USD/CHF Eases Below 0.94200 Level Amid Soft U.S. Economic Data Reports

- USD/CHF attracted fresh selling on Friday after initially seesawing during the early hours of the Asian session and dragged spot prices below the 0.94200 level

- Retreating treasury bond yields force the U.S. Dollar to trim parts of its previous gains

- U.S. trade deficit widens as goods exports hit a seven-month low while the US ISM Services PMI unexpectedly jumped to 56.5 in November of 2022

- The mixed Swiss macro data was a key factor that underpinned the Swiss Franc and helped exert downward pressure on the USD/CHF pair

USD/CHF pair seesawed between tepid minor gains and tepid minor losses during the second part of the Asian session. The cross attempted to capitalize on extending Monday's overnight modest pullback from the vicinity of the 0.93308 level and ran out of steam after attracting fresh bearish bets in the last hour or so on Wednesday. The pair was last seen trading in modest losses below the 0.94200 level heading into the European session.

They were retreating treasury bond yields amid signs of the FED slowing the pace of interest rate hikes after a slew of soft economic data releases. It forced the U.S. Dollar to trim parts of its previous gains after a strong uptick witnessed over the last two days. Apart from this, signs of stability in the equity markets were another factor that undermined the greenback. Additionally, recession concerns were another factor that weighed on the greenback. As per press time, the U.S. Dollar index (DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, is down 0.12%/0.129 points to trade at 105.502.

The U.S. trade gap widened to a four-month high of $78.2 billion in October of 2022, following an upwardly revised $74.1 billion deficit in September and compared to market forecasts of $80 billion, according to data released by the U.S. Bureau of Economic Analysis. Exports went down 0.7%, a second consecutive monthly fall, to $256.6 billion, the lowest value since May. Sales fell for natural gas, other petroleum products, and pharmaceutical preparations but rose for crude oil, soybeans, travel, transport, and business services. Meanwhile, imports were up 0.6% to $334.8 billion, the highest since June, led by fuel oil purchases, finished metal shapes, nuclear fuel materials, passenger cars, pharmaceutical preparations, travel, telecommunication, and computers.

In other news, The US ISM Services PMI unexpectedly jumped to 56.5 in November of 2022, rebounding from a more than 2-year low of f 54.4 hits in October and beating market forecasts of 53.3. Business activity increased faster (64.7 vs 55.7), and employment rebounded (51.5 vs 49.1), prompted by a new fiscal period and the holiday season. Additionally, The S&P Global U.S. Services PMI was revised slightly higher to 46.2 in November of 2022 from a preliminary of 46.1 but continued to point to a fifth straight month of falling services activity and the second-sharpest decline since May 2020. There was a steeper decrease in new orders as domestic and foreign client demand remained weak. The mixed macro data was a key factor that undermined the greenback and exerted downward pressure on the USD/CHF pair.

Shifting on to the swiss docket, Switzerland's Gross Domestic Product (GDP) expanded by 0.50 percent in the third quarter of 2022 over the same quarter of the previous year, according to data released last week by the Switzerland State Secretariat for Economic Affairs. Additionally, The Swiss economy expanded 0.2% on quarter in the three months to September of 2022, picking up from a downwardly revised 0.1% growth in the previous quarter and below market forecasts of a 0.3% expansion.

In other news, The annual inflation rate in Switzerland stood at 3 percent year-on-year in November 2022, unchanged from the previous month's five-month low and in line with market expectations of 3 percent. Every month, consumer prices were flat in November after increasing by 0.1 percent in October, according to data released by the Swiss Federal Statistical Office. Additionally, Retail sales in Switzerland dropped by 2.5 percent year-on-year in October of 2022, following a downwardly revised 2.6 percent growth in the previous month. It was the first fall in retail trade since May, as sales declined for food, beverages and tobacco (-3.7 percent vs -0.3 percent in September) and non-food products (-2.2 percent vs 4.2 percent). Every month, retail trade slumped by 2.7 percent, the largest decrease since February 2021. That said, The mixed macro data was seen as a key factor that underpinned the Swiss Franc and helped to exert downward pressure on the USD/CHF pair.

As we advance, investors look forward to the swiss economic docket featuring the release of the Unemployment Rate (Nov), which is expected to show an increase in the unemployment rate and land at 2.0%, up from 1.9% in October. Investors will also look for further cues from the release of the U.S. Nonfarm Productivity (QOQ) (Q3), which is expected to land at 0.6%, up from 0.3% in October. The reports would influence the near-term USD Price dynamics. This, in turn, should assist traders in determining the next leg of a directional move for the USD/CHF Pair.

