US 30 Index Up Over 1.3% Reigniting Hopes Of A Santa-Claus Rally, Fed's Preferred Inflation Gauge Awaited

- The US30 Futures Index witnessed some busying during the early Asian session to extend the modest overnight rebound from the 32468 level

- Concerns of recession contributed to the Sell-Off in stocks on Thursday

- US Economy grew more than expected

- All 11 Dow Jones 30 sectors declined, led by industrials, technology, and financial

Dow Jones 30 Futures edged higher through the mid-Tokyo session and was last seen trading solidly above the 33000 mark in the last hour. The index futures added to the heavy overnight gains and witnessed some follow-through buying for the second day after a brief sell-off earlier during the Thursday regular trading session, raising hopes for an end-of-year rally.

In regular trading on Thursday, the Dow tumbled as much as 2.41% before ending the day 1.05% lower, while the S&P 500 and Nasdaq Composite dropped 1.45% and 2.18%, respectively.

All 11 Dow Jones 30 sectors declined, led by industrials, technology, and Financial. Those moves came as concerns of a recession resurged, dashing some investors' hope for a year-end rally. Investors worry that overtightening from central banks worldwide could force the economy into a downturn.

Additionally, Those moves came as an upward revision to third-quarter US GDP numbers, reinforcing the case for the Federal Reserve to raise interest rates further and maintain them higher for longer.

The final estimate for GDP growth showed the US economy expanded by 3.2% in Q3, better than 2.9% in the second estimate and rebounding from two straight quarters of contraction. Consumer spending rose more than anticipated (2.3% vs 1.7% in the second estimate), as growth in health care and "other" services partially offset a decrease in spending on goods, namely motor vehicles and food and beverages.

The job market, meanwhile, remained tight as initial jobless claims fell less than expected last week, according to data released on Thursday by the US Department of Labor.

"The labor market remains very tight," Jefferies said in a note. "We expect it will soften eventually, but it is starting from a very significant position of strength, and it will take a little while longer for the cracks to form."

Micron Technology Inc Stock Slumps

Micron Technology Inc (NASDAQ: MU) plunged more than 3% after reporting quarterly results that missed the top and bottom line as the gloomy macroeconomic background continued to weigh on demand.

While the chip maker's outlook for the fiscal second quarter was "soft", Deutsche Bank says, there is a risk for more downside as Micron's estimates point to a demand recovery toward mid-CY23, which "seems optimistic."

Additionally, the Semiconductor maker announced on Wednesday that it would reduce its headcount by about 10% in 2023, in the latest example of a technology industry slowdown affecting employment. Following the top management's decision, Shares of Micron fell more than 1% in extended trading on Wednesday.

Boeing Co Stock Declines

The industrial sector was down more than 1%, dragged lower by Boeing Co (NYSE: BA) and other airline stocks. Airlines including American Airlines (NASDAQ: AAL), Southwest Airlines (NYSE: LUV), and Delta Air Lines (NYSE: DAL) cancelled hundreds of flights this week as winter storms are set to wreak havoc ahead of a busy Christmas weekend.

This came on the back heel of the latest announcement by Boeing in which they announced on Thursday that they had resumed flight testing of its 777X jets after an inspection in October found an engine issue.

Carmax Shares Tumble on weaker than Expected Quarterly Results

CarMax (NYSE: KMX) contributed to the wobble in Consumer stocks after falling 3% as the largest used car dealer in the US, and quarterly results fell short of Wall Street estimates.

As we advance, Investors now look ahead to the November PCE report, the Fed's preferred inflation gauge, personal income, new home sales, and consumer sentiment data, all set for release during the early North American Session.

