EUR/USD Eyes Further Upside Move Above Key FIB Level As U.S. CPI Data Looms

- EUR/USD gains positive traction on Tuesday to extend modest pullback from key fib level

- A fresh leg down in Us Treasury bond yields undermined the safe-havens greenback exerting upward pressure on the pair

- guidance for further aggressive monetary tightening pushed the Euro higher against the dollar

- Euro gets boosted by the news of substantial territorial gains made by Ukrainian troops over the weekend

EUR/USD pair witnessed renewed buying pressure after attracting fresh bullish bets in the last hour. The early Asian session to extend the modest retracement from the 1.01133 level or the 50% Fib level touched overnight on Monday. The pair now looks to build upon its offered tone heading into the European session.

A fresh leg down in the U.S. Treasury Bond yields and a weaker risk tone undermined the safe-haven greenback. As such, the yield on the 2-year Treasury dipped less than one basis point to 3.563%. Apart from this, signs of stability in the U.S. equity markets capped the safe-haven greenback and helped limit the downside for the major. The U.S. Dollar index(DXY), which measures the value of USD against a basket of currencies, weakened in early European trade on Monday and traded 0.8% lower to 107.912, falling back from the 20-year high of 110.79 seen last week.

On the other hand, the Euro jumped to a three-week high as traders reassessed the European Central Bank's interest rate trajectory in the wake of last week's jumbo rate hike. The European Central Bank raised its key deposit rate to 0.75% from zero last week, its largest ever hike, and President Christine Lagarde guided for another two or three hikes to bring inflation at record levels back to the bank's targeted 2%. This guidance for further aggressive monetary tightening has pushed the Euro higher against the dollar, with EUR/USD edging up 1.2% to 1.0154, close to its highest level in three weeks. "Thursday's step was a clear sign, and if the inflation picture stays the same, further clear steps must follow," Bundesbank President Joachim Nagel said in a radio interview on Sunday.

The ECB officials see a rising risk that they will have to raise their key interest rate to 2% or more, at least 125 basis points of hiking, to curb record-high inflation in the Eurozone despite a likely recession, Reuters reported Monday. The single currency was also boosted by the news of substantial territorial gains made by Ukrainian troops over the weekend, raising the potential, however remote, of an early end to Russia's invasion of Ukraine.

Ukraine has retaken more than 3,000 sq km (1,160 sq miles) this month. Ukrainian chief commander General Valeriy Zaluzhnyi said on Sunday that most of this ground was being taken thanks to a rapid weekend offensive that forced Russia to abandon its main logistics hub in the Kharkiv region.

That said, the European stock market cheered the positive news. It closed the day in healthy gains even after disappointing U.K. growth data illustrated the economic difficulties the region is currently suffering. U.K. gross domestic product grew by 0.2% in July from June, according to U.K.'s Office of National Statistics, below the growth of 0.3% expected. In the three months to July, GDP was flat compared to the previous three months.

On the American Docket, The New York Fed's Survey of Consumer Expectations showed that in August, Americans expected inflation to be 5.7% one year ahead. That is down from 6.2% in July and the lowest reading since October 2021.

The Federal Reserve meets next week and is widely expected to hike interest rates by a substantial amount once more. Appraisals of other jumbo lifts have questioned if price pressures continue to ease.

It's worth noting that comments from U.S. Treasury Secretary Janet Yellen and some of the prominent Fed policymakers could also be linked to the EUR/USD pair's latest struggle to keep sellers on the board. Fed Governor Christopher Waller said on Friday that he supports "a significant increase at our next meeting," and St. Louis Fed President James Bullard called for another hike of 75 basis points, which would be the third increase of this size in a row.

As we advance, Investors will look for cues from the release of the European ZEW Economic sentiment, which is expected to show some slight optimism among institutional investors in the European sector. The main focus shifts toward the release of the Consumer Price index report(CPI) later today at 8:30 E.T. (12:30 GMT), and it is expected to show inflation eased to an annual rate of 8.1%. In August, from the prior month's reading of 8.5, The report would influence the near-term USD price dynamics. This, in turn, should assist traders in determining the next leg of a directional move for the EUR/USD pair.

