EUR/USD Weakens Further Below 1.000 Psychological Level Amid Large FED Hikes

- EUR/USD pair attracts fresh selling on Thursday to decline further below the 1.0000 Psychological Level

- Elevated US treasury bond yields uplift US Dollar Index hence exerting downward pressure on the pair

- The Federal Reserve raised its benchmark interest rates by another three-quarter of a percentage point and indicated it would keep hiking well above the current level.

- Russian President Vladimir makes a thinly-veiled threat to use the country's nuclear arsenal to defend his conquests in Ukraine

- Deutsche Bank strategists dramatically slash their 2023 economic growth forecasts

EUR/USD cross attracted fresh selling on Thursday to extend the modest pullback from the vicinity of the 1.00507 level and dragged spot prices to over a two-week low/20-year low amid the risk-averse. The pair is now trading at the 0.98300 level, just below the 1.0000 psychological level and posting a 0.17% daily loss. EUR/USD stays in the negative territory amid a stronger US Dollar across the board, as the risk-off market mood underpinned the safe-haven greenback and acted as a headwind for the EUR/USD pair.

Elevated US treasury bond yields bolstered by the recent FED rate hike turned out to be a key factor that weighed on the EUR/USD pair. As such, the yield on the 2-year Treasury note topped 4.1% after the Federal Reserve raised interest rates by another 0.75 percentage points and surged to its highest level since 2007. While, the yield on the benchmark 10-year Treasury rose to a high of 3.64%, its highest level since February 2011.

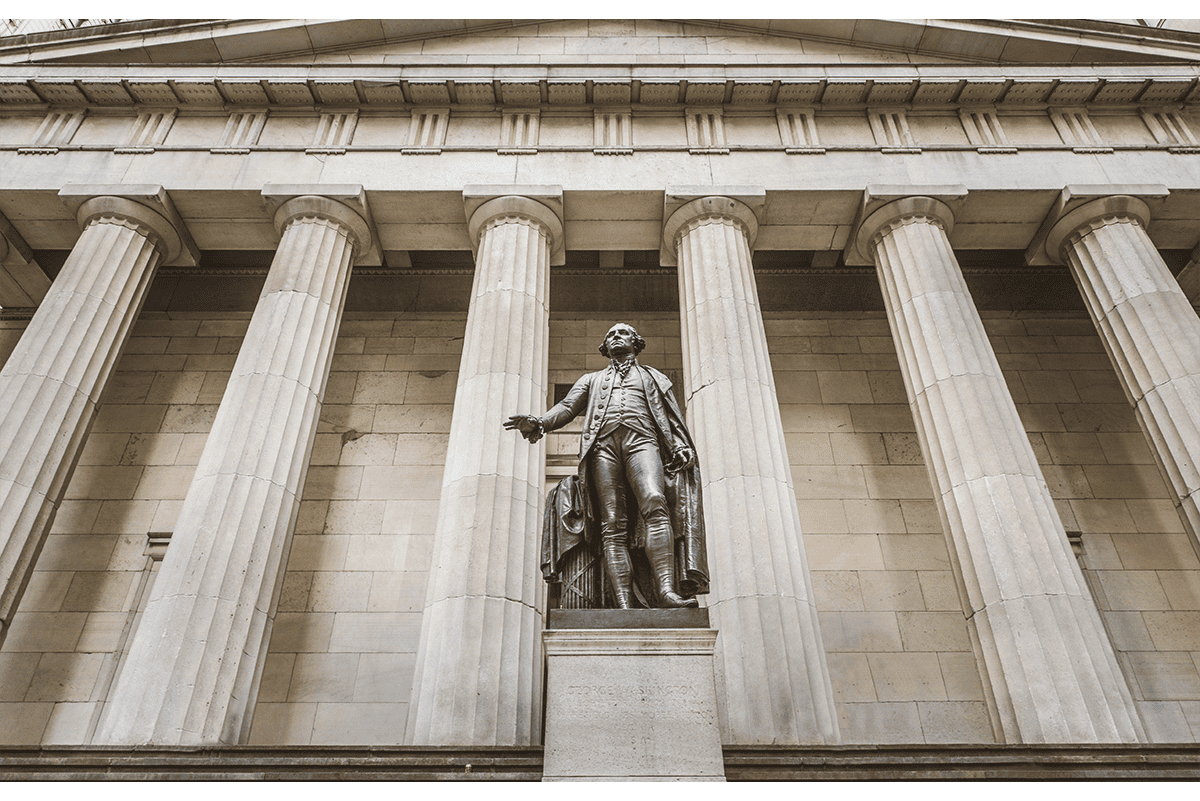

The US Dollar index(DXY), which measures the value of the United States dollar relative to a basket of foreign currencies, surged to a fresh two-decade high on Wednesday after the Federal Reserve raised interest rates by another 75 basis points and signalled more large increases at its upcoming meetings. The Federal Reserve on Wednesday raised benchmark interest rates by another three-quarter of a percentage point and indicated it would keep hiking well above the current level. In its quest to bring down inflation, running near its highest levels since the early 1980s, the central bank took its federal funds rate up to a range of 3%-3.25%, the highest it has been since early 2008, following the third consecutive 0.75 percentage point move.

