GBP/USD Eases From One-Month Peak Amid U.S. Dollar Strength, Slew of U.S. Economic Data Awaited

- GBP/USD Cross rebounds from the vicinity of 1.22892 level amid renewed U.S. Dollar buying

- A combination of factors underpins the USD and keeps a lid on further gains.

- Stronger wage growth data might force the BoE to hike further and boosts the British Pound.

- A slew of U.S. Economic data set to be released today

GBP/USD pair came under renewed selling pressure on Wednesday after attracting bearish bets during the early hours of the Asian session to drag spot prices below mid-1.2200s. At the time of speaking, the pair is down over 20 pips for the day and looks to have snapped a four-day winning streak. As we advance to the European session, the shared currency looks set to maintain its offered tone.

Expectations for a more aggressive policy tightening by the Federal Reserve assist the U.S. dollar in attracting some dip-buying and offers some support to the GBP/USD pair. However, retreating U.S. Treasury bond yields and a generally upbeat tone around the equity markets should limit the upside for the safe-haven buck.

The U.S. Dollar index (DXY), which measures the value of the United States Dollar relative to a basket of foreign currencies, was up 0.32% at 102.780 (as per 05:57 UTC+3) extending its modest rebound from the vicinity of 101.7/seven-month low following a heavy sell-off after data last week showed that U.S. consumer prices fell for the first time in more than 2-1/2 years in December.

Lifting the greenback was the recent U.S. soft data that confirmed inflation in the U.S. was slowing down. The New York Fed's barometer of business activity in the New York state fell in January to the lowest since mid-2020 as orders plunged and employment growth stalled. The New York Fed's "Empire State" index on current business conditions plummeted to -32.9 this month from -11.2 in December. Economists polled by Reuters had forecast the index at -9.0.

Shifting to the U.K. docket, The British Pound strengthened a bit on Tuesday following the release of the U.K. monthly employment details, which, in turn, saw the GBP/USD pair rise higher. The U.K. Office for National Statistics (ONS) reported that Average weekly earnings, including bonuses in the U.K., increased by 6.4% year-on-year to GBP 629 in the three months to November of 2022, the most since the same period to May, above an upwardly revised 6.2% gain in the three months to October, and topping market estimates of 6.2%. Additionally, the number of people claiming unemployment benefits in the U.K. increased by 19.7K in December of 2022, following a 16.1K rise in November. On the other hand, the unemployment rate was unchanged at 3.7% in the three months to November of 2022, the same as in the previous period and in line with expectations. The combination of mixed data could pressure the Bank of England to raise interest rates by another 50 bps at the next policy meeting and provide a modest lift to the domestic currency.

As we advance, investors look forward to the U.S. docket featuring the release of the Retail Sales data for December, seen lower at -0.8%, down from -0.6% in November while excluding automobiles core retail sales data for December is also seen lower at -0.4%, down from -0.2% in November. Investors will further look for cues from the release of the Producer price index(PPI) data for December, seen lower at -0.1%, down from 0.3% in November, while excluding food and energy, the Core Producer price index(PPI) data for December is also seen lower at 0.1% down from 0.4% in November. Traders will look for subtle clues from the speech of Atlanta Fed President Mr Raphael Bostic regarding the Fed's interest rate policy plans.

