USD/CHF Surrenders Modest Intraday Recovery Gains, Retreats Below 0.90300’s, US NFP Data Awaited

- USD/CHF edges back below 0.90300's after failing to capitalize on the earlier session's goodish bounce

- The risk-on impulse is weighing down on the safe-haven buck and acting as a headwind to the USD/CHF pair

- Despite Swiss National Bank being widely expected to pause its rate hikes, incoming Swiss and U.S. data might hold investors back from placing aggressive bullish bets

- The focus for the week remains on Friday's NFP data

USD/CHF pair struggled to capitalize on its earlier session's goodish bounce from the vicinity of the 0.90385 level, witnessed fresh supply during the mid-Asian session, and dragged spot prices back below the 0.90300 level. The pair looks set to extend its offered tone heading into the European session.

A fresh leg down in U.S. Treasury bond yields and a weaker risk tone helped revive the U.S. dollar supply, which in turn was seen as a key factor that undermined the USD/CHF pair. In fact, the U.S. Dollar Index (DXY), which measures the value of the USD against a basket of currencies, extended its pullback from a two-month peak during the mid-Asian session and was trading in modest losses below $104.200 as the U.S. debt ceiling deal continues to lift risk appetite in world markets, which in turn limits the greenback's safe-haven demand. Apart from this, signs of stability in the U.S. equity markets capped the safe-haven greenback and helped limit the downside for the major.

News over the weekend that U.S. President Joe Biden had finalized a budget agreement with House Speaker Kevin McCarthy to suspend the $31.4 trillion debt ceiling until Jan. 1, 2025, and the deal was ready to move to Congress for a vote saw the U.S. stock markets and the U.S. dollar rally on Monday before subduing following opposition from a handful of hard-right Republican lawmakers who said they would oppose a deal to raise the United States $31.4 trillion debt ceiling. As quoted by Reuters, the opposition highlights the hurdles Democratic President Joe Biden and top congressional Republican Kevin McCarthy will face getting the package through the Republican-controlled House of Representatives and Democratic-controlled Senate before the limit is reached, likely by the following Monday.

Despite the combination of negative factors, the downside seems limited amid firm market expectations that the Federal Reserve (Fed) will continue to raise interest rates. The bets were further boosted after the latest U.S. core PCE inflation readings showed inflation remained sticky in the U.S. despite increased interest rates.

That said, fed fund futures traders have seen pricing in almost a 61 % chance of a 25 bps interest rate hike in the next Fed meeting in June, up from 25.7% last week, with the remaining 39% odds favored for a Fed pivot, according to the CME's Fedwatch tool's latest update. Further underpinning the greenback are signs of a potential recession in the U.S., the hawkish Fed rhetoric, robust job growth data, strong Michigan consumer sentiment readings, and the hawkish Fed meeting minutes outlook released mid-this month.

Shifting to the Swiss docket, the Swiss franc continues to be undermined by market expectations that the Swiss National Bank (SNB) will pause rate hikes sooner than expected. The bets were further raised following the latest inflation data report released early this month, which showed the annual inflation rate in Switzerland had eased to 2.6% in April 2023 from 2.9% in the previous month and was less than market forecasts of 2.8%. That said, the difference in monetary policy adoption between the SNB and the FED is set to act as a headwind for the Swiss franc in the long run and suggests the path of least resistance is to the upside for the USD/CHF pair.

However, incoming data on Wednesday is expected to show a rise in the aggregate values of sales at the retail level across Switzerland and land to -1.4%, up from -1.9% the previous month. This, in turn, might hold investors back from placing aggressive bullish bets and encourage them to wait for near-term depreciating moves before placing fresh bullish bets. This week's incoming U.S. data is expected to show low U.S. consumer confidence, a weak manufacturing PMI reading, and a high U.S. unemployment rate, followed by fewer jobs created in the U.S. economy last month.

As we advance, investors look forward to the U.S. docket featuring C.B. Consumer Confidence (May) data and the S&P/CS HPI Composite-20 n.s.a (YoY) (Mar) data. Investors will further look for cues from the release of the Swiss GDP (YoY) (Q1) data and the Swiss KOF Leading Indicators (May) data. The main focus, however, remains on the U.S. NFP data report scheduled for release on Friday during the mid-north American session and is expected to show a drop in the number of people employed in May and land to 180K, down from 253K in April.

