EUR/USD Takes A Breather, And Further Upstick Seems Elusive Amid Further Aggressive Fed Rate Hike Bets

- EUR/USD attracts some dip buying from the vicinity of the 0.98811 level to start a new month on the right foot

- A 75 Bps interest rate hike by the FED is fully expected

- Eurozone Inflation Surges higher amid GDP painting Bleak picture

- The Latest US GDP showed the US economy expanded in the third Quarter of 2022

EUR/USD pair came under renewed buying pressure on Tuesday after attracting bullish bets during the early hours of the Asian session to lift off spot prices from the vicinity of the 0.98811 level. At the time of speaking, the pair is up over 5 pips for the day and looks set to maintain its offered tone heading to the European session.

A fresh leg down in the US Treasury Bond yields and a weaker risk tone undermined the safe-haven greenback. Additionally, investors' decision to wait on the sideline ahead of Wednesday's Fed Interest Rate decision was evident and was also seen as a key factor that undermined the greenback. Apart from this, a generally upbeat tone around the equity markets further undermined the safe-haven greenback and helped limit deeper losses for the EUR/USD pair, at least for the time being. That said, Many market observers expect the central bank to continue its pattern of 75 basis point interest rate hikes in its Monetary Policy meeting tomorrow. "A 75-basis point rate hike on Wednesday should be fully expected, as the unemployment rate is still at a 50-year low and there is nothing to suggest that (Jerome) Powell will soften his stance on fighting inflation," said Danielle DiMartino Booth, chief strategist at Quill Intelligence. "The stock market surge since the last Fed meeting in mid-September only strengthens Powell's case for continuing to tighten financial conditions."

But many will watch from the statement and question-and-answer segment with Powell, the chair, to see how hawkish the language is around inflation. Some are expecting future meetings to bring lower interest rate hikes.

On the Euro front, The Euro has weakened against the buck recently as traders reassessed the latest economic data coming from Europe of downbeat GDP and peak inflation in the eurozone area in the wake of last week's jumbo rate hike by the ECB. According to data released on Monday by Eurostat The Euro Area economy expanded 0.2% on quarter in the three months to September of 2022, following a 0.7% growth in Q2, in line with market expectations, flash estimates showed. It was the weakest GDP growth since the rebound from Covid-19 restrictions in Q2 2021, and indicators are pointing to a shift from expansion to a contraction in Q4, as the inflation rate continues to break records with the energy prices remaining elevated and the ECB raising interest rates sharply.

Following Monday's sharp slowdown in eurozone GDP, Moody's Analytics reiterated its projection for a contraction in the fourth quarter. "Net trade, by contrast, will likely detract from GDP. Even with the better third-quarter data, the outlook for the final quarter of the year is little changed. Intense stress on both supply and demand channels will cause a contraction in fourth quarter GDP." Ross Cioffi, an economist at Moody's Analytics. That said, the Annual inflation rate in the Euro Area continued to break record-high levels and jumped to 10.7% in October of 2022 from 9.9% in September. Figures came higher than market forecasts of 10.2%, preliminary estimates released on Monday by Eurostat. Prices of energy continue to have the biggest impact (up 41.9% vs 40.7% in September), followed by food, alcohol & tobacco (13.1% vs 11.8%), non-energy industrial goods (6% vs 5.5%) and services (4.4% vs 4.3%). The reading indicates that the European Central Bank will need to continue with aggressive interest rate hikes, having already raised rates by 200 basis points over the last three months, and will further cement market expectations for a recession.

Further weighing down on the Euro was the downbeat Euro Area Services Sentiment news released by the European Commission last week. The services confidence indicator in the Euro Area was down for a fourth straight month to 1.8 in October 2022, the weakest level since April 2021 and below market expectations of 3.2, due to a marked deterioration of all three components: views on the past business situation; one-time demand; and demand expectations. That said, the latest US GDP data released by the Bureau of Economic Analysis showed the US Economy expanded in the third quarter of 2022. The real GDP increased at an annual rate of 2.6 percent against market expectations of 2.4% growth, and it was up from 0.6 percent in the second quarter.

The increase in real GDP reflected increases in exports, consumer spending, nonresidential fixed investment, federal government spending, and state and local government spending, which were partly offset by decreases in residential fixed investment and private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased. In turn, this was seen as another factor that offered some support to the greenback amid expectations of further rate hikes by the Fed. As we advance, investors will look for cues from the US docket featuring the release of the JOLTS Job Openings report for September and the ISM manufacturing PMI report for October. That said, the primary focus shifts toward tomorrow's Fed Interest Decision in which the FED is expected to hike interest rates by 75bps and take its Fed Funds Rate to 3.25% from 2.50%.

