What is Notional Value?

Key Takeaways:

- Notional value refers to a theoretical or nominal value assigned to a specific financial contract or instrument

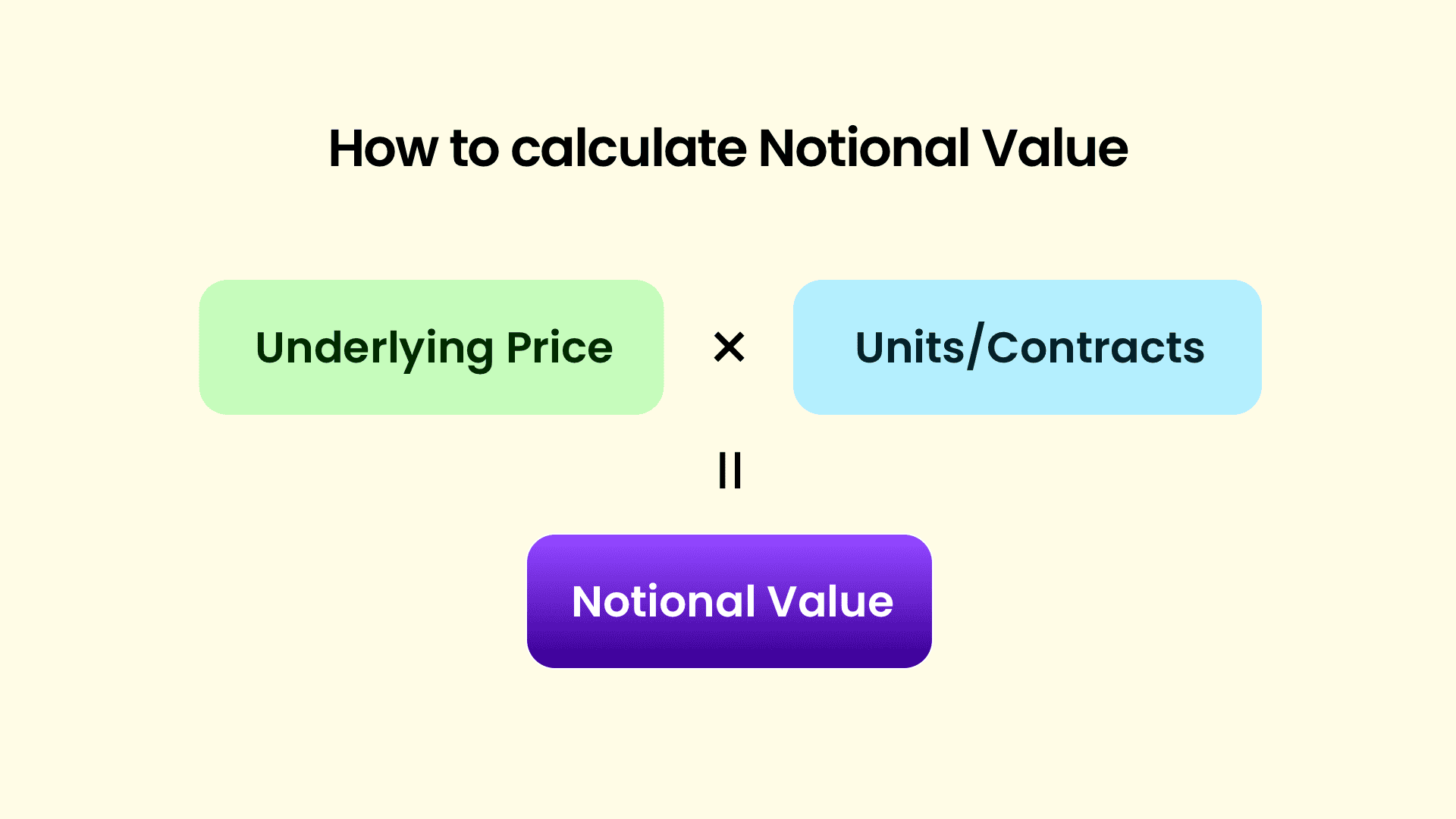

- Notional value can be calculated as units/contracts multiplied by the instrument price

- Notional and market values are integral to financial markets but represent different aspects of an investment or contract

While notional value is a term commonly used within the financial industry, it often remains a mystery to those not well-versed in the intricacies of the markets. Understanding notional value is crucial, as it plays a significant role in derivative trading and risk management strategies. This article will delve into the background of notional value and shed light on its meaning, purpose, and practical implications in the financial realm. By understanding notional value, individuals can enhance their comprehension of complex financial instruments and make informed decisions in their investment journeys.

