NZD/CAD Extends Sharp Recovery Above Mid 0.84000 As RBNZ Hikes Rates To Over 14 Years High, Flags More To Come

- NZD/CAD cross witnessed some dip-buying during the early Asian session to extend the sharp rebound from the vicinity of 0.83744 level/weekly low

- The Reserve Bank of New Zealand (RBNZ) hikes interest rates to 4.75% despite the cyclone, in turn, offers support to the Kiwi

- Mixed Canadian macroeconomic data undermines the Loonie

NZD/CAD pair attracted some dip-buying from the vicinity of 0.84072 levels during the early-Asian session. The cross so far has managed to extend the sharp rebound from the vicinity of 0.83744 level/weekly low to stage an intraday recovery. At the time of speaking, the pair has managed to recover a majority of its previous losses. The shared currency looks set to maintain its bud tone heading into the European session.

Lifting the Kiwi was news that the Reserve Bank of New Zealand had raised its official cash rate by 50bps to the highest since January 2009 of 4.75% during its first meeting of the year, matching market consensus. Today's move was the 10th straight rise, bringing a 450bps hike since October 2021, the most aggressive tightening since 1999. The board said inflation was too high, at an annual rate of 7.2%, core inflation stayed elevated, employment was beyond its sustainable level, and inflation expectations remained high. The committee flagged more rate hikes, seeing the rate peak at 5.5% this year. The central bank still projected the economy would start shrinking in Q2 of 2023.

On the impact of Cyclone Gabrielle, the RBNZ said rising inflation and output disruptions are expected in the near term and that rebuilding work will increase activity in the coming years. The best contribution monetary policy can make to free up resources elsewhere by slowing demand through higher interest rates.

Further lifting the Kiwi was the softer Canada inflation data which showed inflation in Canada dropped more than expected last month. Canada's annual inflation rate fell to 5.9% in January of 2023, the least since February 2022 and below market expectations of 6.1%, slowing from the 6.3% in the previous month amid base-year effects according to data released on Tuesday by Statistics Canada. Every month, the Canadian CPI rose by 0.5%, rebounding from the 0.6% drop in the previous month and below market expectations of 0.7%. Excluding food and energy, January prices rose by 5.0 % yearly compared with a 5.4% increase in December and below market expectations of 5.5%. Monthly inflation rose by 0.3% in January from -0.3% in December and above the market expectations of 0.2%.

Commenting on the inflation report, the January inflation figures give the Bank of Canada "somewhat greater comfort in their decision to go on pause at least temporarily," said Doug Porter, chief economist at BMO Capital Markets. "A low-side inflation read will definitely prove to be a nice antidote to some of those high-side surprises," he said. It is worth noting last week on Friday, Bank of Canada Deputy Governor Paul Beaudry said its policy-setting path could diverge from central banks in other countries as long as inflation is ultimately brought down to target. In turn, this was perceived by markets as a hawkish tone, which should cap the upside of the NZD/CAD in the longer run.

In other news, Retail sales in Canada likely rose 0.7% month-over-month in January 2023, preliminary estimates showed. Considering December 2022, retail sales were up by 0.5% from a month earlier, following a revised flat reading in November and matching preliminary estimates according to a report by Statistics Canada. Year-on-year, retail sales surged 7.3% in December, the most in five months, after a 5.2% rise in the previous month. That said, rebounding oil prices as persistent concerns about global economic growth outweighed supply curbs and prompted investors to take profits on the previous day's gains was also seen as another factor that undermined the Loonie and exerted upward pressure on the NZD/CAD pair.

As we advance, investors now look forward to the Canadian docket featuring second-tier economic data (New Housing Price Index-Jan), which is higher at 0.1% from 0.0% in the previous month.