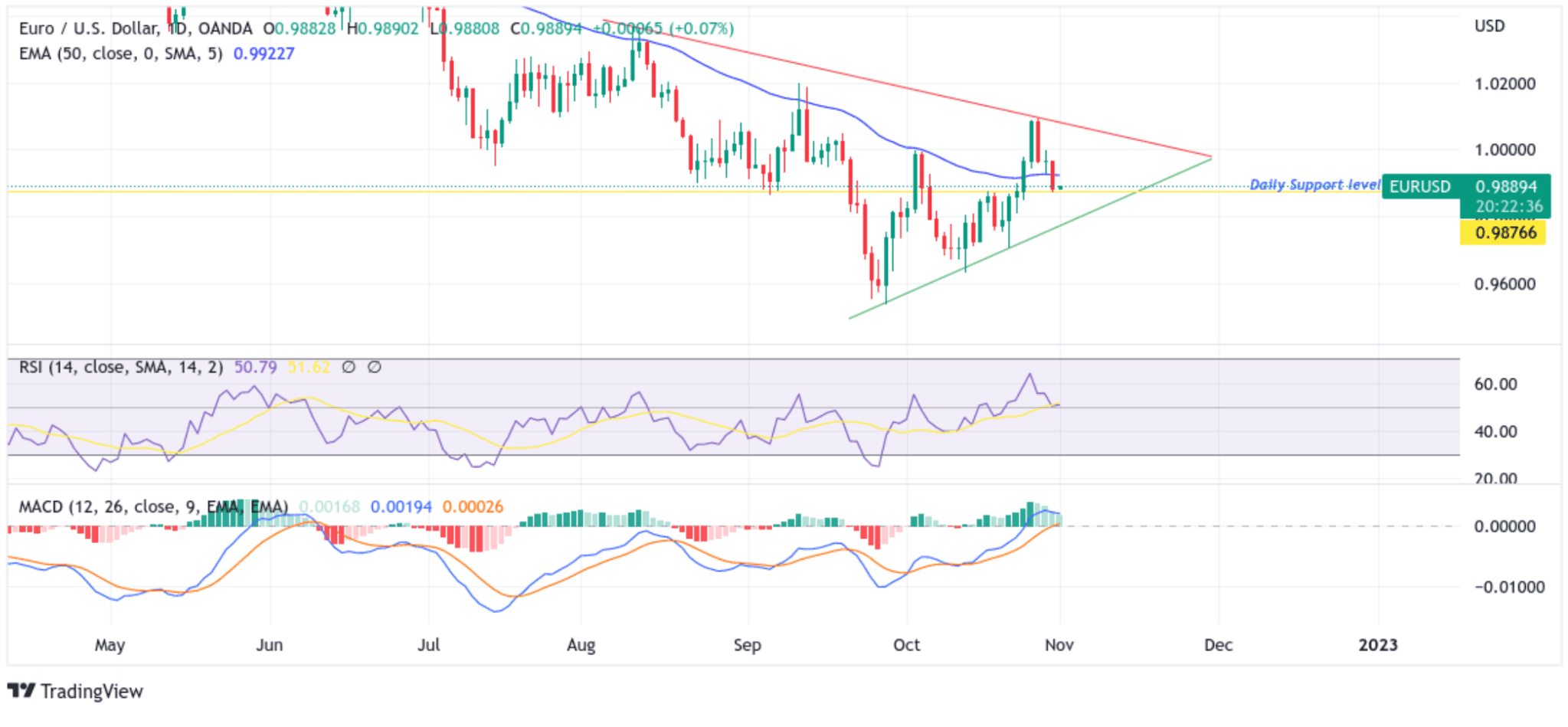

Technical Outlook: Four-Hour EUR/USD Price Chart

From a technical standstill using a one-day price chart, the price has extended a modest rebound from the vicinity of the 0.98727 support level. Some follow-through buying would lift spot prices toward the upper trendline of the bearish pennant chart pattern but would face resistance from the 50 Exponential Moving Average(EMA) at the 0.99239 level. That said, acceptance above the aforementioned EMA level would pave the way for additional gains and uplift the EUR/USD pair toward the upper trendline plotted from the August 2022 swing high. If Buyers break above this ceiling, it would negate the bullish outlook and pave the way for technical buying around the EUR/USD Pair.

The RSI(14) level at 50.79 is flat-lined after trending downwards late last week. The moving average convergence divergence (MACD) crossover at -0.00628 paints a bullish filter above the signal line, pointing to a bullish sign for price action this week.

On the flip side, any meaningful pullback now finds some support at the 0.98727 level, which, if broken decisively, would pave the way for some selling around the EUR/USD pair. The downward trajectory could then accelerate toward testing the lower trendline of the bearish pennant chart pattern plotted from the September 2022 swing low. That said, weakness beyond the aforementioned support level would negate any near-term bullish outlook and pave the way for aggressive technical Selling.