USD/JPY Holds Firmly Above 150.000 Psychological Mark On Stronger Japanese Data And Weaker U.S. Dollar

Key Takeaways:

- The Japanese yen held firmly above the 150.00 USD mark on Monday during the early Asian session to kick off a new week on a more vital note

- Stronger-than-expected Japanese capital spending data underpins the yen and helps cap the downside for the major currency

- A generally weaker U.S. dollar across the board further acts as a tailwind to the USD/JPY pair

- Despite the combination of negative factors, the fundamental backdrop seems firmly tilted in favor of U.S. dollar bulls

The Japanese yen held firmly above the 150.00 USD mark on Monday during the early Asian session, steadily rebounding from an earlier dip from the 149.839 level touched earlier in the session as fresh Japanese economic data pointed to a potential revision in preliminary Gross Domestic Product (GDP) data, which showed now the world's fourth largest economy had fallen into a recession in the fourth quarter of 2023.

A Japanese Ministry of Finance report released earlier today showed that Japanese companies increased spending on plant and equipment by 16.4% year-on-year in the fourth quarter of 2023, rising for the eleventh straight quarter and accelerating from a 3.4% gain in the third quarter as corporate activity continued to recover from the pandemic-induced slowdown.

Further underpinning the Japanese Yen (JPY) on Monday were the hawkish comments by Bank of Japan (BoJ) board member Hajime Takata on Thursday, who called on the central bank to begin discussing details of a potential end to ultra-loose monetary policy, including an exit from negative interest rates and bond yield control. He said, "It's necessary to consider taking an agile and flexible response, including how to exit or shift gear from the current extremely accommodative monetary policy. Japan's top currency diplomat, Masato Kanda, also said on the side-lines of the G20 finance leaders meeting in Brazil that the government is watching currency moves "with a strong sense of urgency" and stands ready to respond.

That said, the ongoing retreat in U.S. Treasury bond yields amid further uncertainty about the timing of interest rate cuts by the Fed weighs heavily on the greenback and turns out to be another factor acting as a tailwind to the USD/JPY pair.

This comes after a U.S. Bureau of Economic Analysis (BEA) report released on Thursday showed the U.S. core PCE price index, the Federal Reserve's preferred gauge to measure inflation, rose by 2.8% from the previous year in January 2024, the least since March 2021. The result aligned with market expectations and marked a slight slowdown from last month's 2.9%. Every month, however, core PCE prices advanced by 0.4%, accelerating from the 0.1% increase in December.

Moreover, a fresh round of disappointing U.S. macro data further weighs on the buck and is seen as a contributing factor helping cap the downside for the USD/JPY pair. The ISM Manufacturing PMI in the United States fell to 47.8 in February 2024 from 49.1 in the previous month, firmly below market expectations of 49.5 to point to the 16th consecutive period of declines in manufacturing activity, erasing last hopes of fresh traction in the sector.

Additionally, the University of Michigan consumer sentiment for the U.S. was revised lower to 76.9 in February 2024 from a preliminary of 79.6 compared with 79 in January.

That said, despite the combination of negative factors, the fundamental backdrop seems firmly tilted in favor of U.S. dollar bulls, and current price action runs the chances of fizzling out sooner or later. This comes from firm expectations that the Fed will leave rates unchanged during the March and May meetings and start cutting rates during the third quarter of 2024.

The bets were reaffirmed after the latest Fed meeting minutes released late last month showed the Fed is concerned about cutting rates too soon, signaling early rate cuts were entirely off the table.

The January FOMC Meeting minutes came days after a U.S. Bureau of Labor Statistics (BLS) report showed consumer and wholesale inflation rose in the U.S. in January, which, when combined with robust U.S. job data and the recent hawkish Fed official's comments, fully debunks the idea of early aggressive rate cuts and supports the view that rates are likely to stay higher for longer.

As we advance, traders look forward to the speech of Philadelphia Fed President Patrick Hacker during the mid-North American session for clues regarding future monetary policy actions. The main focus, however, remains on the release of the U.S. monthly jobs data report- popularly known as the Non-Farm Payrolls (NFP) report, on Friday.