"My main message has not changed since Jackson Hole," Powell said in his post-meeting news conference, referring to his policy speech at the Fed's annual symposium in August in Wyoming. "The FOMC is strongly resolved to bring inflation down to 2%, and we will keep at it until the job is done." Fed officials signalled to continue to hike with the massive rate increases until the funds level hits a "terminal rate," or endpoint, of 4.6% in 2023. That implies a quarter-point rate hike next year but no decreases. In their quarterly updates of estimates for rates and economic data, officials united around expectations for the unemployment rate to rise to 4.4% by next year from its current 3.7%. Increases of that magnitude often are accompanied by recessions.

They also see GDP growth slowing to 0.2% for 2022, rising slightly in the following years to a longer-term rate of just 1.8%. The revised forecast is a sharp cut from the 1.7% estimate in June and comes following two consecutive quarters of negative growth, a commonly accepted definition of recession. Powell conceded a recession is possible, particularly if the Fed continues to keep tightening aggressively. "No one knows whether this process will lead to a recession or, if so, how significant that recession will be," he said. The hikes also come with the hopes that headline inflation will drift down to 5.4% this year, as measured by the Fed's preferred personal consumption expenditures price index, which showed inflation at 6.3% in July. The summary of economic projections then sees inflation falling back to the Fed's 2% goal by 2025.

The reduction in economic growth came even though the FOMC's statement massaged language that in July had described spending and production as having "softened." This meeting's statement noted: "Recent indicators point to modest growth in spending and production." Those were the only changes in information that received unanimous approval.

Markets have been bracing for a more aggressive Fed.

"I believe 75 is the new 25 until something breaks, and nothing has broken yet," said Bill Zox, portfolio manager at Brandywine Global, about the size of the rate hikes. "The Fed is not anywhere close to a pause or a pivot. They are laser-focused on breaking inflation. The key question is, what else might they break."

According to CME Group data, traders had fully priced in the 0.75 percentage point move and even had an 18% chance of a full percentage point hike. Futures contracts just before Wednesday's meeting implied a 4.545% funds rate by April 2023. Along with the rate increases, the Fed has been reducing the number of bond holdings it has accumulated over the years. As it is known in markets, September marked the beginning of full-speed "quantitative tightening," with up to $95 billion a month in proceeds from maturing bonds being allowed to roll off the Fed's $8.9 trillion balance sheet.

On the European docket, Russian President Vladimir Putin declared a partial mobilization of the country's 2-million-strong military reserve and confirmed his intention to annex those parts of Ukraine currently under Russian occupation. The move marks a massive shift for the Kremlin that risks antagonizing a large part of the Russian population and alienating what remains of his international support. Putin's invasion of Ukraine seven months ago has failed to achieve any of its strategic objectives. In recent weeks, it has sustained increasingly heavy losses of men and equipment as Ukrainian forces have recaptured significant territory in the country's east.

In a recorded video address, Putin threatened to use the country's nuclear arsenal to defend his conquests in Ukraine while accusing the West of practising "nuclear blackmail" against it. "If Russia's territorial integrity is threatened, we will use all means at its disposal. This is not a bluff," Putin said. European currencies bore the brunt of selling in foreign exchange markets as Putin's comments exacerbated concern about the economic outlook for a region already struck by Russia's squeeze on gas supplies to Europe. Deutsche Bank strategists have abandoned hopes for a "mild recession" in Europe this winter and have dramatically slashed their 2023 growth forecasts.

The bank now expects EU-area growth to decline 2.2% in 2023, from a previous forecast for a 0.3% decline. The economists noted that such a peak-to-trough decline would be 50% bigger than that of the euro crisis, though only half as big as the one seen during the 2007-09 recession. That downgrade comes after the indefinite closure of the Nord Stream 1 pipeline for Russian gas into Europe, which was announced in early September. The cutoff has added "further potential upside to inflation and downside to growth," said a team led by Peter Sidorov, senior economist, on Wednesday.

The Deutsche Bank economists said they are sticking to expectations for the European Central Bank deposit rate to top out at 2.5%, but that call comes with two-sided risks. "If the recession drags jobs and inflation expectations more than expected, ECB hiking could be stopped at c.2%. We see the balance of risks skewed to the upside of 2.5% given our concerns about inflation persistence — underlying inflation and second-round effects," said Sidorov and the team. The combination of negative factors undermined the Euro and exerted downward pressure on the pair.

As we advance, in the absence of any major market-moving economic news releases from both dockets, the FEDS monetary policy, US bond yields, and broader market risk sentiment will influence the US dollar and allow traders to grab some trading opportunities around the pair.

Technical Outlook: One-day EUR/USD Price Chart

From a technical perspective, using a one-day price chart, the price has extended the modest rebound from the vicinity of the 1.00507 level. Some follow-through selling would drag spot prices toward the lower boundary channel of the multi-week-old descending channel pattern plotted from the May 2022 swing low. The aforementioned support level, if broken decisively, would be seen as a fresh trigger for bears to continue pushing down the price and pave the way for additional losses.

All the technical indicators point to a strong downward trajectory. That said, The RSI(14) level at 35.2744 level is in bearish territory and not far away from flashing oversold conditions. On the other hand, the Moving average convergence divergence(MACD) crossover at -0.0041 adds to the bearish filter. Additionally, The 20 and 50 Exponential Moving Average(EMA) crossover at the 1.20913 level adds credence to the downside move.

On the flip side, if buyers resurface and spark a bullish turnaround, initial resistance comes in at 0.99132- 0.99637 levels. On further strength, the focus shifts higher toward the 20 Exponential Moving Average(EMA) at the 0.99889 level. The upside trajectory could then accelerate toward testing the upper boundary channel of the multi-week-old descending channel pattern.