UK Brent Crude Oil Edges Higher, Snaps One-Week Losing Streak As Fed Minutes Point To More Rate Hikes

- UK Brent crude oil futures edged slightly higher during the early Asian session pausing from a one-week losing streak

- Minutes from the Federal reserve's latest policy meeting show policymaker's willingness to keep raising rates to bring down inflation

- Expectations of tighter global supplies and increasing demand from China cap the crude oil prices from a further downside move

UK Brent crude oil futures rose slightly on Thursday during the early Asian session and, for now, seems to have snapped a seven-day losing streak buoyed by concerns that more aggressive interest rate hikes by Central banks would dent economic growth and fuel demand. As per press time, Brent crude oil futures was up 56 cents/0.70% for the day to trade at $80.78 per barrel. While its counterpart, US WTI oil futures, was up 40 cents/0.54% for the day to trade at $74.27 per barrel.

The minutes from the last Federal Reserve's (FED) policy meeting showed inflationremained "well above" the Fed's 2% target, adding that the labor market is still "very tight, contributing to continuing upward pressures on wages and prices." Fed officials also noted that "inflation data received over the past three months showed a welcome reduction in the monthly pace of price increases but stressed that substantially more evidence of progress across a broader range of prices would be required to be confident that inflation was on a sustained downward path," the minutes said. "The participants favoring a 50-basis point increase noted that a larger increase would more quickly bring the target range close to the levels they believed would achieve a sufficiently restrictive stance, taking into account their views of the risks to achieving price stability in a timely way," the minutes said.

The minute's release came before a slew of stronger-than-expected U.S. employment, and consumer prices data prompted markets to the price at least three more 25 basis point rate hikes this year. Keeping a floor under prices were expectations of tighter global supplies and increasing demand from China. Market participants expect China's oil imports to hit a record high in 2023 amid rising demand for transportation fuel and as new refineries come online.

Additionally, Russia plans to cut crude oil production by 500,000 barrels per day, or about 5% of its output, in March after the West imposed price caps on Russian oil and oil products over the invasion of Ukraine. The cut, announced this month, will apply only to March output for now, Deputy Prime Minister Alexander Novak said on Tuesday, according to news agency reports. Russia is part of the OPEC+ group comprising the Organization of the Petroleum Exporting Countries (OPEC) and allies, which agreed in October to cut oil production targets by 2 million bpd until the end of 2023. Further offering support to Brent crude futures was the better-than-expected business activity surveys in Europe and Britain which pointed to a less gloomy European economic outlook than previously feared.

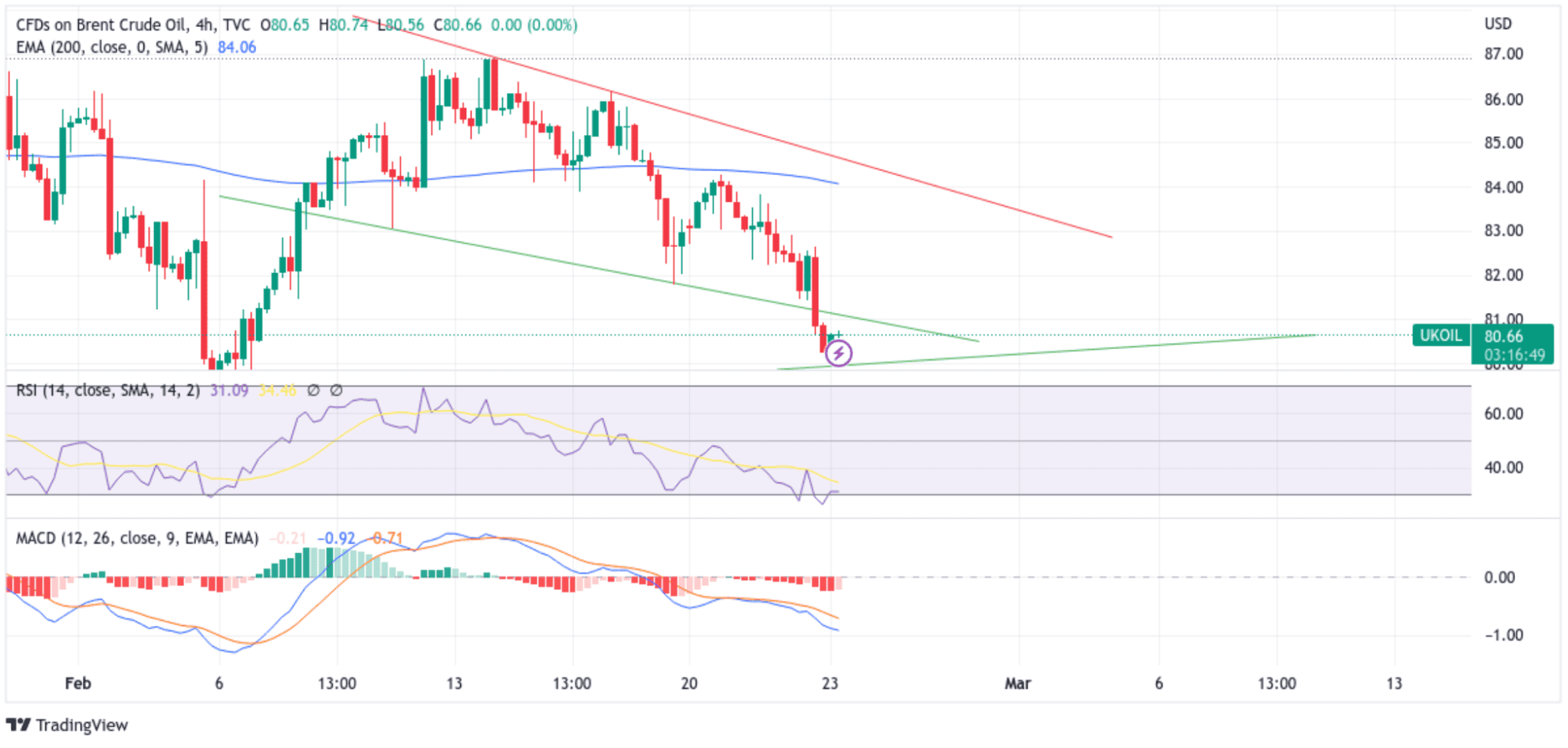

Technical Outlook: Four-Hours UK Brent Crude Futures Price Chart

From a technical perspective, the move beyond Tuesday's YTD low at around the $81.46 level confirmed a solid bearish breakout and supported prospects for additional losses. However, the price found support at the $80.27 level and inched up, targeting to overcome the barrier ahead, plotted by a downward trendline extending from the 9th February 2023 sharp rebound (lower low). Sustained strength above this level in the coming sessions would be a new trigger for bulls to continue pushing the price higher.

All the technical oscillators on the chart are deep in negative territory hence portraying a bearish bias which is supported by acceptance of the price below the technically strong 200 Exponential Moving Average (EMA) at the $84.13 level. That said, if the price fails to break above the key resistance level, the bearish filter would be fully confirmed and seen as a trigger for bears to enter the market.

On the flip side, if bears resurface and spark a bearish turnaround with waiting for rejection on the key resistance level, the price will first find support at the key support level plotted by a one-month-old ascending trendline. If sellers manage to breach this floor, downside pressure could accelerate, paving the way for a drop toward the $78.59 level. On further weakness, the focus shifts down towards the $75.67 floor.