AUD/USD Seeks To Extend Weekly Gains After Minor Correction, U.S Inflation Data Awaited

- AUD/USD cross seeks to extend weekly gains though further uptick seems elusive

- Holidays in China and South Korea make up for slow trading on Monday

- Hopes of overcoming inflation fears jostle with receding hawkish expectations from RBA to restrict further upside moves

- Tuesday's U.S. Consumer Inflation Data report to determine the FEDs probable rate hike path

AUD/USD cross attracted some deep buying from the vicinity of 0.68238 level to lift spot prices to a new daily high during the early Asian session. At the time of speaking, the pair is up over 18 pips for the day and looks to maintain its bid tone heading onto the European session though further uptick seems elusive.

A fresh leg up in the U.S. Treasury Bond yields, along with a softer risk tone, offered some support to the safe-haven greenback. Apart from this, the underlying bullish solid sentiment surrounding the U.S. Dollar kept the U.S. Dollar bulls on the defensive and acted as a headwind for AUD/USD pair.

The U.S. Dollar index(DXY), which measures the value of USD against a basket of currencies, hit a five-week high and posted its biggest weekly gain since April 2020 on Wednesday. Still, for now, the Dollar has run into some profit taking from a market that is very long of the currency after a month of sustained gains.

Investors remain worried about a slowing economy and the Fed's next moves on rate hikes, as policymakers imply further aggressive moves will likely be needed to temper rising costs. Still, recent Fed data has shown that while inflation is still climbing, the pace of its rise is slowing.

Holidays in China and South Korea made for slow trading on Monday. At the same time, traders were unsure about what implications Ukraine's surprising success against Russian forces might have.

Challenging the upside momentum is the latest news from Reuters suggesting that U.S. President Joe Biden is to hit China with broader curbs on U.S. chip and tool exports. On the same line could be the analysis suggesting a 20-year low oil demand from China due to covid curbs, shared by Reuters.

It's worth noting that comments from U.S. Treasury Secretary Janet Yellen and some of the prominent Fed policymakers could also be linked to the AUD/USD pair's latest struggle to keep buyers on the board. That said, U.S. Treasury Secretary Janet Yellen mentioned that, during the CNN interview on Sunday, "Fed is going to need skill and luck to bring inflation down while maintaining labor market strength." The policymaker also mentioned that U.S. consumers could experience a spike in gas prices in winter when the European Union significantly cuts back on buying Russian oil.

Elsewhere, Federal Reserve Governor Christopher Waller was the prominent one as he said on Friday that he supports another significant hike in two weeks. On the same line was Kansas City Fed President Esther George, who said, as reported by Reuters, "Case for continuing to remove policy accommodation is clear cut." Furthermore, FED Vice-chairman Lael Brainard said on Wednesday that interest rates would need to rise further this year but didn't elaborate on the size of the likely increase at the central bank's next policy meeting on September 20th-21st.

It should also be noted that a divergence between Fed Chairman Jerome Powell's hawkish tone and Reserve Bank of Australia (RBA) Governor Philip Lowe's hesitance in suggesting aggressive rate hikes is also seen as another factor challenging the AUD/USD buyers. USD Bears now are hoping Tuesday's reading on U.S. consumer prices will hint at a peak for inflation as falling petrol prices are seen pulling down the headline index by 0.1%. The core is forecast to rise 0.3%, though some analysts see a chance of a softer report.

"Arguably, with the economy having contracted through the first half, and household discretionary spending capacity under significant pressure, we are due a modest downside surprise," said economists at Westpac. "As such, we forecast +0.2% for core and -0.2% for the headline," they added. "If achieved, it should not be assumed that October and beyond will see repeats, with volatility likely to persist." A soft number might revive speculation the Federal Reserve will only hike by 50 basis points this month. However, it would likely be fragile to have a real impact, given how recent, stridently hawkish policymakers have been.

As we advance, Given the light calendar and China's holiday, AUD/USD traders may witness a lackluster day ahead. However, Tuesday's U.S. Consumer Price Index (CPI) and Thursday's Australia jobs report are the key catalysts for the pair traders to watch for clear directions.

