What are OPEC and OPEC+, and how do they affect oil prices?

Key Takeaways:

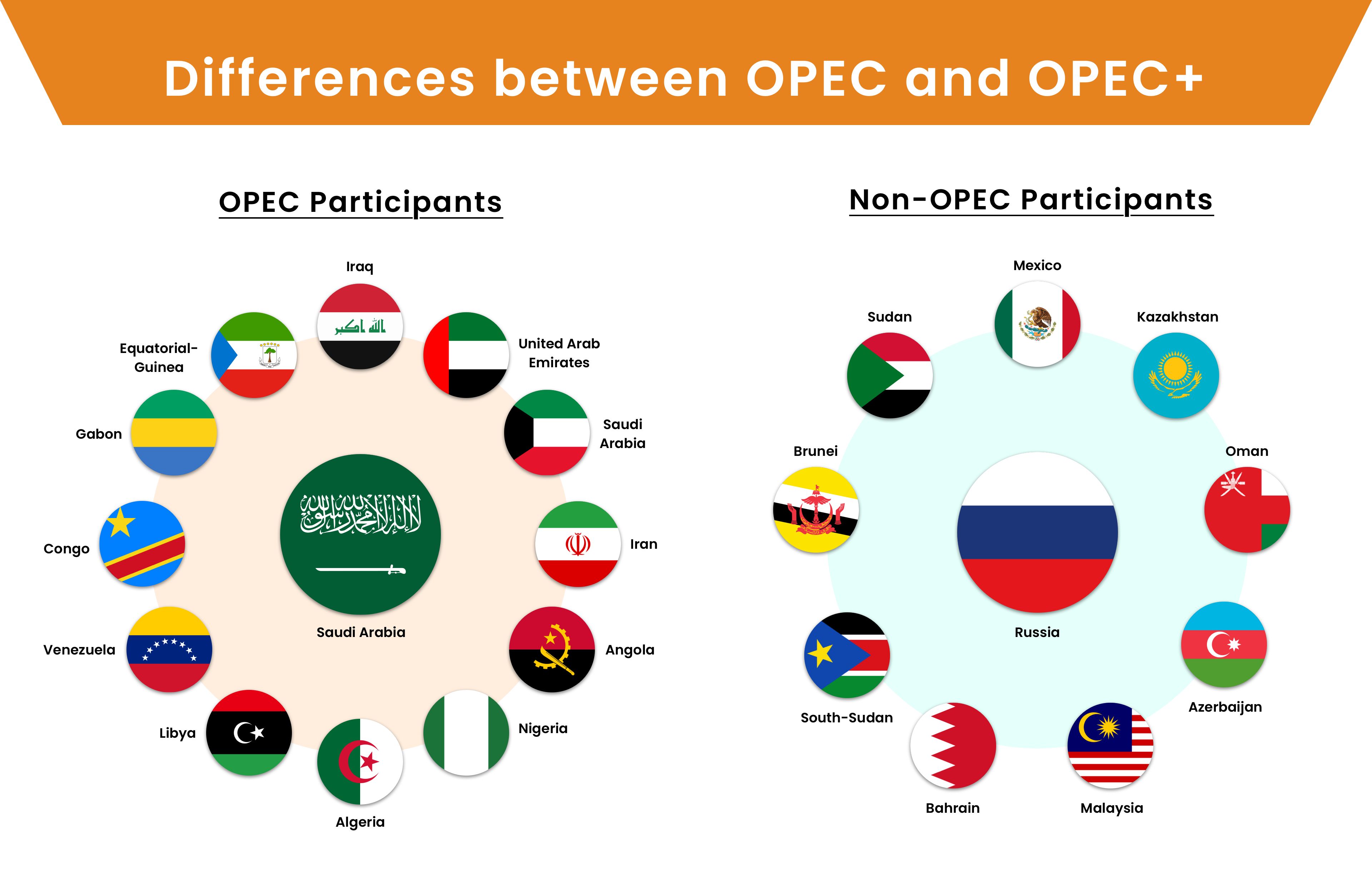

- OPEC, formally known as the Organization of the Petroleum Exporting Countries, is an intergovernmental organization consisting of 13 oil-producing nations

- OPEC+ refers to the alliance between the Organization of the Petroleum Exporting Countries (OPEC) and a group of non-OPEC oil-producing countries

- OPEC's primary objective is to coordinate and unify the petroleum policies of its member nations, ensuring the stabilization of oil markets while ensuring fair returns for oil producers

- The decisions made by OPEC have far-reaching consequences, directly influencing oil prices and subsequently impacting economies, industries, and consumers worldwide

Oil is a crucial resource that powers industries, fuels transportation, and shapes the global economy. Oil-producing countries have organized themselves into a formidable alliance known as the Organization of the Petroleum Exporting Countries (OPEC) to ensure stability and optimize their profits. With its founding in 1960, OPEC aimed to establish control over the oil market by coordinating production levels and influencing oil prices. Over time, OPEC has become a significant player in the global energy landscape, responsible for more than 40% of the world's oil production. This article delves into the origins and objectives of OPEC, exploring its impact on the complex web of interconnected oil markets.

What is OPEC?

OPEC, formally known as the Organization of the Petroleum Exporting Countries, is an intergovernmental organization comprising 13 oil-producing nations in the Middle East, Africa, and South America.

The countries include Iran, Iraq, Kuwait, Saudi Arabia, Venezuela, Libya, United Arab Emirates, Algeria, Nigeria, Ecuador, Gabon, Angola, and the Congo. Each member country has a certain quota or share of the total oil production, determined through negotiations and agreements within the organization.

