UK Brent Crude Oil Rebounds On Strong China GDP, Settles above $86.00 Per Barrel Despite FED Jitters

- UK Brent crude oil futures rebounded on Tuesday to settle firmly above $86.00 per barrel

- China's economy grew 4.5% in the first quarter, the fastest pace in a year

- FED Jitters Set to limit further gains in U.K. Brent crude oil prices

- Oil traders look forward to the release of the U.S. crude stockpiles report for further guidance on crude oil inventories

UK Brent crude oil futures rose slightly on Tuesday during the mid-Asian session after news showed China's economy grew faster than market expectations in Q1 and the economic recovery was well on track. As per press time, UK Brent crude oil futures was up 0.11%/9 cents for the day to trade at $86.39 per barrel, while its counterpart US WTI crude oil futures was also up 0.11%/19 cents to trade at $82.63 per barrel amid subdued U.S. Dollar demand and retreating treasury bond yields.

China's economy grew more than expected in the first quarter of 2023, data showed on Tuesday, indicating that recovery was largely on track after the country relaxed most anti-COVID restrictions at the beginning of the year. China's first quarter GDP grew 4.5 annually in the first three months of 2023, more than expectations of 4% and 2022's growth of 3%. GDP grew 2.2% from the prior quarter, in line with expectations. The reading comes as the relaxing anti-COVID measures triggered a sharp rebound in business activity and spending, with pent-up demand benefiting the service industry. Several government stimulus measures also boosted the recovery as it sought to remove the economy from a pandemic driven-slump.

However, the oil market sentiment remained cautious due to the ambiguity surrounding the extent of the Federal Reserve's interest rate increase. The hawkish remarks from Fed officials and the indication of the U.S. economy's strength led to a reassessment of the anticipated break in the Fed's interest rate hike trend.

Furthermore, the crude oil markets were facing downward pressure due to the strengthening of the U.S. dollar, which has experienced a significant rebound from its lowest point in a year during recent trading sessions. On Tuesday, the dollar's value stabilized against a range of other currencies, and there was also an increase in the yields of U.S. Treasury bonds.

Fed Fund futures prices show that markets are pricing in an 84.1% chance that the Fed will hike rates by 25 basis points in May, up from 72.2% last week. Markets are also positioning for a 22.6% chance that the Fed will hike again in June, although a majority of expectations are still skewed towards a pause. Focus is now on a slew of Fed speakers in the coming days before the bank enters its pre-meeting blackout period. The Fed will announce its interest rate decision on May 3.

That said, crude oil prices had a strong momentum early this month after OPEC+ announced surprise Oil cuts to support market stability; however, concerns over slowing economic growth, especially as interest rates rose further, cut short the more significant rally. Additionally, subdued fears of an impending global recession also turned out to be another factor that weighed on the greenback and offered support to the precious black liquid. Meanwhile, U.S. crude oil and natural gas production in the seven biggest shale basins is expected to rise in May to the highest on record, data from the Energy Information Administration showed on Monday.

As we advance, oil traders look forward to releasing the U.S. crude stockpiles report, which is expected to show U.S. crude oil inventories likely fell by about 2.5 million barrels last week, according to a preliminary Reuters poll.

