96142 - 6.96632 levels followed by a convincing break below the aforementioned zone would negate any near-term bullish bias and pave the way for technical selling.