Founded in 1960 in Baghdad, Iraq, OPEC's primary objective is to coordinate and unify the petroleum policies of its member nations, ensuring the stabilization of oil markets while ensuring fair returns for oil producers. With its headquarters in Vienna, Austria, OPEC significantly influences global oil prices through its decisions on production levels and export quotas. By strategically managing its vast oil reserves, OPEC has become a key player in shaping energy policies worldwide, wielding the power to influence economic growth, geopolitical relationships, and environmental sustainability.

What is OPEC+?

OPEC+ refers to the alliance between the Organization of the Petroleum Exporting Countries (OPEC) and a group of non-OPEC oil-producing countries. The "+" symbolizes the collaboration between the 13 OPEC members and 10 other non-OPEC producing countries, including Russia, Mexico, and Kazakhstan.

The decision to form the OPEC+ alliance was driven by the recognition that the actions of non-OPEC oil-producing nations could significantly impact global oil prices. The alliance aims to regulate oil production to balance supply and demand, prevent extreme price fluctuations, and maintain stability in the oil market.

The alliance periodically meets to discuss and adjust oil production levels in response to changing market conditions, geopolitical events, and economic factors. These meetings are crucial in influencing oil supply and global oil prices.

Objectives And Roles Of OPEC+ And Saudi Influence

- Oil Price Stability: One of OPEC's primary objectives is maintaining oil price stability. By coordinating production levels, OPEC aims to prevent extreme fluctuations that can adversely affect producers and consumers.

- Market Share Management: OPEC seeks to manage the collective market share of its member countries to ensure a fair distribution of production quotas and revenue among its diverse members.

- Investment in Upstream Activities: OPEC emphasizes developing and enhancing upstream activities to secure long-term sustainability in oil production.

The Organization of the Petroleum Exporting Countries (OPEC) and its extension, OPEC+, play pivotal roles in the global oil market by influencing production levels and stabilizing oil prices. Regular meetings serve as a platform for member countries to discuss objectives, set targets, and define their roles within the organization's framework. Among the member countries, Saudi Arabia stands out as one of the most influential players, contributing significantly to the decisions made during these meetings.

Targets set by OPEC+:

- Production Quotas: OPEC regularly sets production targets for its member countries to balance the global oil supply and demand equation. Adjustments to these quotas are often made to respond to changing market conditions.

- Price Bands: OPEC establishes target price ranges for crude oil, adjusting production levels to keep prices within these bands. This approach is vital in preventing both excessively high and low oil prices.

Roles of OPEC+:

- Coordinated Production Adjustments: OPEC+ was formed to enhance cooperation among OPEC members and non-member oil-producing countries, such as Russia. The alliance works together to manage oil production levels and respond collectively to market dynamics.

- Emergency Meetings and Quick Decision-Making: OPEC+ allows emergency meetings to address unforeseen oil market events. This flexibility enables the group to make rapid decisions in response to crises, as demonstrated during the COVID-19 pandemic.

Saudi Arabia's Influence Within OPEC and OPEC+:

- Saudi Arabia holds a prominent position within OPEC and OPEC+, wielding significant influence due to its status as the world's leading oil exporter and substantial oil reserves. The country's influence is evident in several key aspects:

- Production Capacity: Saudi Arabia possesses the highest production capacity among OPEC members, allowing it to play a crucial role in adjusting overall production levels to stabilize prices.

- Strategic Decision-Making: The Kingdom's role in shaping strategic decisions is pronounced, as Saudi Arabia often takes the lead in coordinating with other member countries and non-OPEC partners to achieve consensus on production adjustments.

- Economic Impact: Given the Saudi economy's dependence on oil revenue, the country's influence within OPEC is geopolitical and economically driven. Decisions made during OPEC meetings directly impact Saudi Arabia's fiscal policies and economic stability.1

- Saudi Arabia controls 79.4% of proven crude oil reserves and supplied approximately 44% of the world’s oil.1

How do OPEC decisions affect oil prices?

The decisions made by OPEC have far-reaching consequences, directly influencing oil prices and subsequently impacting economies, industries, and consumers worldwide.

Response to Crisis

In the face of oil demand shocks, for instance, induced by the pandemic, OPEC faced the challenging task of stabilizing oil prices. In April 2020, OPEC and its non-member allies, collectively known as OPEC+, took decisive action to address the oversupply issue. The group agreed to historic production cuts of nearly 10% of the global oil supply. These cuts were intended to mitigate the impact of the demand slump and bring stability back to the oil market.

Impact on Oil-Dependent Economies

OPEC decisions can disproportionately impact countries heavily reliant on oil exports. Depending on the prevailing oil price environment, nations within and outside the organization may experience economic booms or recessions. Oil-dependent economies often face challenges in diversifying their revenue streams, making them particularly vulnerable to the fluctuations caused by OPEC decisions. This underscores the importance of economic diversification for countries heavily reliant on oil revenue.

Conclusion

OPEC (Organization of the Petroleum Exporting Countries) and OPEC+ play a critical role in global oil markets and strongly influence oil prices. By collectively agreeing on production levels and quotas, OPEC members control a significant portion of the world's oil supply. This allows them to stabilize prices and maintain market equilibrium. However, OPEC's decisions can also lead to price volatility and fluctuations. Additionally, the recent collaboration with non-OPEC countries under the OPEC+ agreement further strengthens their influence. The impact of OPEC's actions on oil prices affects the profitability of member countries and has wide-ranging consequences on global economies, energy markets, and consumer prices. As such, it is crucial for industry stakeholders, governments, and investors to closely monitor OPEC's decisions and understand their implications to navigate and respond effectively to the ever-changing dynamics of the oil market.

Looking to grow your wealth through social trading? Look no further than Pocket Trader! With Pocket Trader, you can connect with other traders, learn from experienced investors, and share your own insights with the community! Trade wiser now.

Source: IG.com