USD/CHF Price Retraces From 61.8% FIB Level Amid Renewed USD Buying

- USD/CHF pair gains positive traction on Friday though further uptick seems elusive

- A positive risk tone undermines the safe-haven Swiss Franc and exerts upward pressure on the Pair

- Investors look forward to the Non-Farm Payroll Report today for clues on the Federal Reserve's path of rate hikes and the state of the economy

USD/CHF cross attracted some deep buying from the vicinity of 0.95436 to rebound modestly from the 61.8% fibonacci retracement level and lift spot prices to a new daily high during the early Asian session. At the time of speaking, the Pair is up over 8 pips for the day and looks to build upon the retracement correction heading onto the European session though further uptick seems elusive.

A softer tone surrounding the U.S. Treasury bond yields bolstered by the latest hawkish remarks by the FED Officials hinting more rate hikes are coming helped revive USD demand and turned out to be a key factor that weighed on the USD/CHF pair. Cleveland FED President Loretta Mester said on Thursday that the "U.S. Federal Reserve should raise interest rates to above 4% to help bring down inflation and must aim to keep tightening through the first half of next year"." It is not unrealistic to believe that we will have to do a 75bps in September. However, it might as well be 50, and we will be guided by the statistics" she added. Her comments came after also earlier this week on Tuesday after a trio of Fed officials from across the policy spectrum suggested that they and their colleagues remain resolute and united on getting U.S. interest rates up to a level that will put a dent in activity and inflation.

Despite the fact that tensions caused by U.S. House Speaker Nancy Pelosi's visit to Taiwan against China's strong opposition, largely impressive corporate earnings boosted investors' confidence. This is evident from a generally positive tone around the equity markets, which undermined the safe-haven Swiss franc and lent support to the USD/CHF pair. Key figures in the Chinese government have repeatedly continued to call on Pelosi's visit to Taiwan as a threat to peace and stability and a serious violation of the one-China principle and the provisions of the three China-U.S joint communiquȇs.

Fears of an impending recession in the U.S. have increased lately, even after the latest GDP report confirmed that the U.S. economy contracted for the second straight quarter. That said, The negative GDP reading meets a long-held, basic view of recession.

Oh, the Swiss economic data, The latest Swiss CPI report for July showed that CPI remained stable in July compared with the previous month, remaining at 104.5 points. However, inflation was +3.4% compared with the same month of the previous year. The positive economic data has been shrouded to a larger extent by the hawkish-fed remarks and mounting fears of recession. Apart from this, investors also seem to have to decide to wait on the sidelines and await Friday's jobs report for July by the Labor Department for further clues about the Federal Reserve's path of rate hikes and the state of the economy. Signs that the U.S. job market continues to be robust will likely bolster expectations for more monetary policy tightening from the Fed.

Going forward, in the absence of any major market-moving economic news releases from the Swiss docket, the NFP report scheduled for release during the early Mid-North American session would influence the USD price dynamics. This, in turn, should assist traders in determining the next leg of a directional move for the USD/CHF pair.

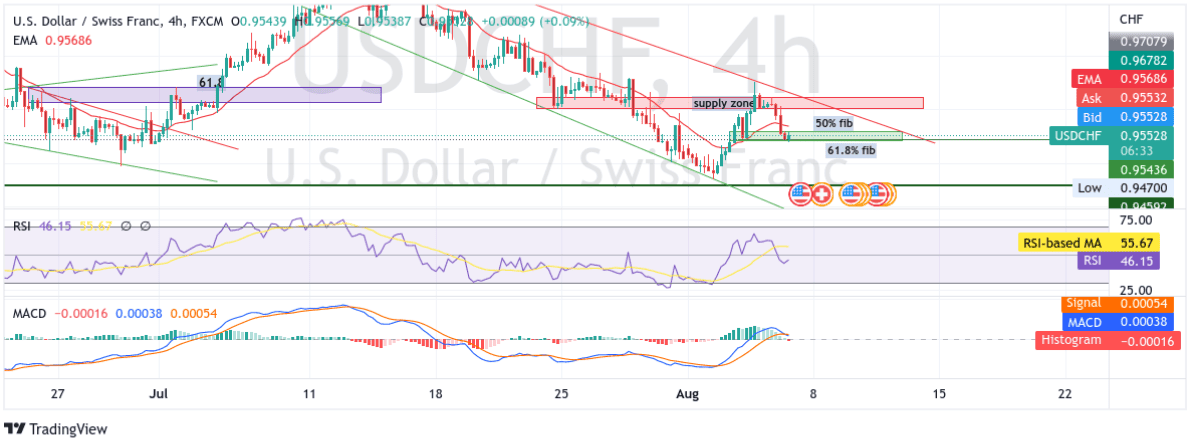

Technical Outlook: Four-hour USD/CHF Price Chart

From a technical standstill, using a four-hour price chart price, the price rebounded modestly after strong rejection from the 61.8% Fibonacci retracement level at 0.95401 level. Subsequent follow-through buying would push the asset to the next immediate hurdle ranging from 0.95995 - 0.96235 levels. The former coincides with the upper horizontal trendline of the descending channel pattern plotted from 14th July. The aforementioned supply zone would act as a barrier against the asset. That said, a clean break above the supply zone would be a fresh trigger for bulls to continue pushing the price up and pave the way for additional gains.

The RSI(14) level at 46.15 level is in bearish territory and not far away from the oversold condition. The Moving average convergence divergence(MACD) crossover will add to the bearish sentiment later today. Additionally, the 20 Exponential Moving Average(EMA) points downwards, further adding to our bearish credence.