USD/JPY Steadily Climbs Back Above Late 128.00s Amid Renewed U.S. Dollar Buying, BOJ Decision Looms

- USD/JPY pair extended its corrective move-up from the vicinity of 127.235 on Tuesday amid renewed U.S. dollar buying and aims to break above the 129.00 mark

- A goodish pickup in the U.S. Treasury bond yields helped revive the U.S. Dollar demand, which in turn undermined the Yen and exerted upward pressure on the USD/JPY pair

- Markets Challenge BOJ Interest rate decision awaited

USD/JPY Cross extended its corrective move-up from the vicinity of 127.235 level and gained positive traction for the second successive day on Tuesday and, for now, seems to have snapped a two-day losing streak. The momentum lifted spot prices to near the 129.00 mark amid renewed U.S. dollar buying and looks set to maintain its offered tone heading into the European session.

A goodish pickup in the U.S. Treasury bond yields helped revive the U.S. Dollar demand, which was a key factor that offered some support to the USD/JPY pair. Apart from this concerns that the pace of Fed rate hikes would lead the U.S. economy into a recession tempered investors' appetite for perceived riskier assets. This was evident from a weaker tone around the U.S. equity markets, which drove some haven flows towards the USD/JPY pair.

The U.S. Dollar index (DXY), which measures the value of the United States Dollar relative to a basket of foreign currencies, was up 0.22% at 102.510, extending its modest rebound from the vicinity of 101.7/seven-month low after data last week showed that U.S. consumer prices fell for the first time in more than 2-1/2 years in December.

Markets Challenge BOJ

Speculation is building about a change or end to Japanese yield curve control, given that the market pushed 10-year yields above a ceiling set by the Bank of Japan (BOJ) of 0.5% on Friday and Monday and that the amount of bond buying to defend it is starting to look unsustainable. This saw the Yen hit a top of 127.22 per dollar during Asia hours on Monday before easing a little during a holiday-thinned U.S. session to sit around 128.40.

A newspaper report last week has also stoked expectations for a change, so traders are on the lookout for a sharp reaction even if the BOJ makes no move.

Commenting on the newspaper report, "The market has run pretty hard with this story and is looking for a follow up," said Tony Sycamore, an analyst at brokerage I.G. Markets.

He sees three main possibilities: no policy change, a tweak similar to a move in December to widen the 10-year yield target band, and the total abandonment of yield curve control, with the latter likely to drive the most extreme market response.

"The yen would explode higher, Japanese government bond yields would explode higher and global yields would go higher," he said.

It was worth noting last month, the Bank of Japan (BOJ) unexpectedly doubled the yield ceiling for 10-year government bonds. However, Bank of Japan Governor Haruhiko Kuroda said the move was aimed at boosting bond market functionality.

Expectations of upward revisions to the Bank's inflation forecasts, and the upcoming announcement of a new BoJ governor, are also likely to fuel expectations of a policy shift.

As we advance, focus remains on the Japanese yen due to speculation that the Bank of Japan will make further tweaks to, or entirely abandon, its yield control policy at a meeting scheduled to conclude on Wednesday. In the meantime, the US Bond Yields and the broader market risk sentiment will influence the U.S. Dollar price dynamics and allow traders to grab some trading opportunities around the USD/JPY pair.