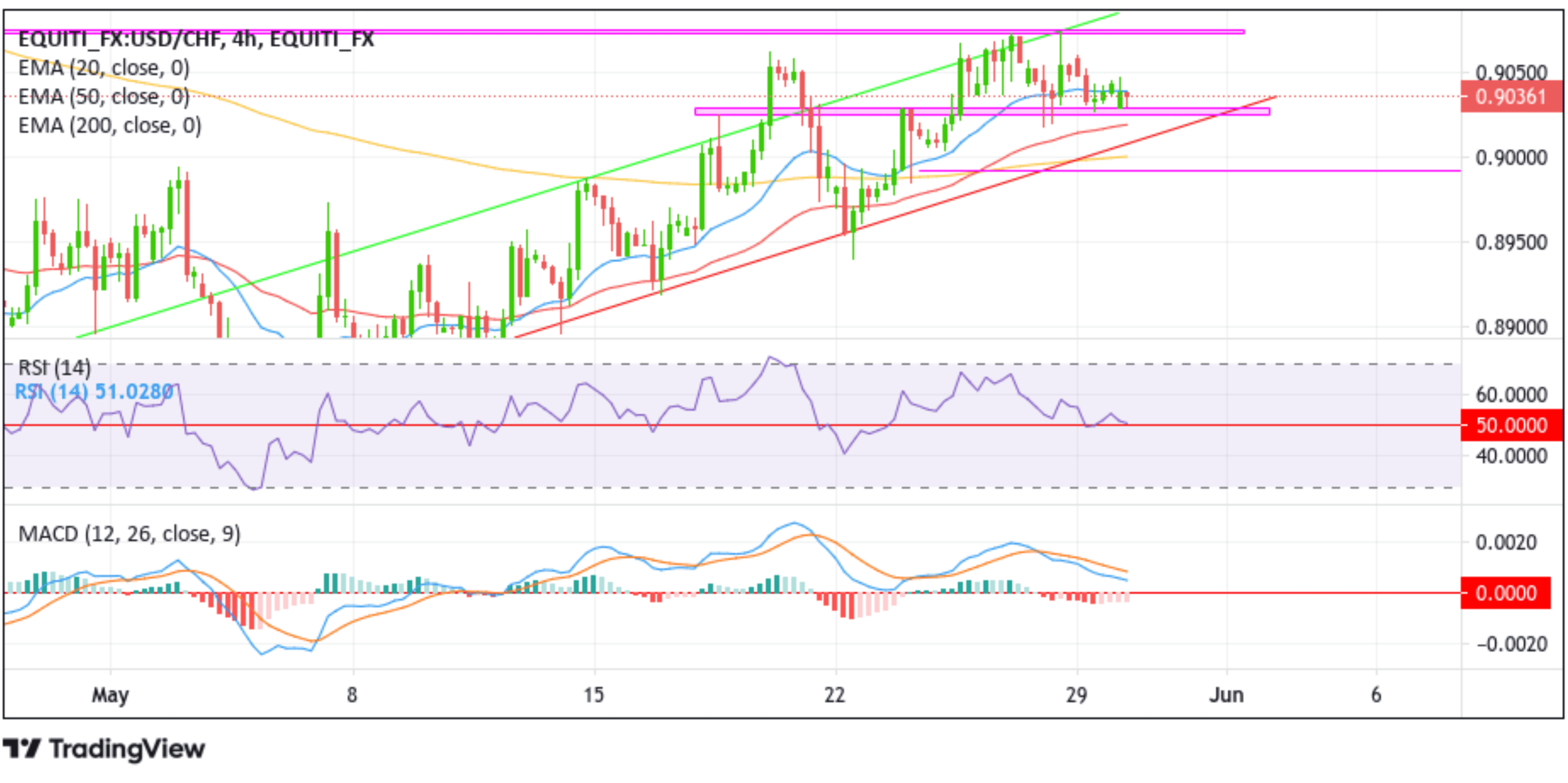

Technical Outlook: Four-Hours USD/CHF Price Chart

From a technical perspective, the price is auctioning at 0.90361 and is sitting just above the key demand zone ranging from 0.90283 - 0.90243 levels. If the price weakens further from the current price level and, in dire cases, below the aforementioned zone, it would pave the way for a drop toward tagging the 50-day (red) Exponential Moving Average (EMA) at the 0.90200 level. A breach below this support level could see the USD/CHF pair accelerate its downfall toward retesting the key trendline support. Sustained weakness below this support level would pave the way for a decline toward confronting the technically strong 200-day (yellow) EMA at the 0.90000 level. A four-hour candlestick close below this level could negate any-near term bullish outlook and pave the way for aggressive technical selling around the USD/CHF pair.

On the flip side, if dip-buyers and tactical traders jump back in and trigger a bullish reversal, initial resistance appears at the 20-day (blue) Exponential Moving Average (EMA) at the 0.90393 level. Buying interest could gain momentum if the price pierces this barrier, creating the conditions for an ascent toward the 0.90750 - 0.90731 supply zone.