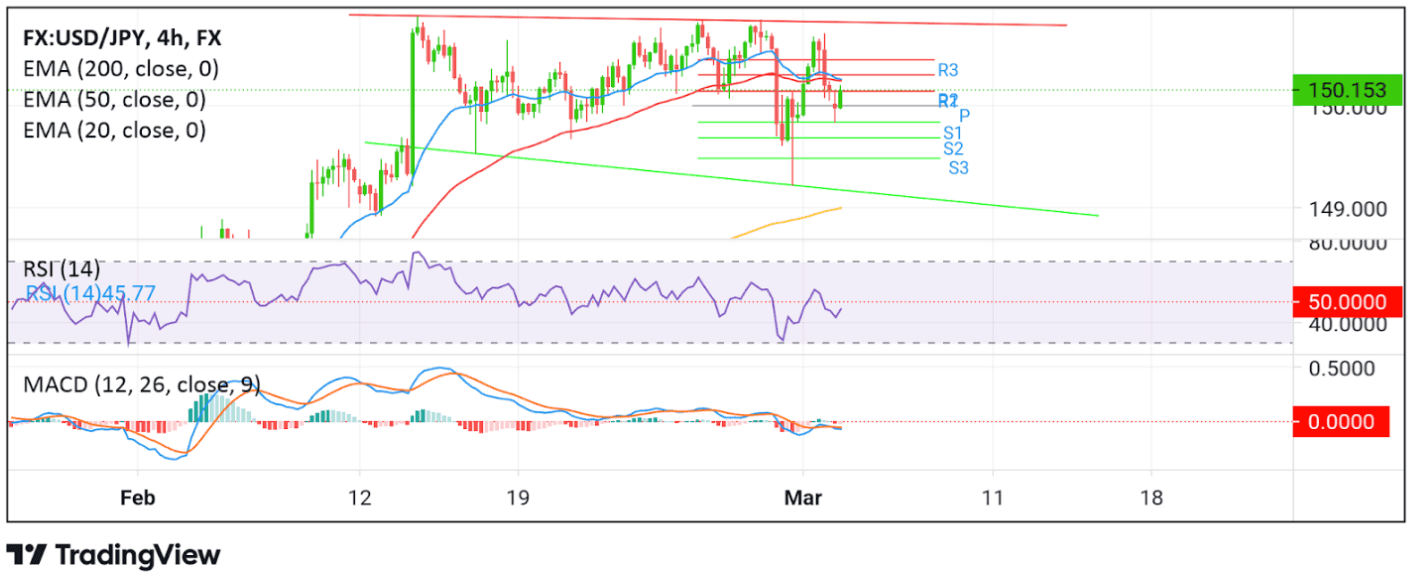

Technical Outlook: Four-Hour USD/JPY Price Chart

From a technical perspective, using a four-hour price chart, USD/JPY is trading with a bullish bias above the 150.000 psychological mark following a sharp bounce from the vicinity of the 149.839 level earlier in the session. For further confirmation of the extension of the bullish uptick, which at this moment is validated by the acceptance of price above the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the $144.871 level, traders should wait for confirmation of a move above the 50 (red) and 20 (blue) EMA levels at 150.267 and 150.283 levels, respectively. The technical oscillators should follow this closely; in this case, the RSI (14) and MACD indicators move above their signal lines. Such a move would validate the bullish bias and pave the way for further technical buying around the major currency. On further strength, the 150.300 (R2) level acts as an immediate hurdle, above which the next barrier is seen at the 150.450 (R3) level. A clean move above this hurdle would set the path for a rally toward the key resistance level plotted by a slightly downward-sloping trendline extending from the mid-February 2024 swing to higher highs. A subsequent break above this level would act as a fresh trigger for new buyers to jump in, paving the way for more gains around the USD/JPY cross.

On the flip side, if sellers return and catalyze a bearish reversal, initial support comes in at the 150.000 psychological mark, which is our pivot level (P). Acceptance below this level would pave the way for a drop toward the immediate support level at $149.840. On further weakness, the attention shifts toward the 149.680 (S2) level, below which the price could decline further toward the 149.483 (S3) level. Sustained weakness below this level would pave the way for an accelerated drop toward the key support level plotted by a downward-sloping trendline extending from the mid-February 2024 swing lower-lows. Such a move would denote almost a 0.65% drop from the current price level, and if sellers manage to break below this key level, downside pressure could pick up pace, paving the way for dip losses around the major currency.