AUD/USD Display Minor Pullback From Key Psychological Level

- AUD/USD struggles to gain meaningful positive traction

- Modest pullback in the ten-year treasury bond yields gave an intraday lift to the safe-haven greenback

- Post dovish interest rate decision remarks by RBA Governor Philip Lowe weigh on Australian dollar and offers support to the greenback

- NFP report awaited

AUD/USD Pair witnessed a modest pullback around the 0.69500 level after displaying a firmer north-side move since Wednesday. AUD/USD cross attracted some buying on Thursday during the early part of the Asian session but lacked bullish conviction and ran out of steam. The pair was last seen trading in modest losses heading into the European session.

A modest pullback in the ten-year treasury bond yields gave an intraday lift to the safe-haven greenback and helped cap the major against further uptick. The greenback continues to draw support from the latest remarks from top Fed officials. Fed officials voiced their determination again on Wednesday to rein in high inflation. However, one noted a half-percentage-point hike in the U.S. central bank's key interest rate next month might be enough to march toward that goal. On Wednesday, San Francisco's Fed President Mary Dal said, "it would be reasonable for the FED to raise interest rates by 50bps next month if the economy evolves as expected.

The U.S. Dollar index, which measures the value of USD against a basket of currencies, was flat-lined on Thursday during the early Tokyo session but remained up sharply for the year. It has eased recently as investors began reassessing how aggressive the Fed may be with rate hikes.

Geo-political tension between the U.S. and China was also seen as another factor that supported the greenback. U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan on Wednesday against China's firm opposition. Pelosi said her trip demonstrated American solidarity with the Chinese-claimed self-ruled island. Still, China condemned the highest-level visit by a U.S. official in 25 years as a threat to peace and stability and a serious violation of the one-China principle and the provisions of the three China-U.S joint communiquȇs. Top Chinese officials have called her out by saying, "what she has done is not about upholding or defending democracy but a provocation and infringement on China's sovereignty and territorial integrity.

Additionally, mounting recession fears turned out to be another factor that exerted downward pressure on spot prices. According to the latest GDP report, the U.S. economy contracted for the second straight quarter. That said, The negative GDP reading meets a long-held, basic view of recession. On the Australian docket, the Reserve bank of Australia hiked its benchmark rate by a largely anticipated range on Tuesday as it looks to tame surging inflation in the country. The Australian Central Bank raised rates by 50 basis points to 1.85%- its fourth hike this year. The aggressive monetary stance adopted by the bank was, however, overshadowed to a larger extent by the Post dovish interest rate decision remarks by RBA Governor Philip Lowe, who said in a statement that the bank is placing a high priority on returning inflation to a range of 2% to 3%. Still, the path to this range is "clouded in uncertainty". The bank is not on a pre-set course to tightening policy and will adopt a data-driven approach instead. This was seen as a key factor that undermined the Major and lent support to the safe-haven greenback.

Going forward, market participants now look forward to second-tier Australia economic data, which along with the broader risk sentiment, will influence the euro price dynamics. On the U.S. docket, investors will look for cues from the release of the Initial jobless claims report scheduled for release during the mid-north American session. Traders will also look for cues from Cleveland Fed president Loretta Mester's scheduled speech. Her speech should play a key role in influencing the near-term sentiment surrounding the shared currencies. That said, the focus remains on the Friday NFP report scheduled for release. The report would influence the USD price dynamics. This, in turn, should assist traders in determining the next leg of a directional move for the AUD/USD pair.

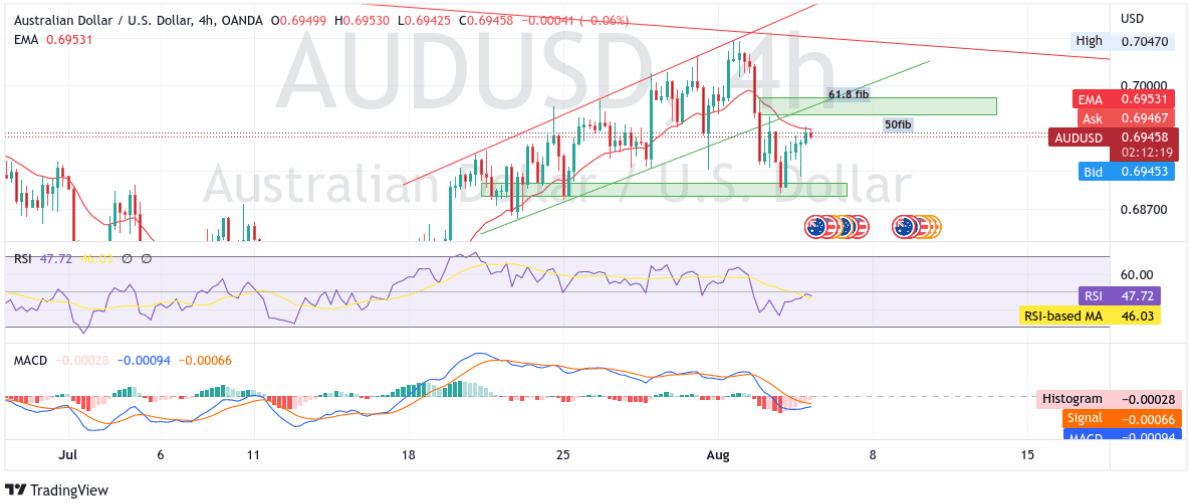

Technical Outlook: Four-hour AUD/USD Price Chart

From a technical perspective, using a four-hour price chart price rebounded modestly from the vicinity of 0.69500 level after attracting fresh selling to push the price below Wednesday's daily high. Some follow-through selling would push the asset towards testing the key demand zone ranging from 0.68827 - 0.68973 levels. A convincing break below the aforementioned zone would be seen as a fresh trigger for bears to continue pushing down the price and pave the way for additional losses.

The RSI(14) level at 47.72 level is in bearish territory and not far away from the oversold condition. Additionally, acceptance below 20 Exponential Moving Average(EMA) at the 0.69537 level adds credence to our bearish filter.

On the Flipside, a pullback toward testing the lower horizontal trendline of the multi-week-old ascending channel pattern turned resistance zone will face stiff resistance as it coincides with the 61.8% and 50% Fibonacci retracement levels at 0.69869 and 0.69672, respectively. A convincing break above the aforementioned barricade would negate any near-term bearish bias and pave the way for additional gains.