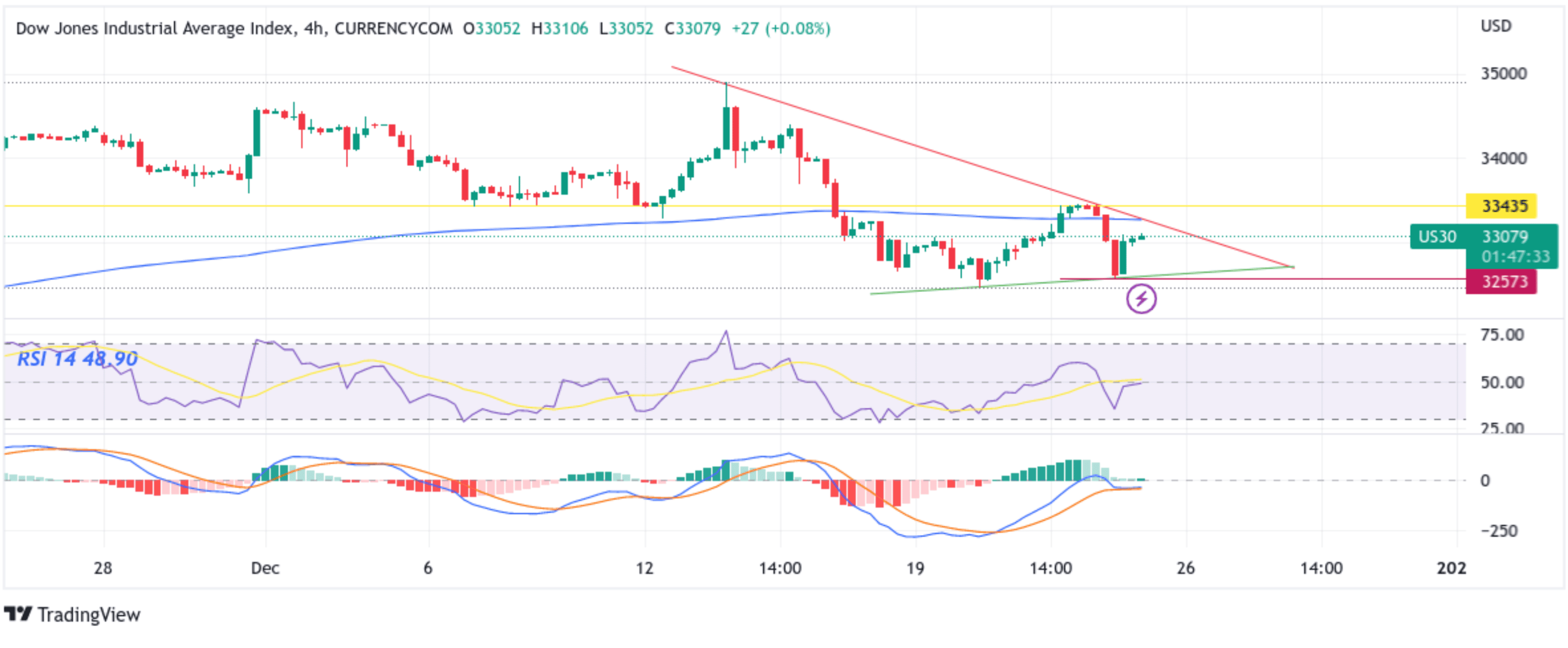

Technical Outlook: Four-Hours US30 Price Chart

From a technical perspective, using a four-hour price chart, spot prices are now looking to extend the momentum further beyond the modest rebound from the vicinity of the 32468 level. Strong follow-through buying would uplift spot prices toward the immediate hurdle plotted by a downward-sloping trendline of the descending triangle chart pattern extending from the 13th December 2022 swing high. Sustained strength above this level(bullish price breakout) would pave the way for aggressive technical buying around the US30 futures index. The bullish trajectory could then accelerate toward retesting the 33435 resistance level. If the price pierces this barricade, it will pave the way for more gains around the US30 futures index.

The RSI (14) level at 48.90 is above the signal line, portraying a bullish filter. On the other hand, the moving average convergence divergence (MACD) is below the signal line, pointing to a bearish sign for price action this week. However, a move above the signal line would trigger traders to place new bullish bets.

On the Flipside, if dip-sellers and tactical traders jump in and trigger a bearish reversal, the price will find support at the key support level plotted by an ascending trendline of the descending triangle chart pattern extending from the 20th December 2022 swing low. If sellers manage to breach this floor, the US 30 futures index could turn vulnerable and accelerate the downfall toward the 32468 support level. Sustained weakness below this barricade would pave the way for a drop toward the 32358 - 32381 Demand zone. A convincing break below this barrier would pave the way for additional losses surrounding the US30 futures index.