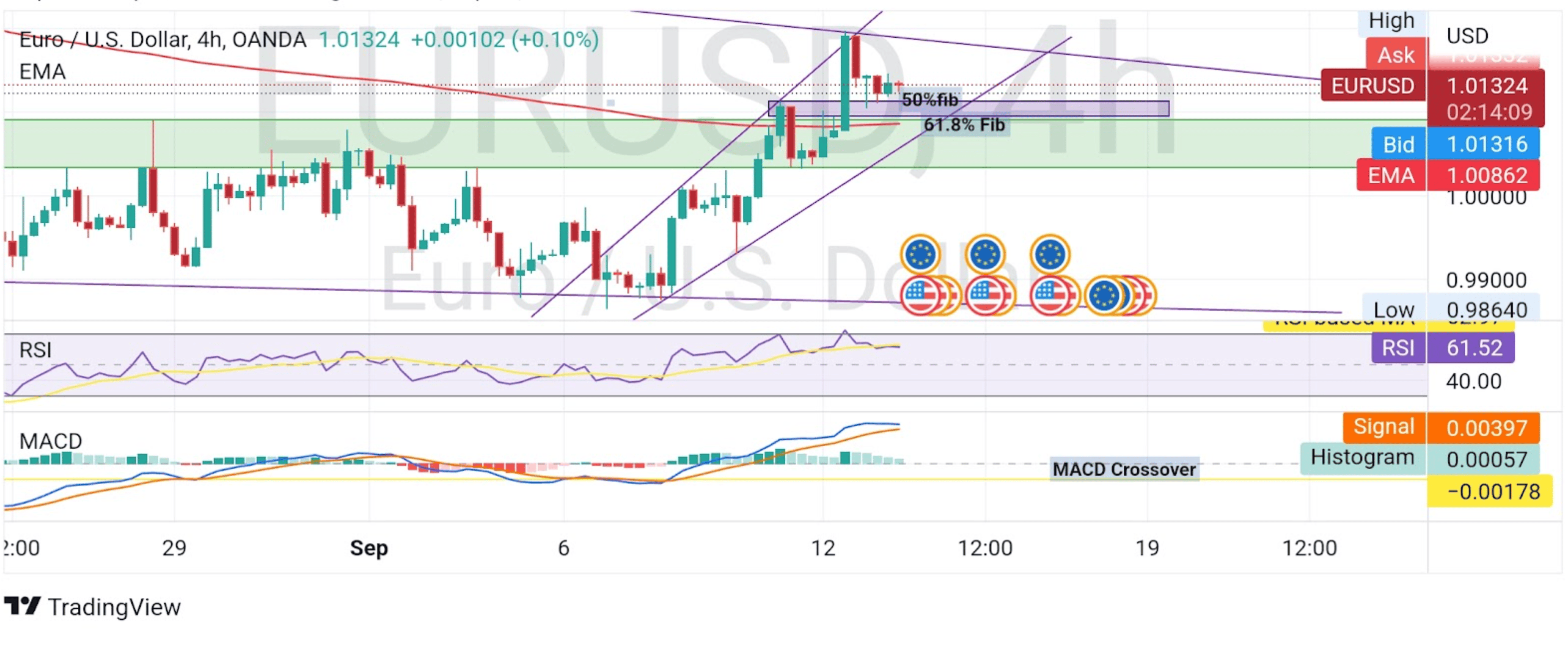

Technical Outlook: Four-Hour EUR/USD Price Chart

From a technical standstill using a four-hour price chart, the price has extended the modest pullback from the 50% fib retracement level at 1.01133. Some follow-through buying would lift spot prices towards the upper trendline of the falling wedge chart pattern plotted from the June 2022 swing high. That said, a clean break above the aforementioned resistance level would be seen as a new trigger for bulls to continue pushing the price up and pave the way for more gains.

The moving average convergence divergence (MACD) crossover at -0.00178 paints a bullish filter. The RSI(14) level at 61.52 favours a downward trend after flashing overbought conditions during the last trading session. On the other hand, the 20 and 50 Exponential Moving Average(EMA) crossover(Golden cross) at the 0.99762 level further adds to the upside bias.

On the flip side, any meaningful pullback now seems to find some support at the 1.00949 level or the 61.8% Fibonacci retracement level. This is followed by the key demand zone ranging from 1.00338 - 1.00911 levels, which, if broken decisively, will negate the positive outlook and prompt aggressive technical selling. The downward trajectory could then accelerate toward testing the lower trendline of the falling wedge chart pattern turned support level.