EUR/USD Seems Vulnerable Amid Downbeat Jobs Expectations

- A combination of factors drags EUR/USD pair lower on the first day of the week

- Large rate hike bets by the FED uplift ten-treasury bond yields

- U.S. economy added 528,000 jobs in July against a dow jones estimate

- The prevalent cautious mood is turning out to be a key factor acting as a headwind for the risk-sensitive euro

EUR/USD pair attracted fresh selling on Monday to extend Friday's sharp rebound from the vicinity of the 1.01940 level and dragged the spot price to a new daily low, around the 1.01740 region in the last hour. The Pair looks set to build on its offered tone heading to the European session.

Elevated Treasury bond yields boosted by large rate hike bets by the FED turned out to be a key factor that weighed on the EUR/USD pair and offered some support to the greenback. The latest US Jobs report released last week on Friday showed that the U.S. economy added 528,000 jobs in July against a dow jones estimate of 258,000 jobs and the unemployment rate was 3.5%, down from 3.6%. The unemployment rate is now back to its pre-pandemic level and tied for the lowest since 1969, though the rate for Blacks rose 0.2 percentage points to 6%. Wage growth also surged, as average hourly earnings jumped 0.5% for the month and 5.2% from a year ago, higher than estimates. The hotter expected Payroll data for July add fuel to an inflation picture that already has consumer prices rising at their fastest rate since the early 1980s. More broadly, the report showed the labour market remains strong despite other signs of economic weakness. The strong job number and the higher-than-expected wage numbers led to a shift in expectations for September's expected rate increase. Traders are now pricing a higher likelihood of a 0.75 percentage point hike for the next meeting, which would be the third straight increase of that magnitude.

Additionally, the ongoing Geopolitical tension between the U.S. and China resulted from U.S. House of Representatives Speaker Nancy Pelosi's Wednesday visit to Taiwan last week against China's firm opposition. This was also seen as another factor that supported the greenback. Despite heavy condemnation and threats by top Chinese officials on Pelosi's visit to the Chinese-claimed self-ruled island, the U.S. has not bent down to the pressure and responded by saying that China's actions will not provoke them; the U.S. secretary of state, Blinken said on Sunday." The U.S. will continue to make maritime transits through the Taiwan strait", he added.

On The European docket, the prevalent cautious mood turns out to be a key factor acting as a headwind for the risk-sensitive euro. The market risk sentiment remains fragile amid growing worries of an economic downturn. According to the latest GDP report, growth in the eurozone economy accelerated in the second quarter of the year. Still, the region's prospects get hit as Russia continues to reduce gas supplies. Officials in Europe have become increasingly concerned about the possibility of a shutdown of gas supplies, leading to an energy crisis in Europe. Further cuts in Russian gas supplies could push eurozone inflation higher and severely impact growth in the eurozone area. Investors also remain concerned that global-supply chain disruptions caused by the Russia-Ukraine war would continue pushing consumer prices even higher.

From now on, in the absence of any major market-moving economic news data from both dockets, the FED's monetary policy interest rates plus the US Bond Yields, along with the broader market risk sentiment, will influence the U.S. Dollar and allow traders to grab some trading opportunities around the Pair. However, the focus now remains on the release of the Consumer Price Inflation report, Producer Price Inflation report, Jobless Claims report, and Consumer Sentiment report later this week.

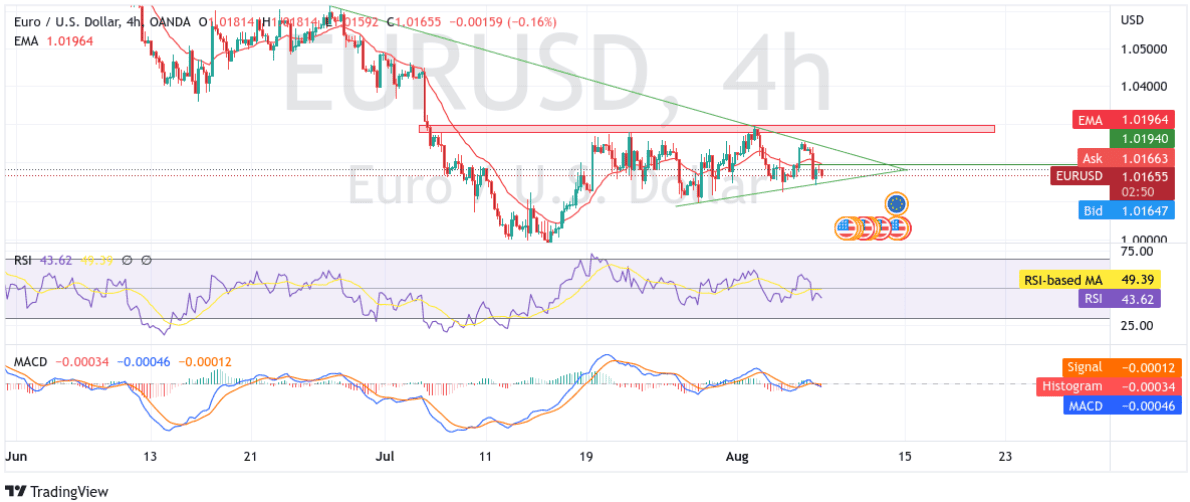

Technical Outlook: Four-hour EUR/USD Price Chart

From a technical standstill, the price has extended Friday's sharp rebound from the vicinity of the 1.01940 level. A Subsequent follow-through selling would push the asset towards testing the lower horizontal trendline of the descending pennant chart pattern formation turned support level. The aforementioned trendline would act as a barrier against the asset. That said, a clean break below the support level would be seen as a fresh trigger for bears to continue pushing the price down and pave the way for additional losses.

The RSI(14) level at 43.62 level is in bearish territory and not far away from the oversold condition. The Moving average convergence divergence(MACD) crossover at 0.00005 adds to the bearish sentiment. Additionally, The 20 and 50 Exponential Moving Average(EMA) crossover at the 1.01972 level adds credence to our bearish filter. On the Flipside, a pullback toward testing the upper horizontal trendline of the descending pennant channel pattern turned resistance level followed by a convincing break above the aforementioned trendline would negate any near-term bearish bias and pave the way for technical buying.