U.S. Crude Oil Futures Dips Further As Markets Gauge U.S. Inventory Build, Recession Worries China

- Oil prices fell further on Thursday as worries about a possible U.S. recession outweighed global economic optimism

- A series of hawkish comments from top FED officials combined with the U.S. crude inventory build up weight on crude oil prices

- Despite the recent lacklustre crude oil performances, China's lifting of restrictions should boost global oil demand to a record high this year hence boosting oil prices

U.S. WTI Crude oil futures weakened further on Thursday as industry data signalled another big weekly build in U.S. crude inventories. In contrast, weak economic data and a potential rise in interest rates fanned growing fears over a looming recession.

As per press time, US WTI Crude oil futures was down 0.79%/62 cents at $78.52 per barrel, while its counterpart Brent futures was also down 0.45%/38 cents to trade at $84.18 per barrel.

US WTI Crude oil futures have so far managed to reverse partially last week's gains as hawkish comments from U.S. Federal Reserve (Fed) officials sparked worries the central bank may not pause interest rate hikes any time soon.

It was worth noting last week, crude oil prices rallied and surged over 13%/$9.83 on the backdrop of hopes for a Chinese economic rebound this year. Reports from the Organization of Petroleum Exporting Countries and the International Energy Agency suggested that crude demand will hit new highs this year on the back of a Chinese recovery.

That said, crude oil prices were further limited by a downbeat US API weekly crude stock data report which showed stocks of crude oil in the United States rose by 7.615 million barrels in the week ended January 13th, 2023, after a record high of 14.865 million barrels gain in the previous week data from the American Petroleum Institute showed. It came above analyst expectations of a 1.750 million barrels decline.

Additionally, hawkish comments from St.Louis Fed President James Bullard and Cleveland Fed President Loretta Mester said rates needed to rise beyond 5% to control inflation, suggesting that high-interest rates are meant to stay, which in turn ignited further fears that the planned rate hikes could drag the U.S. economy into a recession. Additionally, High inflation readings from the U.K. and the Eurozone also factored into fears of an economic slowdown which in turn was seen as another factor that undermined crude oil prices.

However, US WTI Crude oil futures found some support earlier in the session after December's producer price index data, which measures final demand prices across hundreds of categories, showed a larger-than-expected decline and signalled that inflation might be beginning to ease. Wholesale prices fell 0.5% for the month, while economists surveyed by Dow Jones had expected a 0.1% decline.

Additionally, crude oil prices were supported by upbeat China GDP Growth Rate data released Tuesday before the uptick faded. The Chinese economy expanded 2.9% YoY in Q4 of 2022, easing from a 3.9% growth in Q3 but above market estimates of a 1.8% rise. Industrial output increased the least in seven months in December, retail sales remained weak, while the surveyed jobless rate dropped from November's 6-month high. For the full year of 2022, the economy grew by 3.0%, missing the official target of around 5.5% and marking the second slowest pace since 1976 amid the impact of Beijing's zero-COVID policy.

As we advance, despite the recent crude oil performances, China's lifting of restrictions should boost global oil demand to a record high this year, according to the International Energy Agency (IEA). At the same time, price cap sanctions on Russia could dent supply.

Rystad Energy, a consultancy, said the effect of sanctions on Russian crude exports after 1.5 months of the European Union embargo and G7 price cap has not been as devastating as some predicted.

Rystad said the losses were at about 500,000 barrels per day and that India and China remain key Russian crude buyers.