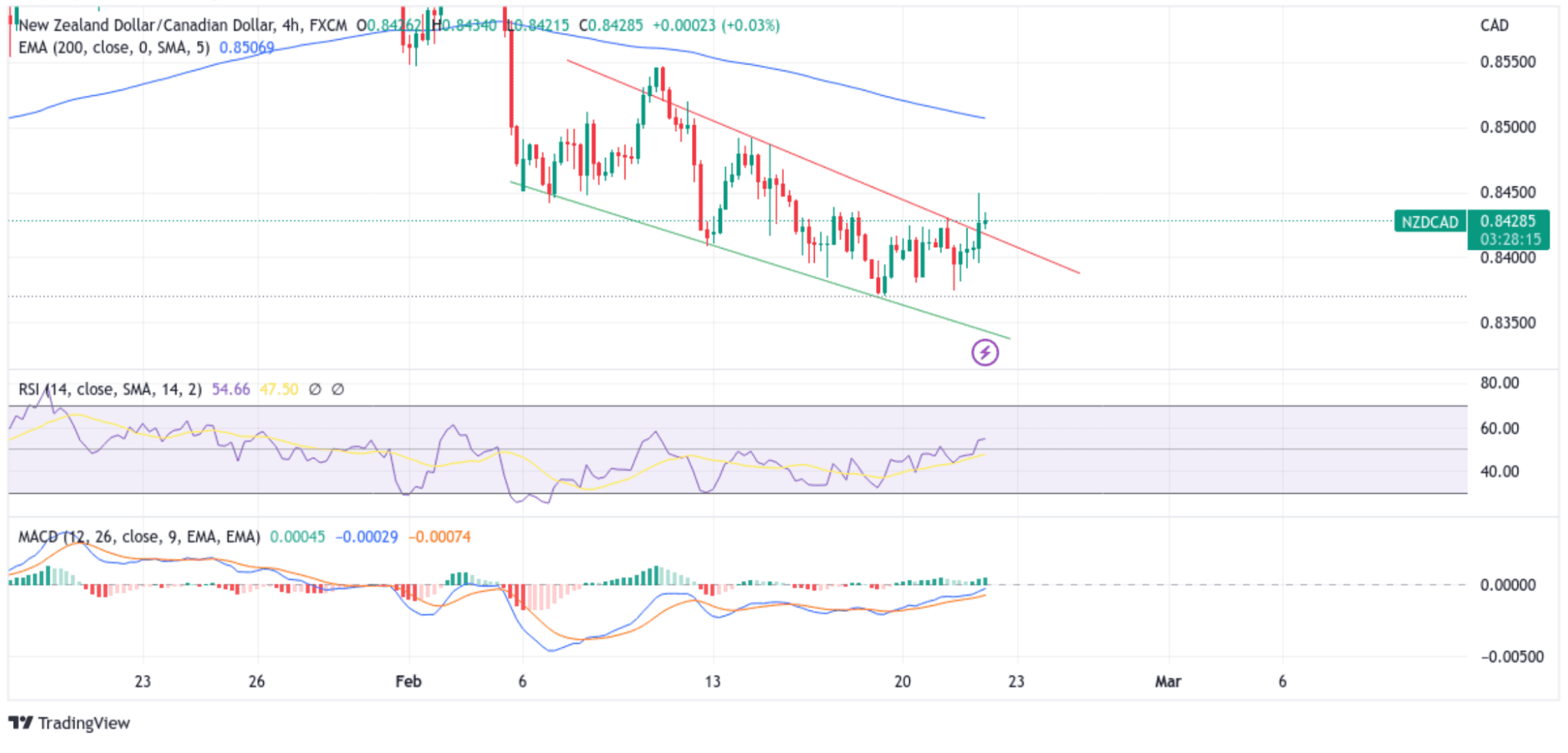

Technical Outlook: NZD/CAD Four-Hour Price Chart

From a technical standstill using a four-hour price chart, spot prices are now looking to extend the momentum beyond the downward-sloping trend line from the 14th February 2023 lower high. The move beyond the previous YTD top at around the 0.84230 mark confirmed a solid bullish breakout and supported prospects for additional gains. Some follow-through buying would lift spot prices toward the supply zone ranging from 0.84534 - 0.84633 levels. If buyers break above this zone, the focus would now turn higher toward the technically strong 200 Exponential Moving Average (EMA) at 0.85074. A convincing move above this strong level would negate any near-term bearish outlook and pave the way for aggressive technical buying around the NZD/CAD pair.

The RSI (14) on the chart is at the 54.66 level (above the signal line) and points to signs of a continuation of the bullish price action. The Moving Average Convergence Divergence (MACD) crossover is on the verge of moving above the signal, which, if it happens in the coming session, would add credence to the bullish filter. Overall a convincing move above the 200 EMA at 0.85074 level would validate the bullish bias.

On the flip side, if dip-sellers and technical traders jump in and trigger a bearish turnaround, the price will first find support at the downward-sloping trendline now turned support level. If sellers pierce this floor (bearish price breakout), it will pave the way for a drop toward the 0.83588 key support level. Sustained weakness below this level would expose spot prices to more losses. The downward trajectory could then accelerate toward retesting the key support level plotted by a downward-sloping trendline extending from the 6th February 2023 lower low. If sellers break below this level, the NZD/CAD will be exposed to further losses.