What is Notional Value?

Notional value refers to a theoretical or nominal value assigned to a specific financial contract or instrument. It represents the size or volume of an underlying asset or derivative. Essentially, notional value is a reference point for trading purposes, allowing investors and stakeholders to determine the potential risk exposure associated with a particular transaction. This concept is particularly crucial in derivative markets, where contracts such as options, swaps, and futures are traded. While notional value is often used interchangeably with face value, they are not entirely synonymous. Face value generally refers to the stated value of a financial instrument, such as a bond or note. In contrast, notional value is a more comprehensive term encompassing various derivatives and their contract sizes or quantities.

How to calculate notional value

Notional value can be calculated as follows:

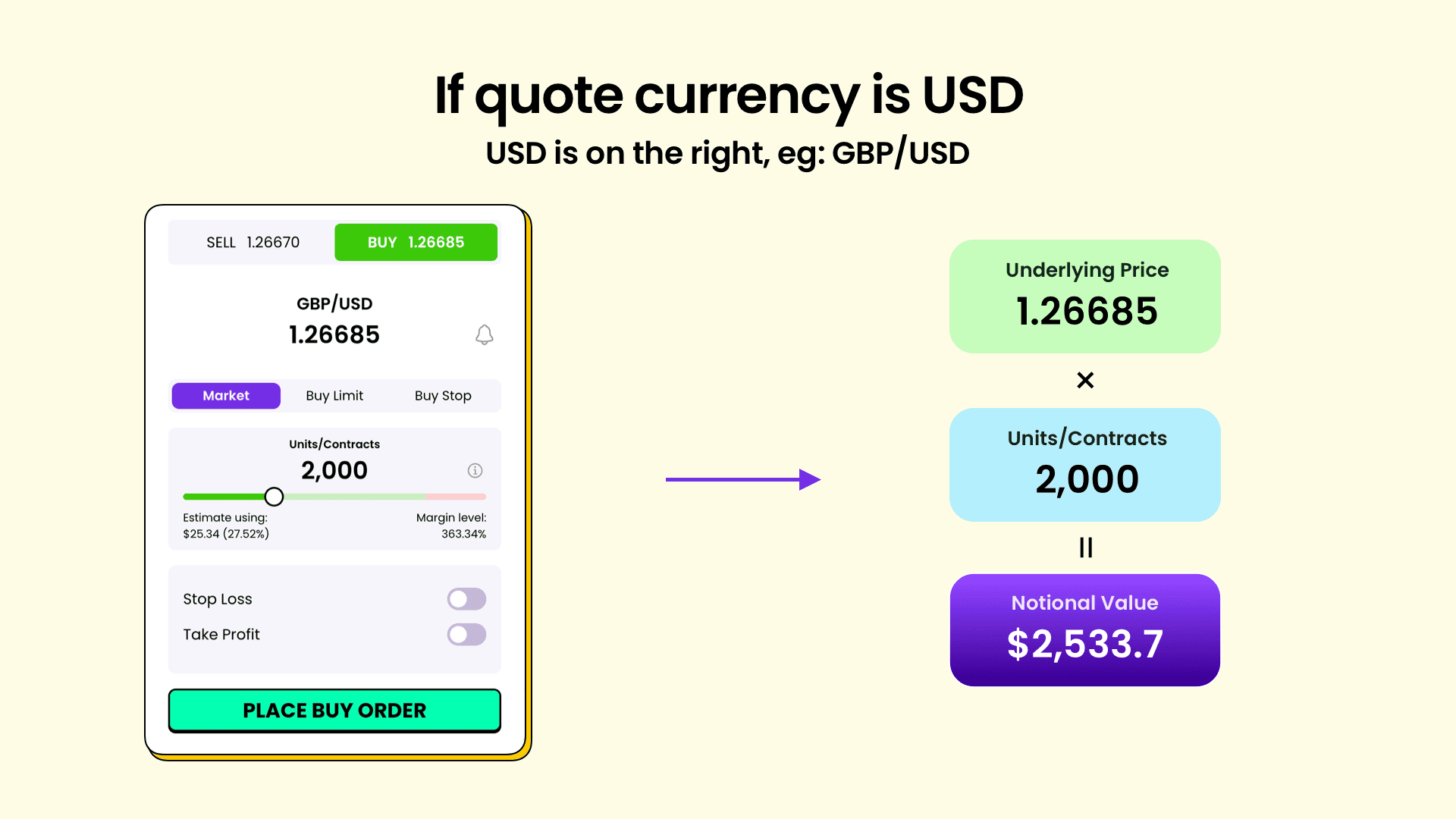

If quote currency is USD, USD is on the right, e.g. GBP/USD

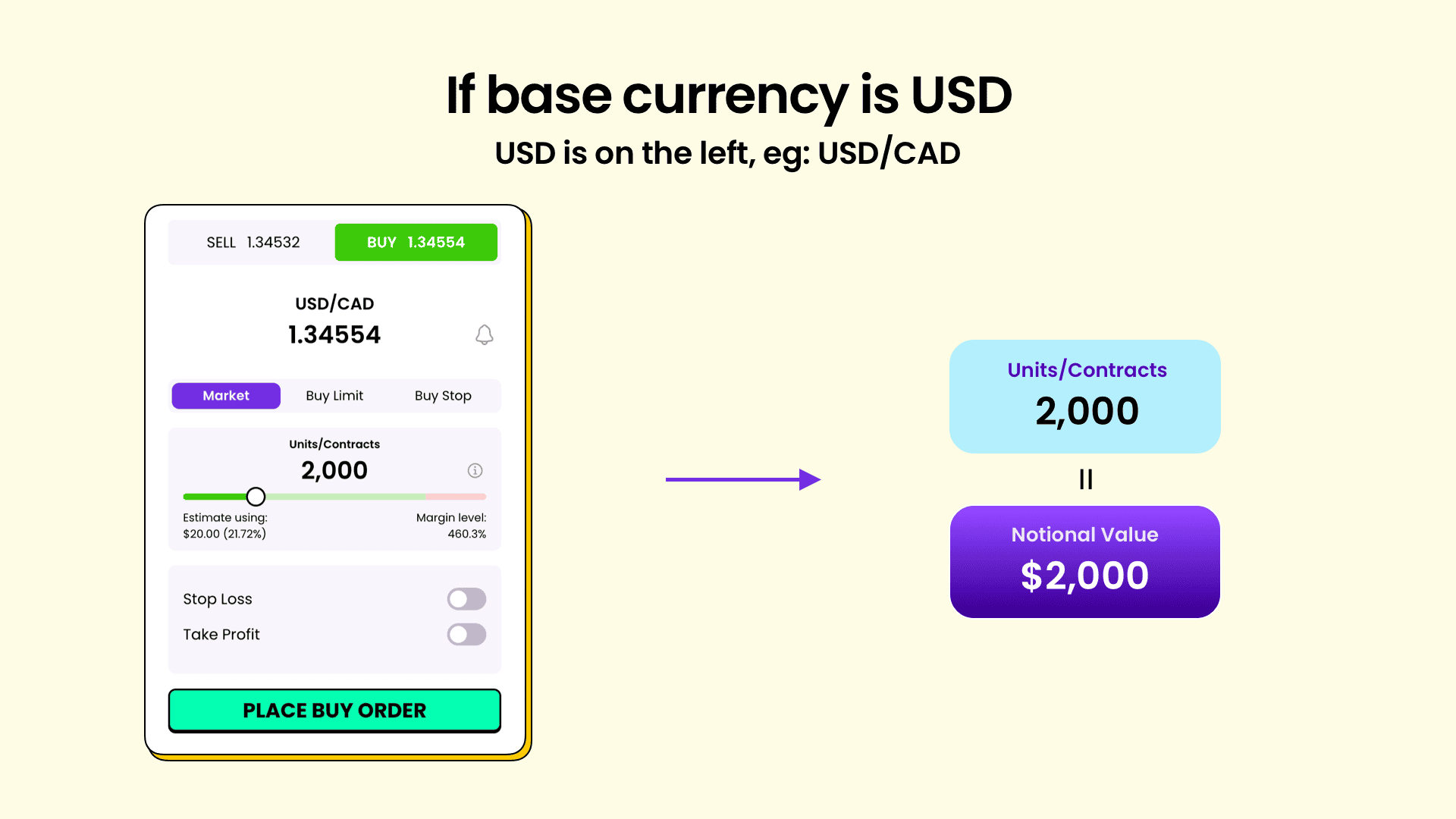

If base currency is USD, USD is on the left, e.g. USD/CAD

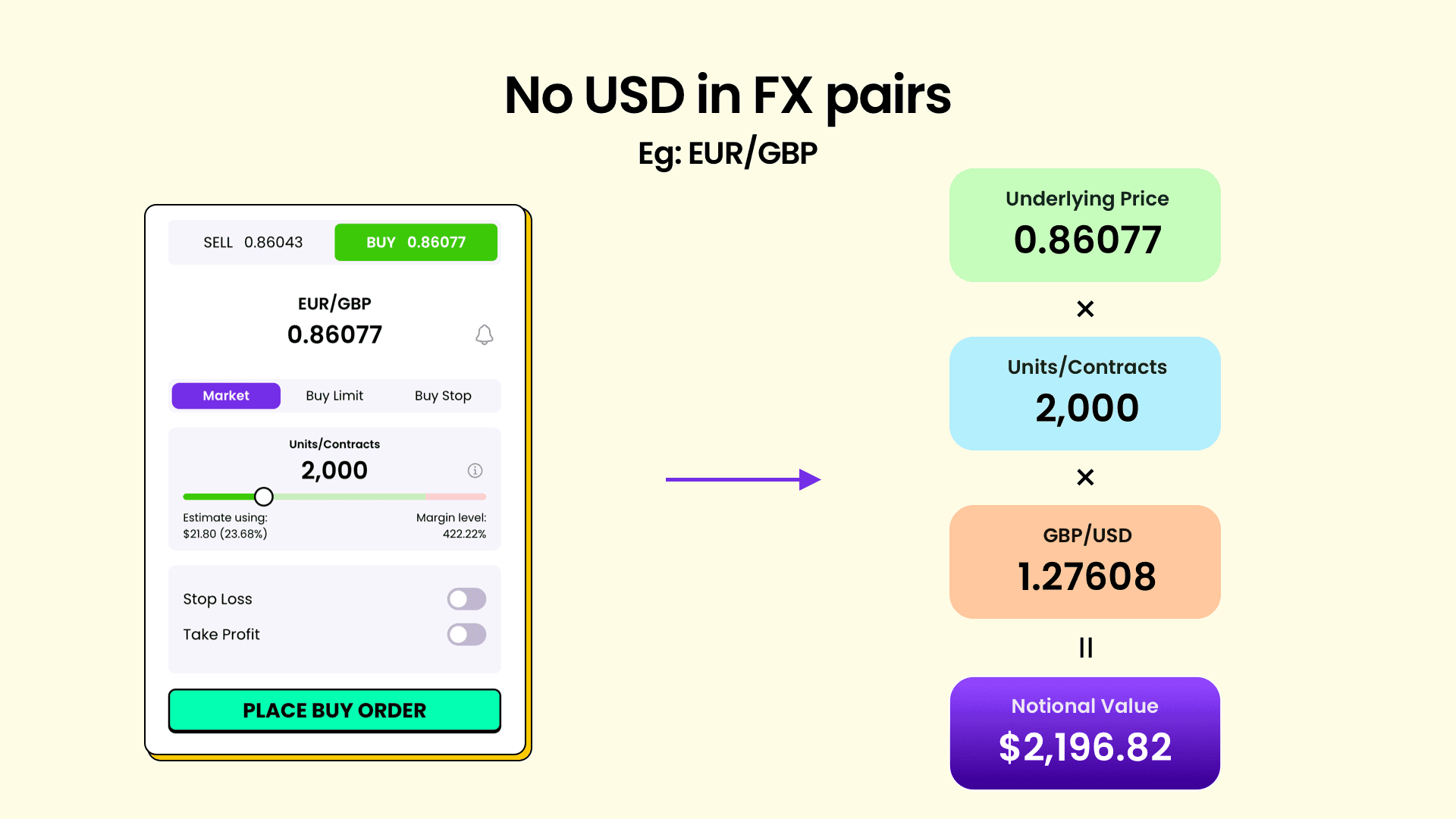

When NO USD in FX pairs, e.g. EUR/GBP

Conclusion

Understanding the concept of notional value is crucial for various financial professionals and investors. Notional value refers to a financial instrument's nominal or face value, such as a derivative contract or an option. While notional value plays a significant role in calculating transaction fees and determining contractual obligations, it is important to note that it does not represent the actual cash flow or market value of the instrument. Instead, notional value is a reference point for measuring price movements and determining contractual terms. It provides a standardized basis for comparing and trading financial instruments. By recognizing the distinction between notional value and market value, financial practitioners can make informed investment decisions and effectively manage risk in the complex world of finance.

Looking to grow your wealth through social trading? Look no further than Pocket Trader! With Pocket Trader, you can connect with other traders, learn from experienced investors, and share your own insights with the community! Trade wiser now.