USD/JPY Remains Capped Below 149.800 Mark On Softer U.S. Dollar, BoJ Decision And U.S. NFP Report Eyed

Key Takeaways:

- USD/JPY pair reverses earlier bounce from the vicinity of 149.466 and moves below the 149.600 level

- Fresh U.S. dollar supply is a headwind to the USD/JPY cross

- Speculations that Japanese authorities will intervene in the F.X. market extend support to the Japanese yen (JPY)

- The market's focus shifts toward the BoJ decision and the U.S. NFP report

The USD/JPY cross witnessed fresh selling on Monday during the second part of the Asian session and edged lower, dropping below the 149.600 mark, supported by new U.S. dollar supply. The shared currency has managed to reverse most of its earlier gains and looks set to maintain its bid tone heading into the European session.

The U.S. Dollar Index (DXY), which measures the greenback against a basket of currencies, rose slightly higher on Monday during the Asian session to trade above the 106.660 mark following a modest bounce from the vicinity of 106.548 before paring gains to settle below the 106.600 mark during the mid-Asian session. In turn, this was seen as a key factor that helped cap the upside for the USD/JPY pair. Apart from this, the modest bounce in the U.S. equity markets was another factor that undermined the greenback and helped limit further gains around the USD/JPY cross.

Additionally, speculations that Japanese authorities will intervene in the F.X. market to combat a sustained depreciation in the JPY by tweaking its yield curve control (YCC) policy during its monetary policy announcement on Tuesday extend support to the Japanese Yen (JPY). Furthermore, increased market bets that the Fed will keep its benchmark policy rate steady at the current 5.25% to 5.5% range during the November meeting remain supportive of retreating Treasury bond yields, which weigh on the buck and help cap the upside for the USD/JPY cross. This comes on the heels of dovish comments by the Fed chair, whose remarks aligned with those of his colleagues. It is worth recalling that during a speech at the Economic Club of New York last Thursday, Jerome Powell declined to outrightly signal another rate hike after he mentioned that the Fed is "proceeding carefully" in evaluating the need for further rate increases.

Despite the combination of negative factors, the greenback continues to be supported by firm market expectations that the Fed will hike interest by at least 25 basis points before the end of the Year. This comes after data last week showed the U.S. economy expanded an annualized 4.9% in the third quarter of 2023, the most since the last quarter of 2021, above market forecasts of 4.3% and a 2.1% expansion in Q2, the advance estimate showed. In that same line, Core Personal Consumption Expenditure (PCE) prices in the U.S., which exclude food and energy, increased by 0.3% from the previous month in September 2023, the most in 4 months, aligning with market estimates and accelerating from the 0.1% increase from the earlier month. The annual rate, regarded as the Federal Reserve's preferred measure of inflation, eased slightly to 3.7%, the lowest since May 2021, but held sharply above the central bank's target of 2%. Apart from this, there are concerns that the Israel-Palestine war would engulf the rest of the Middle East region, in turn leading to a major global crisis, which in turn continues to weigh on investor sentiment.

As we advance, without any significant economic news data from both dockets, the broader market risk sentiment and U.S. Treasury bond yields will continue to influence the U.S. dollar and provide short-term trading opportunities around the USD/JPY pair. The focus, however, remains on the Bank of Japan Interest Rate Decision and the Monthly U.S. Jobs Data Report, popularly known as the Non-farm Payrolls (NFP) report, set for release on Friday.

