USD/CAD Extends Gains Above 1.35000 Mark Amid Weak Oil Demand

- USD/CAD Pair attracts some buying on Wednesday to extend the modest rebound from the vicinity of the 1.34841 level

- A fresh leg up in the U.S. treasury bond yields, along with a softer risk tone, offered some support to the greenback

- U.S. consumer spending barely rose in November while inflation cooled further, according to data by the U.S. Bureau of Economic Analysis

- Retreating Crude Oil prices undermine the Loonie significantly

USD/CAD cross witnessed fresh demand from the vicinity of the 1.35214 level after earlier seesawing between tepid minor gains and minor losses. As per press time, the pair is up over 14 pips for the day and looks set to maintain its bid tone heading onto the European session though further uptick seems elusive.

A fresh leg up in the U.S. treasury bond yields as markets continue to reopen after Monday's Christmas holiday and investors looking more optimistic ahead of 2023. This, in turn, offered some support to the greenback.

The U.S. Dollar index (DXY), which measures the value of USD against a basket of currencies, was up 0.07% at 104.396 after remaining flat on Tuesday on news that China would scrap its COVID-19 quarantine rule for inbound travellers - a major step in reopening its borders, even as COVID cases spike.

According to the National Health Commission, China will no longer require travellers who arrive in the country to undergo quarantine starting on January 8th. In addition, Beijing has lowered its regulations for managing COVID cases to Category B, which is less stringent than the highest level, Category A.

Commenting on the news, investors could be cheered by what some perceive to be "Chinese policymakers' resolve to full reopening", said Christopher Wong, a currency strategist at OCBC.

"There seems to be no let-up in the pace of relaxing COVID restrictions despite the surge in COVID cases in the mainland.

The news from China came days after Data released on Friday showed U.S. consumer spending barely rose in November while inflation cooled further, reinforcing expectations that the Federal Reserve could scale back its aggressive monetary policy tightening.

The personal consumption expenditure price index in the United States increased by 5.5% year-on-year in November of 2022, the least since October 2021 and below 6.1% in October. Compared to the previous month, the PCE Price Index rose by 0.1%, the least in four months, and below 0.4% in October. Excluding food and energy, the core PCE annual rate, the Federal Reserve's preferred gauge of inflation, fell to a four-month low of 4.7% in November of 2022 from 5% in the prior month, in line with market forecasts. Every month, Core PCE prices in the U.S. went up by 0.2% month-over-month in November of 2022, following an upwardly revised 0.3% increase in the prior month, matching market estimates.

Further lifting the greenback was the upbeat goods trade balance data which showed the U.S. Posted the Smallest Goods Deficit in Nearly 2 Years. An advance estimate showed that the U.S. trade deficit in goods narrowed by 15.6 percent from a month earlier to USD 83.3 billion in November 2022, the largest decline since 2009. It was also the smallest deficit since December 2020, as imports tumbled 7.6 percent to an over-year low, as consumers have been shifting spending away from goods and toward services in recent months.

Shifting to the Canadian docket, the Loonie is undermined by a downtick in oil prices due to recession concerns and restarts at some U.S. energy plants shut by winter storms after initially edging up on early Tokyo trading session on Wednesday on hopes of a recovery in fuel demand as China continues to ease its COVID-19 restrictions.

As per press time, US WTI crude oil was down 0.62% to trade at $79.36 per barrel, while its counterpart Brent crude oil was down 0.44% to trade at $84.59 per barrel.

Further weighing down on the Loonie was the downbeat Canadian GDP monthly data report which showed The Canadian economy likely stagnated from the previous month in November of 2022, as increases in accommodation and food services and wholesale trade were offset by declines in construction as well as mining, quarrying and oil and gas extraction, according to a preliminary estimate.

Additionally, Canada's annual inflation rate was at 6.8% in November of 2022, easing slightly from the 6.9% in the prior month but above market expectations of 6.7%. Still, the result marked the slowest price growth since April, according to data released mid-last week by Statistics Canada. Every month, Canadian consumer prices rose by 0.1% in November, slowing from a 0.7% gain in the prior month.

As we advance, investors now look forward towards the U.S. docket featuring the release of the U.S. pending home sales data report for November, which is expected to land at -0.8%, up from -4.6% the previous month.