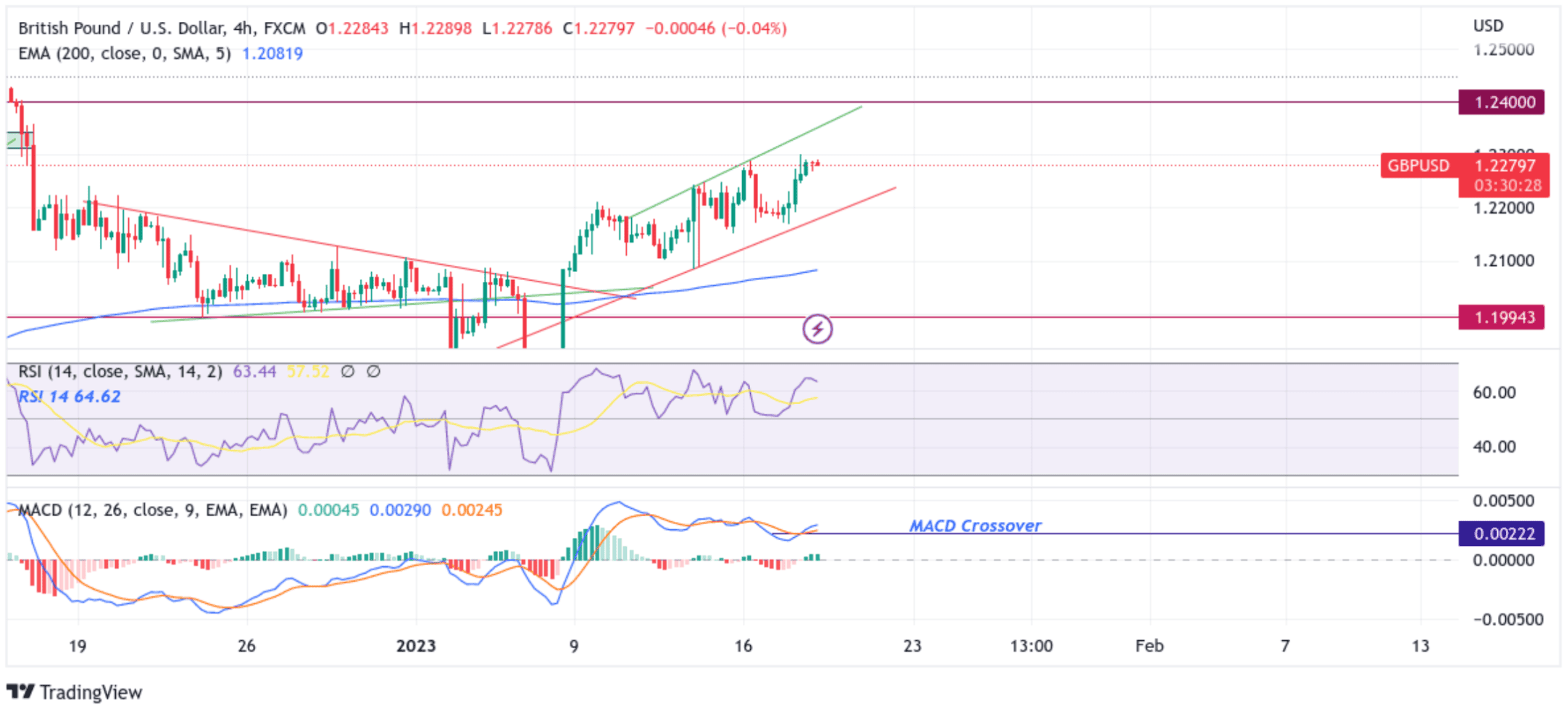

Technical Outlook: Four-Hours GBP/USD Price Chart

From a technical standstill using a four-hour price chart, the price has retreated from the vicinity of the 1.22892 level, which sits above the lower limit of the key supply zone ranging from 1.22873-1.22937 levels. If the price continues to weaken in the coming sessions, it will face stiff resistance at the 1.22476 support level. Suppose sellers manage to breach this key floor. In that case, downside momentum could pick up, paving the way for a drop toward the lower boundary channel of the ascending channel pattern extending from the early January 2023 swing low. Sustained weakness below the aforementioned key support level would pave the way for aggressive technical selling around the GBP/USD pair.

All the technical oscillators are in positive territory, with the RSI (14) at 64.62 above the signal line and treading below overbought conditions, portraying a bearish filter. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is also above the signal line, pointing to a bullish sign for price action this week. However, a subsequent move below the signal would add credence to the bearish bias.

On the flip side, if dip-buyers and tactical traders jump back in and trigger a bullish reversal, initial resistance appears at the key supply zone ranging from 1.22873-1.22937 levels. If the price pierces this barrier, buying interest could gain momentum, creating the right conditions for an advance toward the key resistance level plotted by the upper boundary channel of the ascending channel pattern extending from the early January 2023 swing high. Sustained strength above the aforementioned resistance level would pave the way for additional gains around the GBP/USD pair.