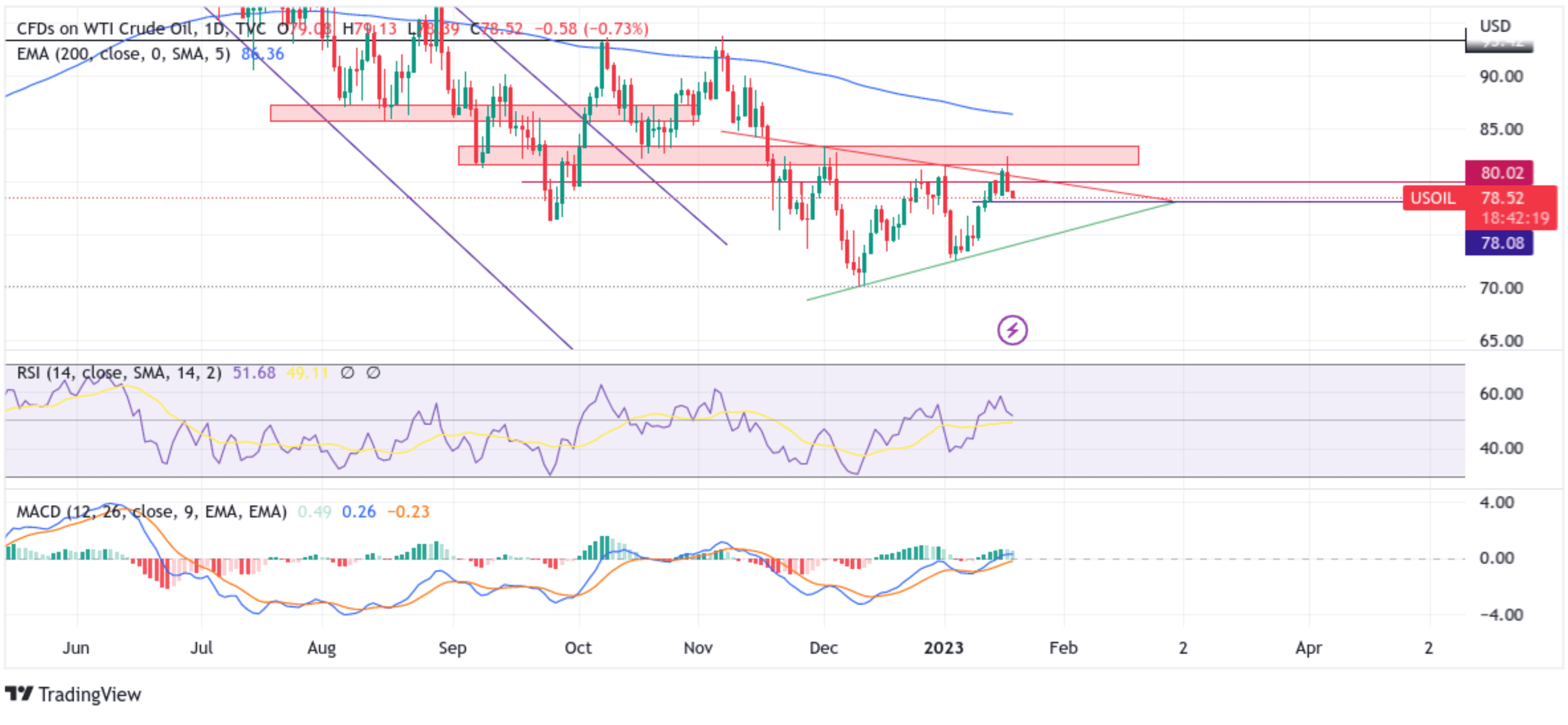

Technical Outlook: US WTI Crude Oil One-Day Price Chart

From a technical standstill using a one-day price chart, the price has extended the sharp rebound from the vicinity of 82.36 level, which sits inside the key supply zone ranging from 81.50 - 83.32 levels. The price's ability to break below the key resistance level (bearish price breakout) plotted by a downward-sloping trendline of the bearish pennant chart pattern extending from the December 2022 swing high supported prospects for additional losses around the US WTI crude oil futures spot prices. If the price manages to weaken further in the coming session, it will face some resistance at the 50% and 61.8% Fibonacci Retracement levels at 76.20 and 74.76, respectively. Suppose sellers manage to breach these key floors. In that case, downside momentum could accelerate further toward the key support level plotted by an ascending trendline of a bearish pennant chart pattern extending from the December 2022 swing low for the third retest. Sustained weakness below this key support level would negate any near-term bullish outlook and pave the way for aggressive technical selling around the US WTI crude oil futures.

The RSI (14) at 51.68 is above the signal line, but a move below the middle line (50) would add credence to the bearish filter. The Moving Average Convergence Divergence (MACD) Crossover is below the signal line but is currently threading near the signal line. It will be prudent to wait for a move further below the signal line in the coming sessions before placing aggressive bearish bets.

On the flip side, if buyers resurface and spark a bullish turn around, initial resistance comes in at the key resistance level plotted by a downward-sloping trendline of the bearish pennant chart pattern extending from the December 2022 swing high. A convincing break above the aforementioned resistance level (bullish price breakout) would pave for additional gains around the US WTI Crude oil futures. Still, the bullish trajectory would face an immediate hurdle plotted by a strong supply zone ranging from 81.50 - 83.32 levels. Sustained strength by buyers above this barrier would negate any-near term bearish outlook and pave the way for aggressive technical buying around the US WTI Crude Oil Futures.