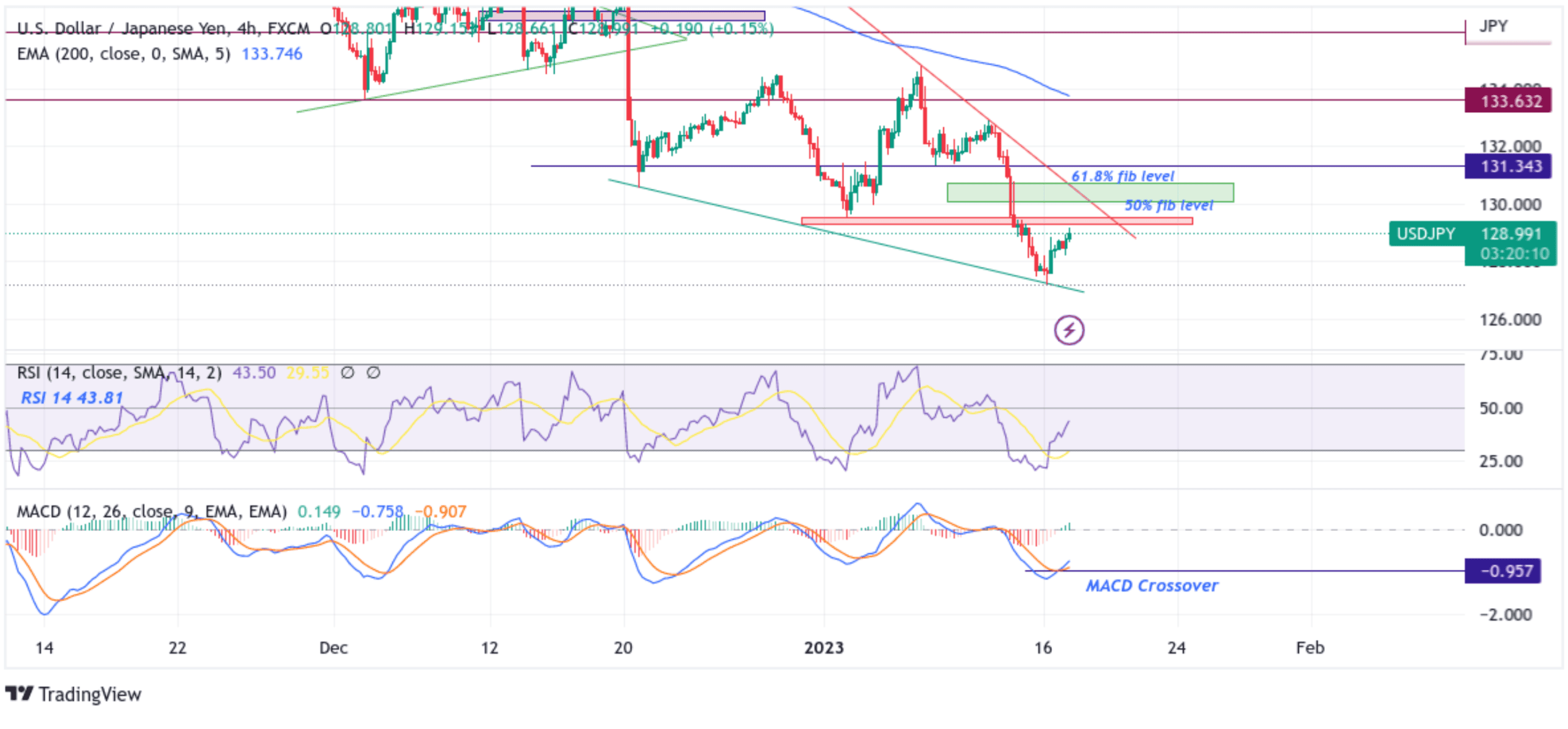

Technical Outlook: Four-Hours USD/JPY Price Chart

From a technical outlook using a four-hour price chart, the price has extended the modest rebound from the vicinity of 127.235 level after a firm rejection from a key support level plotted by a downward sloping trendline extending from late December 2022 swing low. Some follow-through buying would lift spot prices toward the immediate hurdle (supply zone ranging from 129.251 - 129.525 levels), which would act as a barrier against further uptick. However, if buyers manage to pierce this barricade, bullish momentum could accelerate towards the next relevant hurdle (50% and 61.8% Fibonacci retracement levels at 130.042 and 130.711 levels). A convincing break above the aforementioned barrier, followed by acceptance above the key resistance level plotted by a downward-sloping trendline extending from the early January 2023 swing high (bullish price breakout), would pave the way for aggressive technical buying around the USD/JPY pair.

All the technical oscillators are in negative territory, with the RSI (14) at 43.81 below the signal line; however, a subsequent move above the signal line followed by a confirmation of a move above the (supply zone ranging from 129.251 - 129.525 levels) would support the bullish narrative. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is below the signal line, pointing to a bearish sign for price action. Still, a move above the signal line would add credence to the upside bias.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, the price will find first find support at the 128.665 support level en route, the key support level plotted by a downward sloping trendline extending from late December 2022 swing low. If sellers manage to breach these floors, downside pressure could accelerate, paving the way for more losses around the USD/JPY pair.