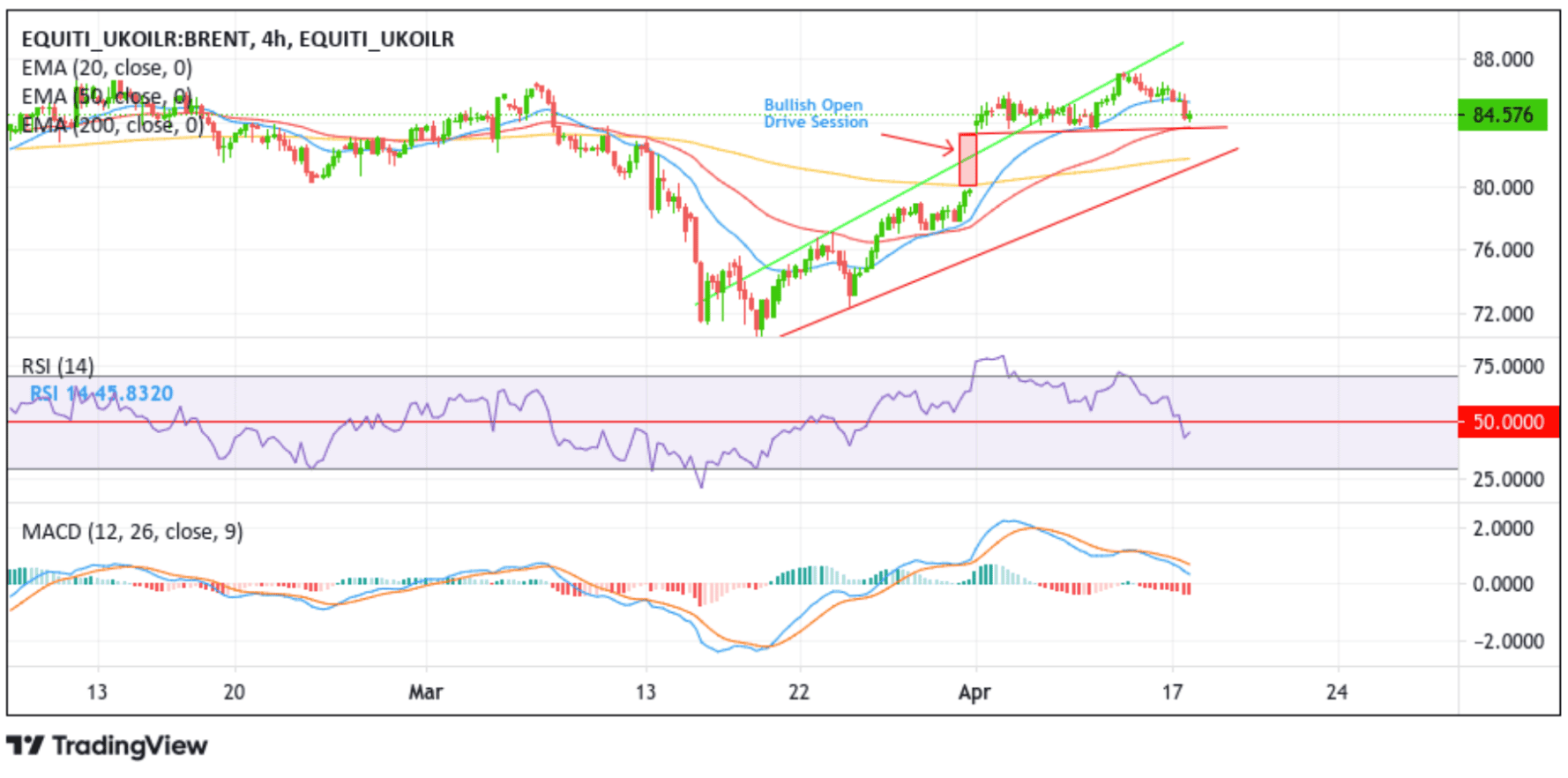

Technical Outlook: Four-Hours UK Brent Crude Oil Futures Price Chart

From a technical standpoint, UK Brent crude oil prices have been trading within a bullish channel for the better part of this month and have registered a 3.23% gain so far this month. The bullish trajectory, as seen in the chart, has been marked by a series of minor corrections and impulsive waves, with the current price action suggesting that U.K. crude oil prices have finished their corrective move before the big move up. A further increase in buying pressure beyond the current level, which sits above the 50 EMA (red) support level, would face initial resistance at the 20 EMA resistance level of $85.253. A four-hour candlestick close above this level would support the case for further gains in oil prices. The bullish uptick could be further extended toward confronting the $86.604 resistance level. A decisive flip of this resistance level into a support level would negate any near-term bearish outlook and pave the way for additional technical buying around crude oil prices.

The technical Oscillators on the chart display a mixed outlook, but traders should wait for further confirmation of an RSI (14) move above the signal line before heeding the call to "BUY" the precious black oil. The MACD crossover above the signal line plus the 50 and 200 EMA crossover (Golden cross) at the $81.10 level validates the bullish thesis.

On the flip side, if traders start taking their profits early, the black liquid could descend to tag the 50 EMA (support) level at $83.767. A breach of this support level could pave the way for a drop toward the next relevant support level at $82.029 en route to the confluence zone (50 and 200 EMA crossover). Sustained weakness below these levels could open the floodgates for more losses around the black liquid. The bearish trajectory could then be extended beyond the key support level plotted by an ascending trendline extending from the mid-March 2023 swing low towards September 2021 swing high and November 2022 swing low at the $80.87 level.