CAD/JPY Slides Back Below 97.200 Mark Amid Weak Oil Demand, Key Central Banks Meetings Awaited

- CAD/JPY cross witnessed some selling on Tuesday during the early Asian session and dropped below the 97.200 mark

- Positive macroeconomic news data from Japan underpins the Yen and exerts downward pressure on the pair.

- Retreating Crude Oil prices undermines the loonie as rate hikes loom and Russian flows stay strong

- Markets now await key central bank meetings

CAD/JPY pair extended its recent modest pullback from the vicinity of 97.767 - 97.874 region, or the weekly high, and witnessed selling during the early Asian session on the last day of the month. As per press time, the shared currency is down over 15 pips and was last seen trading in heavy losses below the 97.200 mark.

The shared currency's lacklustre performance could be attributed to a combination of positive macroeconomic news data from Japan. Retail sales in Japan rose 3.8% in December 2022 from a year earlier, exceeding forecasts for a 3% growth and following a 2.5% gain in November, according to a report released Tuesday by the Japan Ministry of Economic Trade and Industry. Every month, retail trade rose 1.1% in December, reversing from a downwardly revised 1.3% decline in November.

Additionally, Industrial production in Japan edged down 0.1 percent month-over-month in December 2022, compared with market forecasts of a 1.2 percent fall and after a 0.2 percent rise a month earlier, preliminary data by Japan's Ministry of Economic Trade and Industry showed. Every year, industrial production fell 2.8 percent in December, the second straight month of decrease, after a 0.9 percent drop in November.

Last, Japan's unemployment rate remained at 2.5% in December 2022, in line with market forecasts and marking the lowest reading since February 2020. The number of unemployed declined on a seasonally adjusted basis by 1.2% to 1.71 million in December from a month ago, while employment ticked up 0.1% to 67.19 million, according to a report released Monday by Japan's Ministry of Internal Affairs and Communication.

Shifting to the Canadian docket, the loonie continues to face headwinds stemming from declining oil prices as major central banks' looming increases to interest rates weighed on demand, and Russian exports remained strong. Investors expect the U.S. Federal Reserve to raise rates by 25 basis points on Wednesday, followed by half-point increases by the Bank of England and European Central Bank. Any deviation from that script would be a shock. As per press time, US WTI crude oil is down 2.78% for the week to trade at $77.77 per barrel, while its counterpart Brent Crude oil is down 2.70% for the week to trade at $84.29. The market also came under pressure from indications of strong Russian supply despite a European Union ban and G7 price cap imposed over its invasion of Ukraine. Both oil benchmarks last week registered their first weekly loss in three.

As we advance in the absence of significant economic news data from both dockets, the attention shifts toward the key policy interest rate decision announcement by the U.S. Federal Reserve on Wednesday, followed by the Bank of England and European Central Bank interest rate decision announcement on Thursday coming hours away from one another. Should those three central banks still communicate the same message that inflation is still not weakening enough and more needs to be done, we could see Crude oil prices tanking to the low of December last year. However, if both the three central banks play along with the market expectations of a lower interest rate hike, markets would turn in favor of risk assets, and in turn, we could see crude oil prices rising.