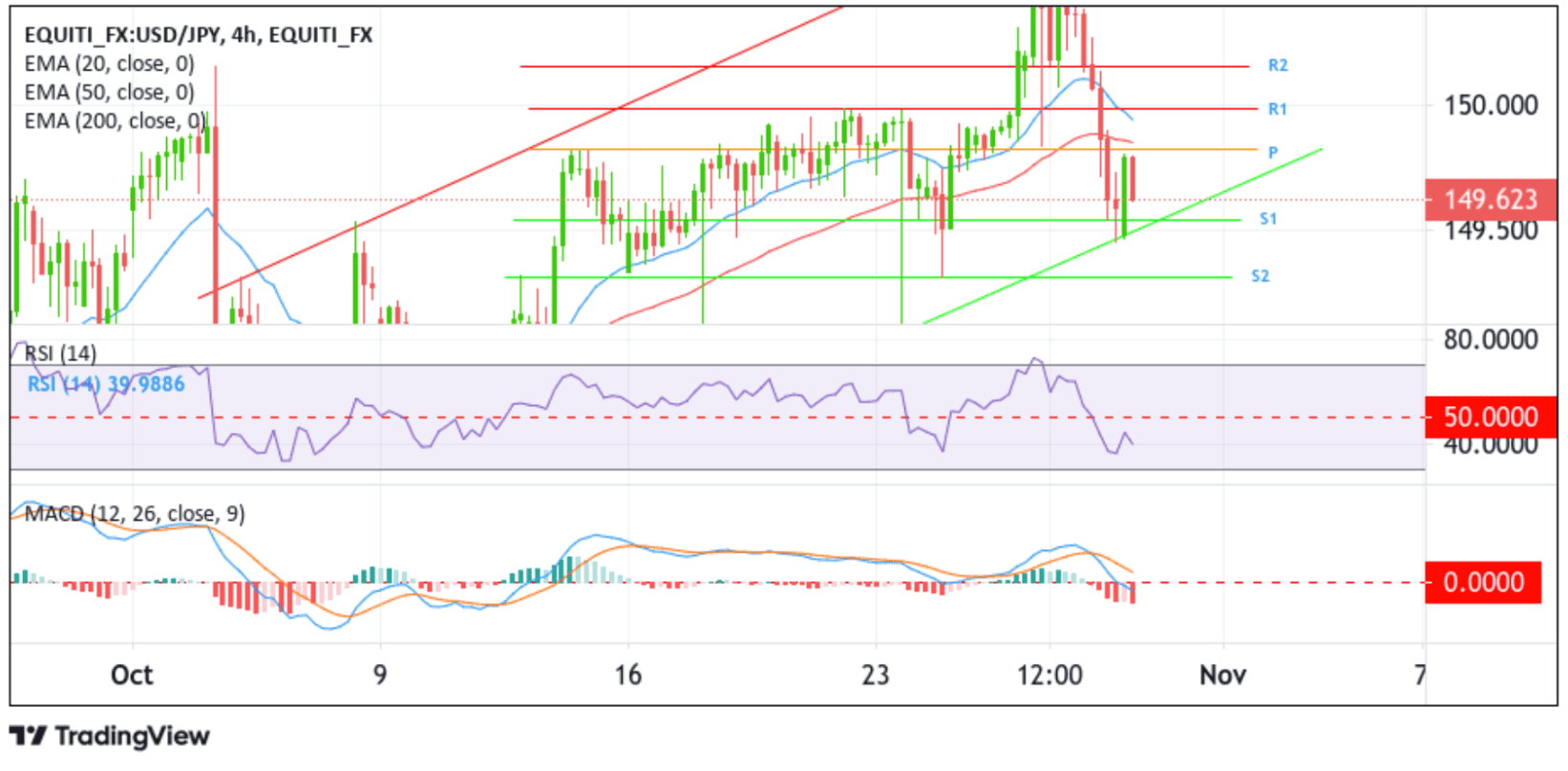

Technical Outlook: Four-Hour USD/JPY Price Chart

From a technical standpoint, the USD/JPY cross is trading below the 149.600 level following a modest bounce from the vicinity of the 149.807 level following the price's failure to find follow-through buying towards the pivotal level at 149.826. Subsequent selling would drag spot prices back toward the 149.540 support level (S1), which sits above the key lower limit of the ascending channel pattern extending from the mid-October 2023 swing low. A convincing move below these barricades would confirm the bullish pullback from the vicinity of 149.466 has run its course, paving the way for a drop toward the 149.313 support level (s2). On further weakness, the price could drop toward the 149.086 support level (S3). In highly bearish cases, the USD/JPY pair could extend a leg down to tag the technically strong 200-day Exponential Moving Average (EMA) at the 148.756 level.

On the flip side, if dip-buyers and tactical traders jump back in and trigger a bullish reversal, initial resistance appears at the 149.826 level. If the price pierces this barrier, buying interest could gain further momentum, creating the right conditions for an advance toward the 149.985 resistance level (R1) followed by the 150.160 resistance level (R2), and in highly bullish cases, the USD/JPY cross could rally toward the 150.769 ceilings.