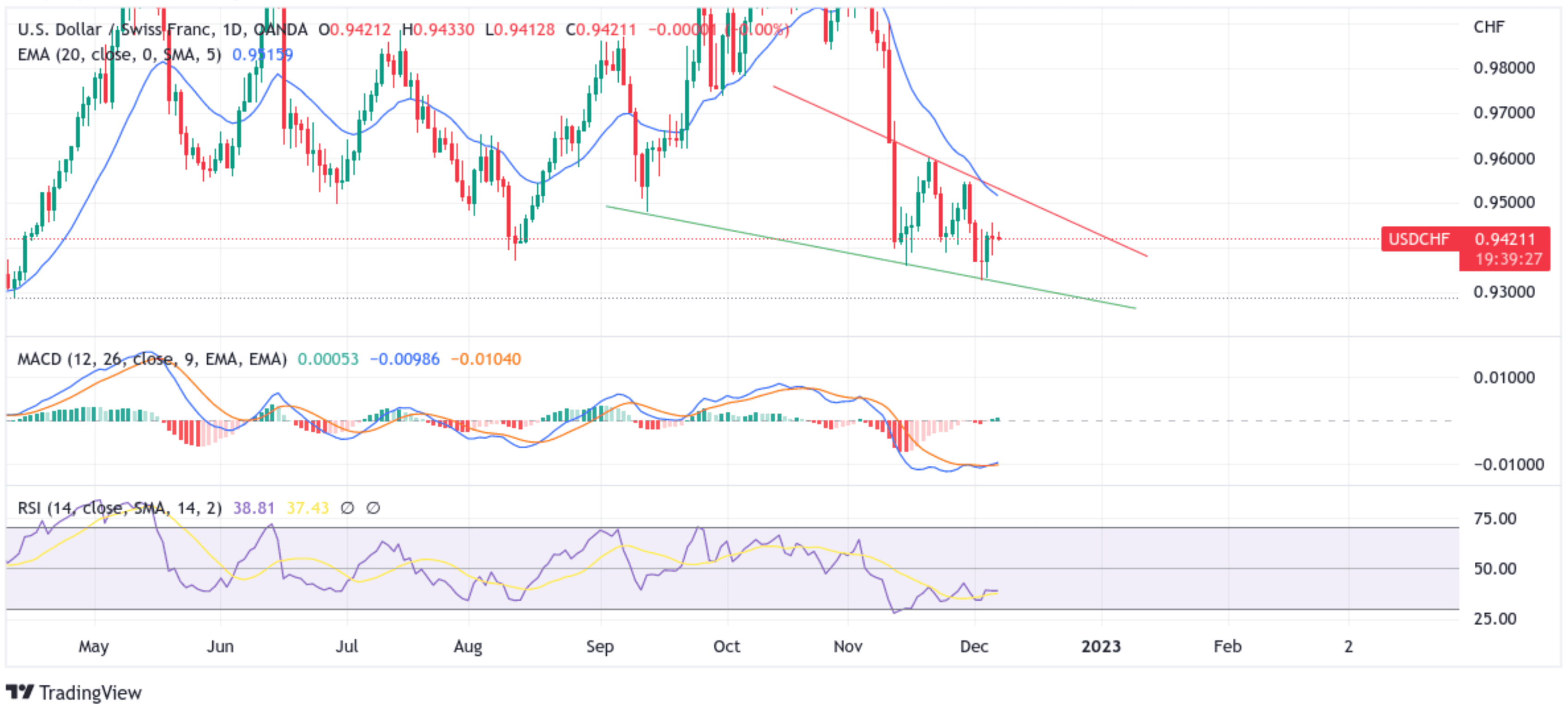

Technical Outlook: One-Day USD/CHF Price Chart

From a technical standstill using a one-day price chart, the price looks to extend the sharp rebound from the vicinity of the 0.94559 level. That said, some follow-through selling would drag spot prices lower toward the 0.93737 support level. If sellers manage to breach the Thai floor, downside pressure could accelerate, paving the way for a drop towards the 0.93273 - 0.93309 Demand zone(the former coincides with a downward sloping trendline plotted from September 2022 swing low).

All the technical oscillators on the daily chart are in negative territory, with the RSI (14) at 38.81, below the signal line, and on the verge of flashing oversold conditions. On the other hand, The Moving Average Convergence Divergence (MACD) Crossover is below the signal line, pointing to a bearish sign for price action this week.

On the Flipside, if dip-buyers and tactical traders jump back in and trigger a bullish reversal, initial resistance appears at 0.94335 en route to the 0.94583 resistance level. If the price pierces these barriers, buying interest could gain momentum, creating the right conditions for an advance toward retesting the key resistance level (downward sloping trendline plotted from 21st November 2022 Higher-highs). Sustained strength above this barrier would negate any near-term bearish outlook and pave the way for aggressive technical buying.