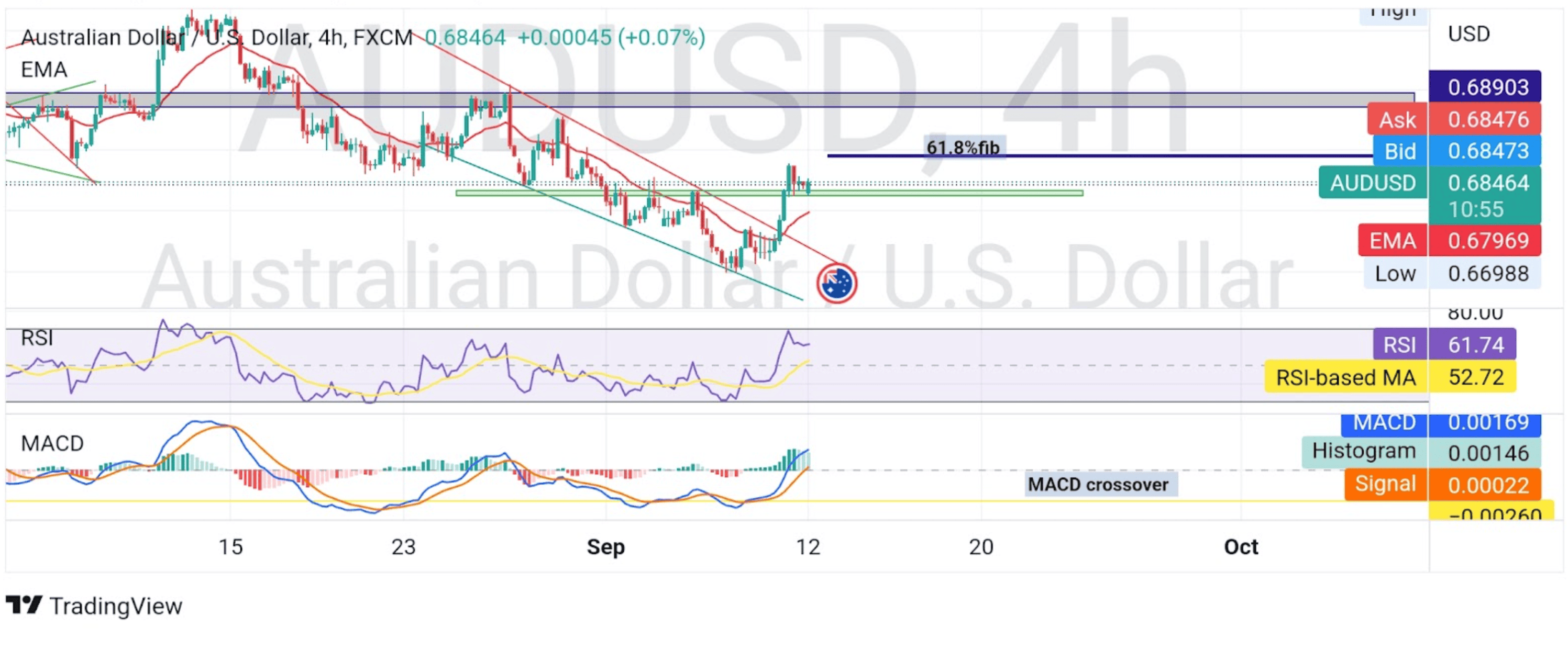

Technical Outlook: Four-hour AUD/USD Price Chart

From a technical perspective, spot prices rebounded modestly from the vicinity of 0.68238 level after finding support from key demand zone ranging from 0.68238-0.68322 levels. Friday's strong move beyond the 0.67616 mark confirmed a solid bullish breakout and supported prospects for additional gains. The bullish momentum, however, faces stiff resistance from the immediate hurdle (61.8% Fibonacci retracement level) at the 0.68903 level. That said, a clean break above the hurdle would be a new trigger for bulls to continue pushing the price up and pave the way for additional gains.

The RSI(14) level at 61.74 favours a downward trend after flashing overbought conditions during the last trading session. On the other hand, The moving average convergence divergence (MACD) crossover at -0.00260 paints a bullish filter. Additionally, The 20 Exponential Moving Average(EMA) pointing upwards further adds to the upside bias.

On the Flipside, a pullback toward retesting the Demand zone ranging from 0.68238-0.68322 levels followed by a strong break below the aforementioned zone would negate any near-term bullish outlook and pave the way for technical selling.