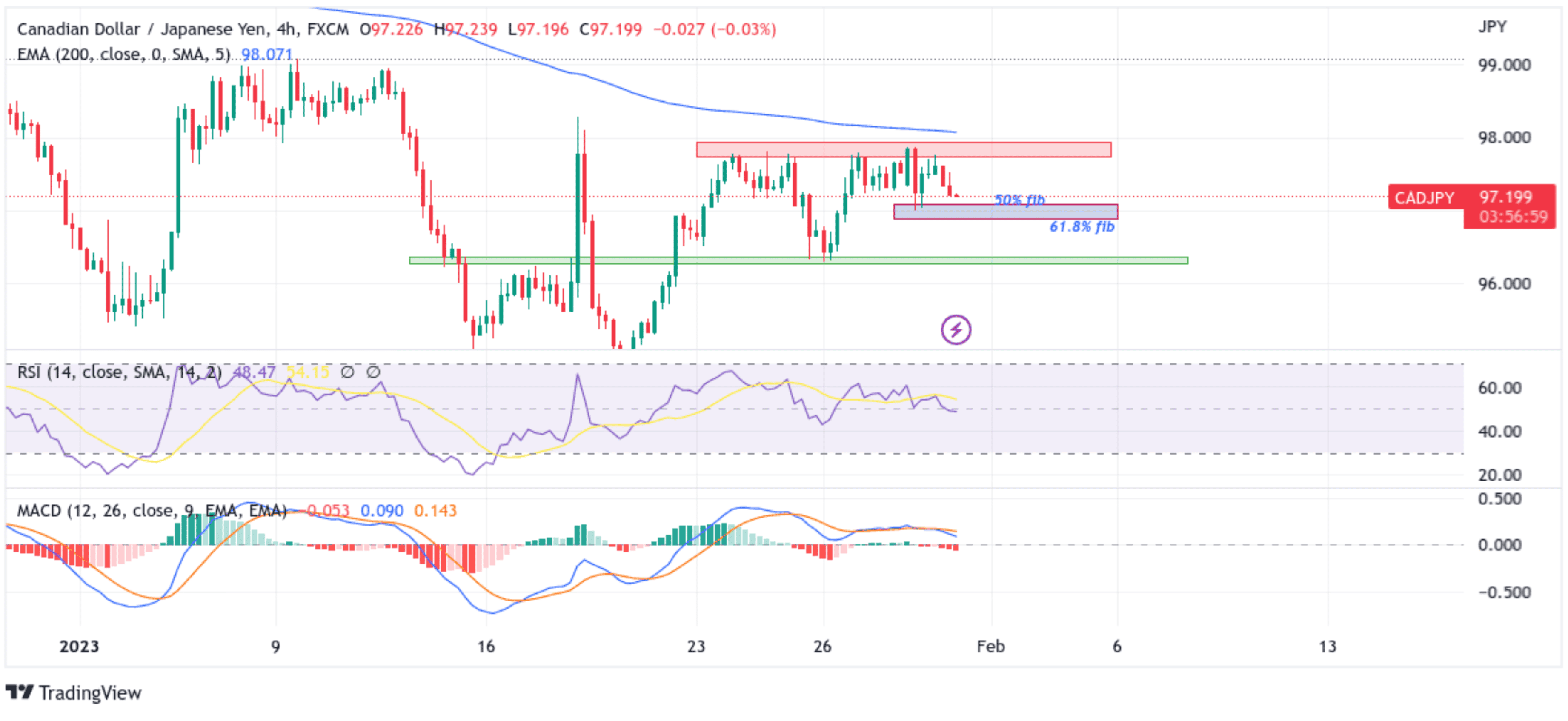

Technical Outlook: CAD/JPY Four-Hour Price Chart

From a technical perspective using a four-hour price chart, spot prices have extended the modest rebound from the vicinity of the 97.767 level, which sits above a key supply zone ranging from 97.720 - 97.874 levels. Some follow-through selling would drag spot prices toward the immediate hurdle plotted by 50% and 61.8% Fibonacci Retracement levels at 97.082 and 96.876 levels, respectively. Sustained weakness below this barricade would pave the way for a drop towards the key demand zone ranging from 96.265 - 96.362 levels. If sellers manage to breach these floors, it will pave the way for aggressive technical selling around the CAD/JPY pair.

The RSI (14) at 48.47 is below the signal line, portraying a bearish filter. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is above the signal line. However, a move below the signal would give credence to the bearish narrative. That said, the bearish narrative is still heavily supported by the price trading below the technically significant moving average (200 EMA), favouring bearish traders and supporting prospects for further losses.

On the flip side, if dip-buyers and tactical traders jump back in and trigger a bullish turnaround, the initial resistance appears at the key supply zone ranging from 97.720 - 97.874 levels. Buying interest could gain momentum if the price pierces this barrier, creating the right conditions for an advance toward the 98.312 resistance level. However, the price will need acceptance above the technically significant moving average (200 EMA) at the 98.073 level. Sustained strength above these levels would negate any near-term bearish outlook pave the way for additional gains around the CAD/JPY.