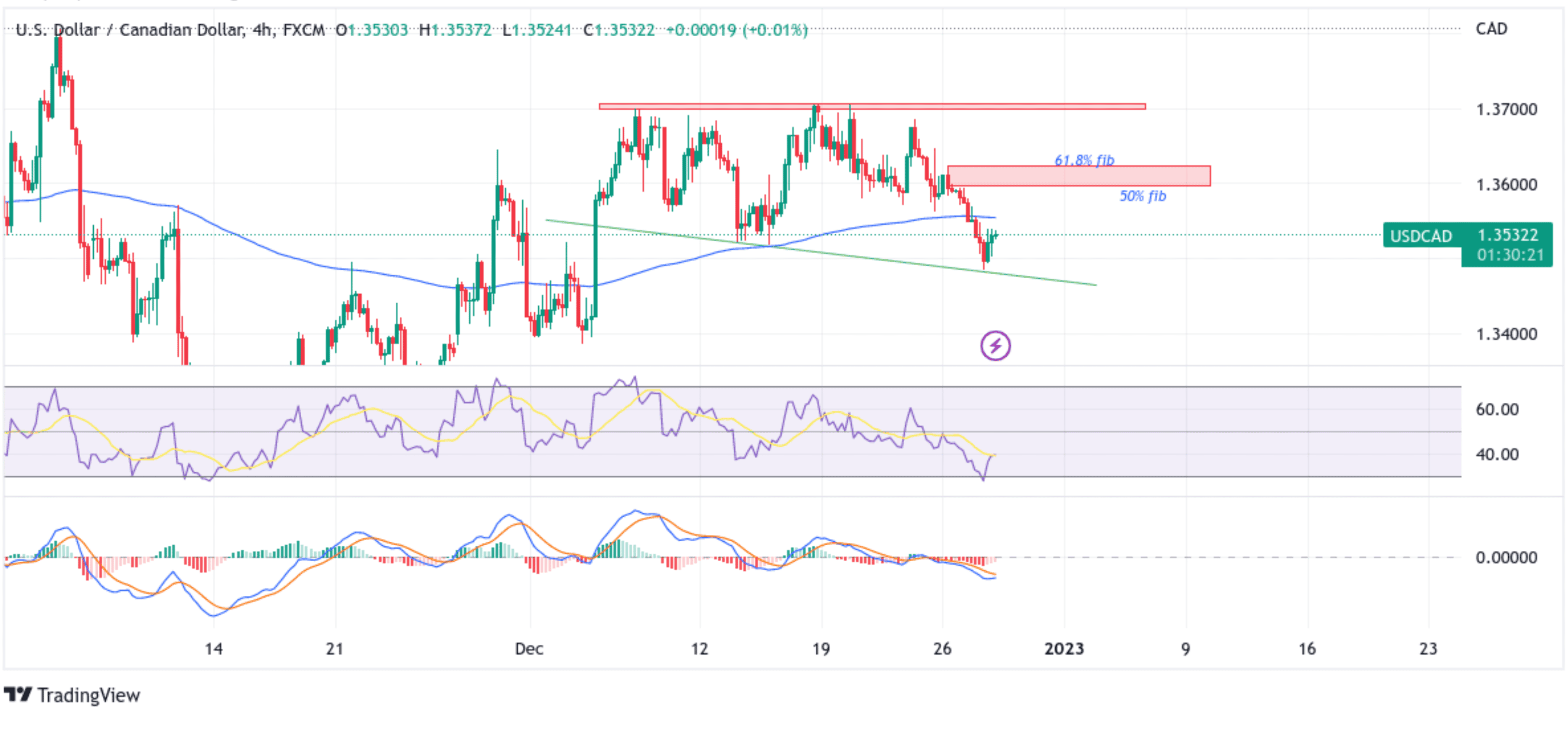

Technical Outlook: Four-Hour USD/CAD Price Chart

From a technical perspective using a four-hour price chart, the price has extended the modest rebound from the vicinity of 1.34841 level after failing to break below the key support level plotted by a downward-sloping trendline extending from December 13th swing lower-lows. Some follow-through buying would uplift spot prices toward the immediate hurdle plotted by 61.8% and 50% Fibonacci retracement levels at 1.36235 and 1.35951 levels, respectively, but would, first of all, need acceptance above the strong 200 Exponential Moving Average (EMA) at 1.35540 level. If the price manages to pierce above the aforementioned barriers bullish uptick could gain accelerate toward retesting the key supply zone ranging from 1.36979 - 1.37047 levels. A convincing break above the aforementioned barrier would negate any near-term bearish outlook and pave the way for aggressive technical buying.

All the technical oscillators on the chart are in negative territory, with the RSI (14) at 40.03 below the signal line, but a move above the signal (a move above the 200EMA) would act as a trigger for bulls to place new bullish bets. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is below the signal line, pointing to a bearish sign for price action this week (but a move above the signal line would trigger new buyers to enter the market and push up the price).

On the Flipside, if dip-sellers and tactical traders jump in and trigger a bearish reversal, the price will find support at the 1.34968 support level en route to the key support level plotted by a downward-sloping trendline. If sellers manage to breach these floors, the USD/CAD pair could turn vulnerable and accelerate the downfall toward September 2015 and January 2017 Monthly peaks. Sustained weakness below this barricade (now turned support level) would pave the way for aggressive technical selling around the USD/CAD pair.